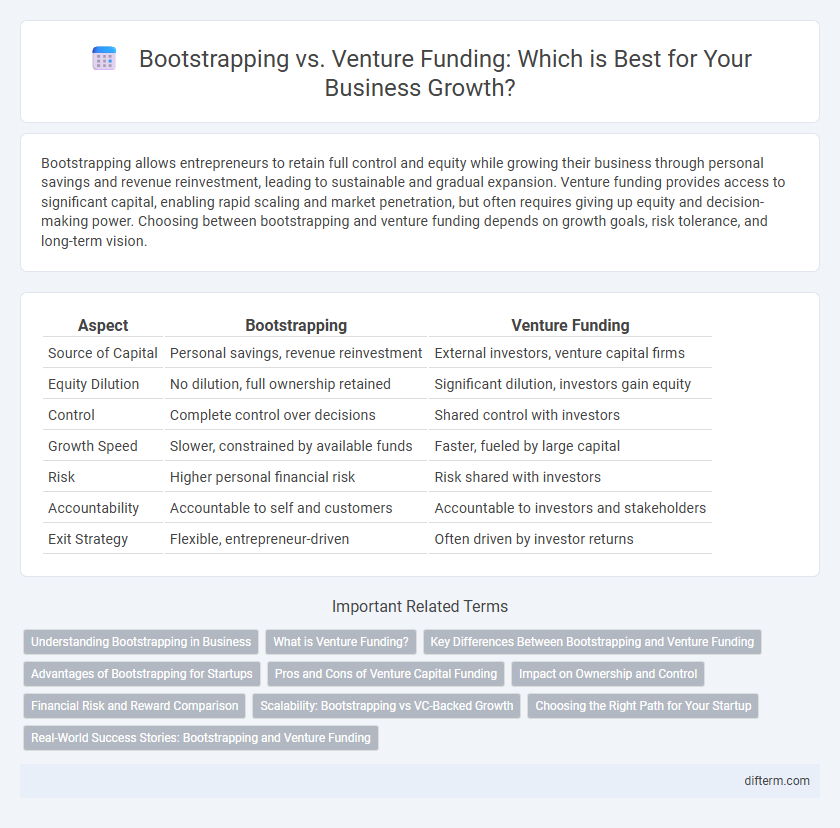

Bootstrapping allows entrepreneurs to retain full control and equity while growing their business through personal savings and revenue reinvestment, leading to sustainable and gradual expansion. Venture funding provides access to significant capital, enabling rapid scaling and market penetration, but often requires giving up equity and decision-making power. Choosing between bootstrapping and venture funding depends on growth goals, risk tolerance, and long-term vision.

Table of Comparison

| Aspect | Bootstrapping | Venture Funding |

|---|---|---|

| Source of Capital | Personal savings, revenue reinvestment | External investors, venture capital firms |

| Equity Dilution | No dilution, full ownership retained | Significant dilution, investors gain equity |

| Control | Complete control over decisions | Shared control with investors |

| Growth Speed | Slower, constrained by available funds | Faster, fueled by large capital |

| Risk | Higher personal financial risk | Risk shared with investors |

| Accountability | Accountable to self and customers | Accountable to investors and stakeholders |

| Exit Strategy | Flexible, entrepreneur-driven | Often driven by investor returns |

Understanding Bootstrapping in Business

Bootstrapping in business refers to the practice of building a company using personal finances and operational revenue without external funding. This method emphasizes financial discipline, lean operations, and organic growth, allowing entrepreneurs to retain full ownership and control. Understanding bootstrapping helps entrepreneurs navigate early-stage challenges by prioritizing cash flow management and cost-efficiency.

What is Venture Funding?

Venture funding is a method of raising capital through external investors who provide funds to startups and early-stage companies in exchange for equity stakes. This financial support enables rapid business growth, product development, and market expansion while involving investor oversight and potential dilution of ownership. Venture capital firms typically seek high-growth potential businesses with scalable models and a strong exit strategy.

Key Differences Between Bootstrapping and Venture Funding

Bootstrapping involves self-funding a business using personal savings or reinvested profits, offering full control and ownership to the entrepreneur. Venture funding provides external capital from investors, enabling rapid growth but often requiring equity dilution and shared decision-making. Key differences include financial risk, control dynamics, and scalability speed, with bootstrapping favoring autonomy and slower growth, while venture funding emphasizes accelerated expansion and investor influence.

Advantages of Bootstrapping for Startups

Bootstrapping enables startups to maintain full ownership and control, avoiding equity dilution that occurs with venture funding. It promotes disciplined cash flow management and fosters resourcefulness, which can lead to sustainable growth and operational efficiency. Without reliance on external investors, founders retain the freedom to make strategic decisions aligned with long-term business goals.

Pros and Cons of Venture Capital Funding

Venture capital funding offers significant advantages such as access to substantial financial resources, expert mentorship, and valuable industry connections that accelerate business growth and market entry. However, it involves relinquishing equity control, potential pressure for rapid scalability, and the risk of misaligned strategic goals between founders and investors. This trade-off requires careful consideration of long-term vision versus immediate capital needs in startup decision-making.

Impact on Ownership and Control

Bootstrapping maintains full ownership and control as founders rely on personal savings or revenue to grow the business, avoiding dilution of equity. Venture funding typically requires giving up a significant portion of ownership and board seats, which dilutes founder control but accelerates growth. The choice between bootstrapping and venture funding impacts strategic decision-making power and long-term business autonomy.

Financial Risk and Reward Comparison

Bootstrapping involves using personal funds for business growth, minimizing financial risk but potentially limiting capital availability and scalability. Venture funding provides significant capital inflows, increasing growth potential and market reach, yet introduces financial risk through equity dilution and investor demands. Evaluating the balance between ownership control and funding scale is critical for aligning financial risk tolerance with expected business rewards.

Scalability: Bootstrapping vs VC-Backed Growth

Bootstrapping limits scalability due to constrained financial resources, often resulting in slower growth and incremental market expansion. Venture funding provides substantial capital injections, enabling rapid scaling through aggressive marketing, talent acquisition, and product development. VC-backed companies typically achieve faster market penetration and higher valuation multiples compared to self-funded startups.

Choosing the Right Path for Your Startup

Bootstrapping offers founders complete control and ownership while relying on personal savings and revenue to fuel growth, minimizing dilution but limiting capital availability. Venture funding provides substantial financial resources and strategic support from investors, accelerating scalability but often requiring equity sharing and decision-making influence. Assessing startup goals, market conditions, and growth timelines is crucial to selecting the optimal funding strategy for sustainable success.

Real-World Success Stories: Bootstrapping and Venture Funding

Bootstrapping enabled companies like Mailchimp to achieve sustained growth without external capital, relying on customer revenue to fuel expansion and maintain control. In contrast, venture-funded startups such as Airbnb leveraged significant investment to scale rapidly, enter multiple markets, and disrupt the hospitality industry. Both approaches demonstrate viable paths to success, with bootstrapping fostering organic growth and venture funding accelerating market penetration.

Bootstrapping vs Venture Funding Infographic

difterm.com

difterm.com