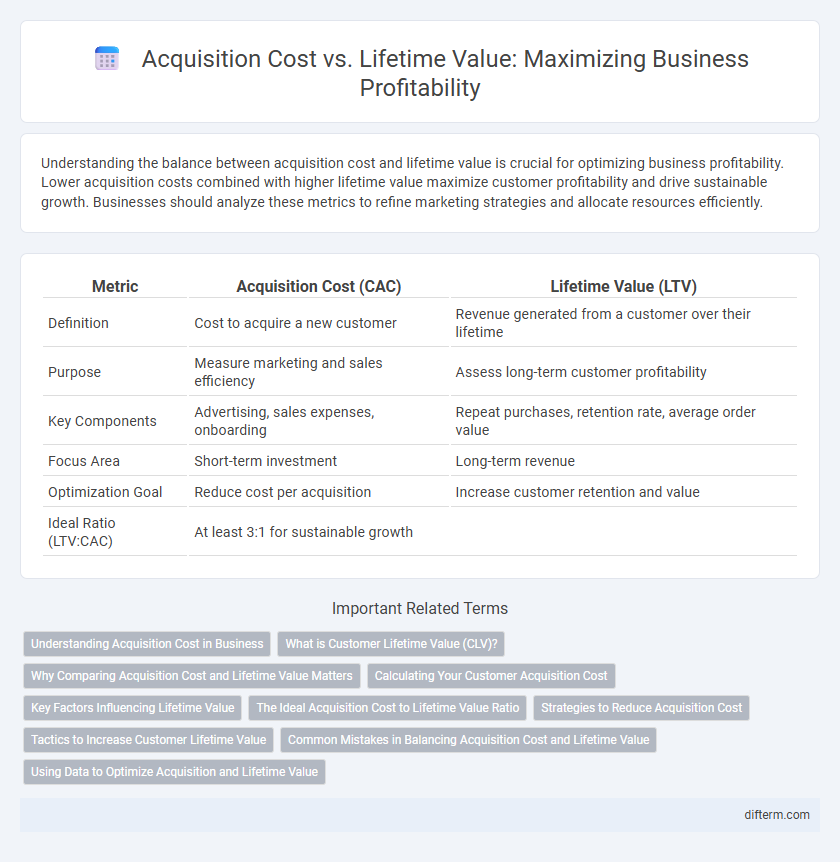

Understanding the balance between acquisition cost and lifetime value is crucial for optimizing business profitability. Lower acquisition costs combined with higher lifetime value maximize customer profitability and drive sustainable growth. Businesses should analyze these metrics to refine marketing strategies and allocate resources efficiently.

Table of Comparison

| Metric | Acquisition Cost (CAC) | Lifetime Value (LTV) |

|---|---|---|

| Definition | Cost to acquire a new customer | Revenue generated from a customer over their lifetime |

| Purpose | Measure marketing and sales efficiency | Assess long-term customer profitability |

| Key Components | Advertising, sales expenses, onboarding | Repeat purchases, retention rate, average order value |

| Focus Area | Short-term investment | Long-term revenue |

| Optimization Goal | Reduce cost per acquisition | Increase customer retention and value |

| Ideal Ratio (LTV:CAC) | At least 3:1 for sustainable growth | |

Understanding Acquisition Cost in Business

Acquisition Cost in business measures the total expense incurred to secure a new customer, encompassing marketing, sales, and onboarding costs. Accurate calculation of Acquisition Cost is essential for optimizing marketing strategies and ensuring profitable customer relationships. Comparing Acquisition Cost to Lifetime Value helps businesses assess the long-term value and sustainability of their investments in customer acquisition.

What is Customer Lifetime Value (CLV)?

Customer Lifetime Value (CLV) represents the total revenue a business expects to earn from a single customer throughout their entire relationship. It quantifies the long-term profitability of acquiring and retaining customers by considering purchase frequency, average order value, and customer retention rates. Understanding CLV enables companies to optimize marketing spend and improve decision-making regarding customer acquisition strategies.

Why Comparing Acquisition Cost and Lifetime Value Matters

Comparing Acquisition Cost (CAC) and Lifetime Value (LTV) is crucial for evaluating the profitability of customer acquisition strategies and ensuring sustainable business growth. A higher LTV compared to CAC indicates efficient marketing spend and strong customer retention, directly impacting revenue and margins. Businesses optimizing this ratio can allocate resources effectively, improve customer segmentation, and increase overall return on investment (ROI).

Calculating Your Customer Acquisition Cost

Customer Acquisition Cost (CAC) is calculated by dividing the total marketing and sales expenses by the number of new customers acquired during a specific period. Precise CAC calculation helps businesses optimize marketing strategies and allocate budgets efficiently. Tracking CAC alongside Lifetime Value (LTV) enables companies to assess profitability and sustainability of customer relationships.

Key Factors Influencing Lifetime Value

Customer retention rates, purchase frequency, and average order value are key factors influencing Lifetime Value (LTV). Effective customer support and personalization strategies enhance engagement, directly increasing LTV. Monitoring these metrics helps align Acquisition Cost with expected revenue, optimizing overall business profitability.

The Ideal Acquisition Cost to Lifetime Value Ratio

The ideal acquisition cost to lifetime value (LTV) ratio in business typically ranges from 1:3 to 1:5, ensuring sustainable profitability while maximizing customer value. Maintaining a ratio where the customer lifetime value is at least three times the acquisition cost helps businesses optimize marketing spend and achieve healthy growth margins. Companies that achieve this balance increase efficiency in customer acquisition strategies and enhance long-term revenue potential.

Strategies to Reduce Acquisition Cost

Reducing customer acquisition cost (CAC) involves optimizing marketing channels by focusing on high-conversion sources such as organic search and referral programs. Implementing targeted content marketing and personalized email campaigns enhances lead quality, lowering overall CAC. Leveraging customer data analytics to refine audience segmentation also improves ad spend efficiency, increasing lifetime value (LTV) relative to acquisition expenses.

Tactics to Increase Customer Lifetime Value

Increasing customer lifetime value (CLV) involves tactics such as personalized marketing, loyalty programs, and upselling strategies that encourage repeat purchases and higher spending per transaction. Enhancing customer experience through responsive support and tailored product recommendations fosters long-term engagement and brand loyalty. Implementing subscription models and proactive retention efforts reduces churn rates and maximizes revenue generated from each customer over time.

Common Mistakes in Balancing Acquisition Cost and Lifetime Value

Businesses often neglect accurately calculating Customer Acquisition Cost (CAC), leading to overspending on low-value customers and unprofitable marketing campaigns. Underestimating Lifetime Value (LTV) causes companies to miss opportunities for long-term revenue growth by focusing on short-term returns rather than customer retention and upselling. Failing to align CAC and LTV metrics results in inefficient resource allocation, reducing overall profitability and hindering sustainable business expansion.

Using Data to Optimize Acquisition and Lifetime Value

Analyzing customer acquisition cost (CAC) alongside customer lifetime value (CLV) enables businesses to allocate marketing budgets more effectively, maximizing return on investment. Leveraging data analytics and customer behavior insights helps identify high-value segments, optimize targeting strategies, and reduce CAC while enhancing CLV. Continuous measurement and adjustment through predictive models ensure sustained growth and profitability by balancing acquisition expenses with long-term customer revenue.

Acquisition Cost vs Lifetime Value Infographic

difterm.com

difterm.com