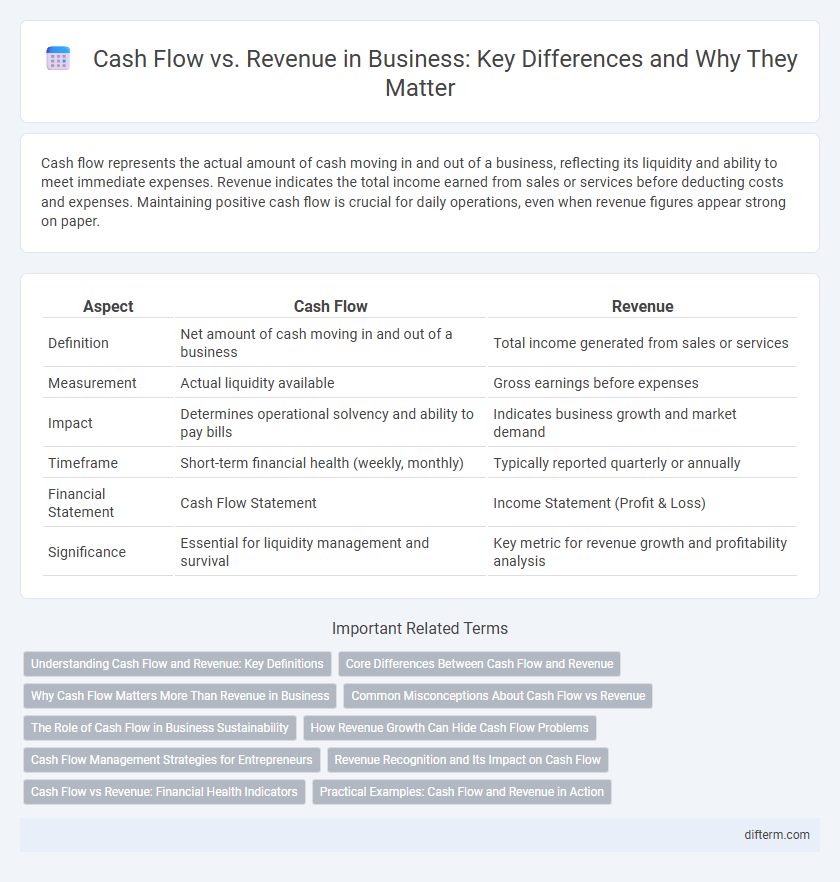

Cash flow represents the actual amount of cash moving in and out of a business, reflecting its liquidity and ability to meet immediate expenses. Revenue indicates the total income earned from sales or services before deducting costs and expenses. Maintaining positive cash flow is crucial for daily operations, even when revenue figures appear strong on paper.

Table of Comparison

| Aspect | Cash Flow | Revenue |

|---|---|---|

| Definition | Net amount of cash moving in and out of a business | Total income generated from sales or services |

| Measurement | Actual liquidity available | Gross earnings before expenses |

| Impact | Determines operational solvency and ability to pay bills | Indicates business growth and market demand |

| Timeframe | Short-term financial health (weekly, monthly) | Typically reported quarterly or annually |

| Financial Statement | Cash Flow Statement | Income Statement (Profit & Loss) |

| Significance | Essential for liquidity management and survival | Key metric for revenue growth and profitability analysis |

Understanding Cash Flow and Revenue: Key Definitions

Cash flow represents the actual inflow and outflow of cash within a business, indicating liquidity and the ability to meet immediate financial obligations. Revenue is the total income generated from sales or services before deducting expenses, reflecting the company's gross earnings. Understanding the difference between cash flow and revenue is essential for assessing financial health, as strong revenue does not always translate to positive cash flow.

Core Differences Between Cash Flow and Revenue

Cash flow represents the actual inflow and outflow of cash within a business, reflecting liquidity and the ability to meet immediate financial obligations. Revenue indicates the total income earned from sales or services, regardless of whether the cash has been received. Understanding the distinction between cash flow and revenue is crucial for accurate financial analysis and maintaining operational stability.

Why Cash Flow Matters More Than Revenue in Business

Cash flow reflects the actual liquidity available for day-to-day operations, making it a critical indicator of a business's financial health, unlike revenue which only shows total sales. Positive cash flow ensures a company can meet short-term obligations such as payroll, supplier payments, and debt servicing, directly impacting operational stability. Investors and creditors prioritize cash flow analysis because it provides a realistic measure of a company's ability to sustain growth and avoid insolvency.

Common Misconceptions About Cash Flow vs Revenue

Many business owners confuse revenue with cash flow, mistakenly assuming high revenue guarantees liquidity. Revenue represents total sales during a period, while cash flow tracks actual cash entering and leaving the business, crucial for operational solvency. Misunderstanding these differences can lead to poor financial decisions, such as overspending despite healthy sales figures.

The Role of Cash Flow in Business Sustainability

Cash flow is critical for business sustainability as it ensures the company can cover daily operational expenses such as payroll, rent, and supplier payments, even when revenue fluctuates. Positive cash flow supports timely debt repayments, reinvestment opportunities, and emergency fund creation, which are essential for long-term stability. Unlike revenue, which represents total income earned, cash flow reflects the actual liquidity available, making it a more accurate indicator of financial health and operational efficiency.

How Revenue Growth Can Hide Cash Flow Problems

Revenue growth can mask underlying cash flow problems by inflating income statements without reflecting actual liquidity. Businesses may show increasing sales figures while struggling to collect receivables or manage payables, leading to negative cash flow despite rising revenue. Monitoring cash flow metrics alongside revenue growth is essential for identifying financial health and sustaining operations.

Cash Flow Management Strategies for Entrepreneurs

Effective cash flow management strategies for entrepreneurs include closely monitoring accounts receivable and payable to ensure timely collections and payments, thus maintaining liquidity. Implementing cash flow forecasting tools helps anticipate shortfalls and align expenses with incoming funds, preventing operational disruptions. Prioritizing cash flow over revenue growth enables sustainable business operations, as consistent cash availability supports daily expenses and strategic investments.

Revenue Recognition and Its Impact on Cash Flow

Revenue recognition determines the timing and amount of revenue reported, directly influencing cash flow projections and financial decision-making. Accurate revenue recognition aligns with accounting standards such as GAAP or IFRS, ensuring reported revenue reflects actual earned income regardless of cash receipt timing. Misalignment between revenue recognition and cash inflows can create liquidity challenges, impacting a business's ability to manage expenses and investments effectively.

Cash Flow vs Revenue: Financial Health Indicators

Cash flow represents the actual inflow and outflow of cash in a business, providing a clear picture of liquidity and the ability to meet short-term obligations, while revenue reflects total sales generated during a period without accounting for expenses. Positive cash flow ensures operational stability and the capacity to invest or pay debts, whereas high revenue alone may not indicate financial health if cash is tied up in receivables or inventory. Monitoring both cash flow and revenue offers comprehensive insights into a company's profitability and sustainability.

Practical Examples: Cash Flow and Revenue in Action

Cash flow represents the actual inflow and outflow of cash within a business, while revenue reflects the total income generated from sales. For example, a company may report high revenue from large orders but experience negative cash flow if payments are delayed or operating expenses are high. Managing cash flow effectively ensures the business can cover its short-term liabilities even when revenue is strong but cash is temporarily unavailable.

cash flow vs revenue Infographic

difterm.com

difterm.com