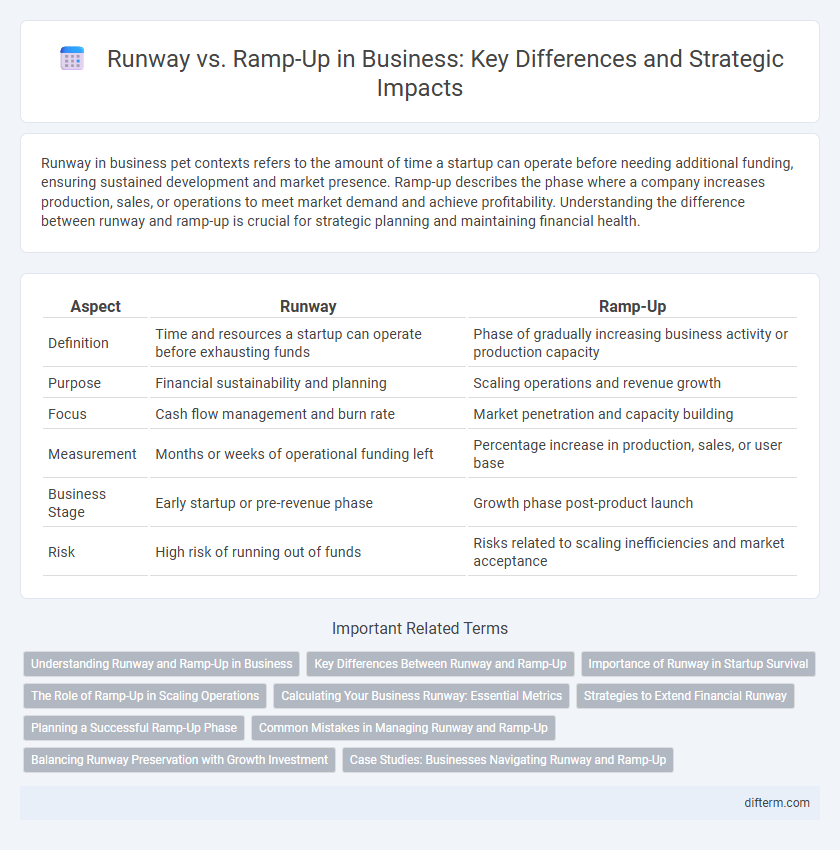

Runway in business pet contexts refers to the amount of time a startup can operate before needing additional funding, ensuring sustained development and market presence. Ramp-up describes the phase where a company increases production, sales, or operations to meet market demand and achieve profitability. Understanding the difference between runway and ramp-up is crucial for strategic planning and maintaining financial health.

Table of Comparison

| Aspect | Runway | Ramp-Up |

|---|---|---|

| Definition | Time and resources a startup can operate before exhausting funds | Phase of gradually increasing business activity or production capacity |

| Purpose | Financial sustainability and planning | Scaling operations and revenue growth |

| Focus | Cash flow management and burn rate | Market penetration and capacity building |

| Measurement | Months or weeks of operational funding left | Percentage increase in production, sales, or user base |

| Business Stage | Early startup or pre-revenue phase | Growth phase post-product launch |

| Risk | High risk of running out of funds | Risks related to scaling inefficiencies and market acceptance |

Understanding Runway and Ramp-Up in Business

Runway in business refers to the amount of time a company can operate before it runs out of cash, calculated by dividing current cash reserves by monthly burn rate. Ramp-up describes the period during which a business increases its production, sales, or operational capacity to reach optimal performance or revenue targets. Understanding runway ensures financial sustainability, while mastering ramp-up accelerates growth and market penetration.

Key Differences Between Runway and Ramp-Up

Runway refers to the amount of time a startup can operate before it runs out of cash, usually calculated by dividing available capital by monthly burn rate. Ramp-up describes the phase when a business scales operations and increases production or sales to reach full capacity or market demand. Unlike runway, which measures financial sustainability, ramp-up emphasizes growth velocity and operational expansion.

Importance of Runway in Startup Survival

Runway represents the critical timeframe a startup has before it exhausts its available capital, directly influencing its survival odds. A sufficient runway ensures startups can execute key business strategies, iterate product development, and achieve market fit without financial pressure. Properly managing runway length is essential to sustain operations during the ramp-up phase, where growth accelerates but cash flow may still be negative.

The Role of Ramp-Up in Scaling Operations

Ramp-up plays a critical role in scaling operations by gradually increasing production capacity and workforce to meet growing market demand, ensuring efficient resource allocation and minimizing operational risks. Unlike runway, which focuses on financial survival and cash flow management, ramp-up emphasizes execution and operational growth through process optimization and capacity building. Effective ramp-up strategies enhance scalability and competitiveness, allowing businesses to transition smoothly from startup phases to full-scale operations.

Calculating Your Business Runway: Essential Metrics

Calculating your business runway involves analyzing key financial metrics such as burn rate, monthly operating expenses, and available cash reserves to determine how long your startup can sustain operations without additional funding. Burn rate, the speed at which a company spends its capital, directly impacts the runway length and must be monitored closely alongside revenue growth during ramp-up phases. Accurate runway calculations enable strategic planning for funding rounds and help balance investment timing with business expansion efforts.

Strategies to Extend Financial Runway

Extending the financial runway requires strategic cost management, including reducing burn rate through optimized operational expenses and renegotiated supplier contracts. Prioritizing high-impact revenue streams accelerates ramp-up, ensuring steady cash flow to sustain growth phases. Implementing milestone-based budgeting aligns resource allocation with key performance indicators, maximizing financial efficiency during scaling.

Planning a Successful Ramp-Up Phase

A successful ramp-up phase requires detailed financial runway analysis to ensure sufficient capital covers operational expenses during growth. Accurate forecasting of sales velocity and resource allocation minimizes risks and supports smooth scaling. Prioritizing data-driven decision-making during planning enhances efficiency and prevents premature cash flow depletion.

Common Mistakes in Managing Runway and Ramp-Up

Many businesses miscalculate runway by underestimating burn rate or overestimating funding availability, leading to premature scaling or cash shortages. Ramp-up challenges often arise from unrealistic growth projections or inadequate resource allocation, causing operational inefficiencies and lost market opportunities. Effective management requires precise financial forecasting and strategic capacity planning to balance runway duration with sustainable ramp-up growth.

Balancing Runway Preservation with Growth Investment

Balancing runway preservation with growth investment requires strategic allocation of capital to extend operational longevity while funding scalable initiatives. Prioritizing key performance indicators such as burn rate, customer acquisition cost, and monthly recurring revenue helps optimize the ramp-up phase without depleting cash reserves. Effective financial management ensures sufficient runway to sustain growth efforts and pivot during market fluctuations.

Case Studies: Businesses Navigating Runway and Ramp-Up

Case studies reveal how startups strategically manage runway and ramp-up phases to achieve sustainable growth, optimizing cash flow while scaling operations efficiently. Companies like Airbnb and Slack prioritized extending runway through lean financial practices, enabling smoother ramp-up periods marked by rapid user acquisition and market penetration. Effective navigation of these stages directly impacts business resilience and long-term success in competitive markets.

runway vs ramp-up Infographic

difterm.com

difterm.com