NFTs (non-fungible tokens) represent unique digital assets with distinct properties and limited supply, making them ideal for art, collectibles, and intellectual property verification. Fungible tokens are interchangeable and uniform, commonly used as currency or utility tokens within blockchain ecosystems. The key difference lies in their divisibility and uniqueness, where NFTs hold singular value while fungible tokens do not.

Table of Comparison

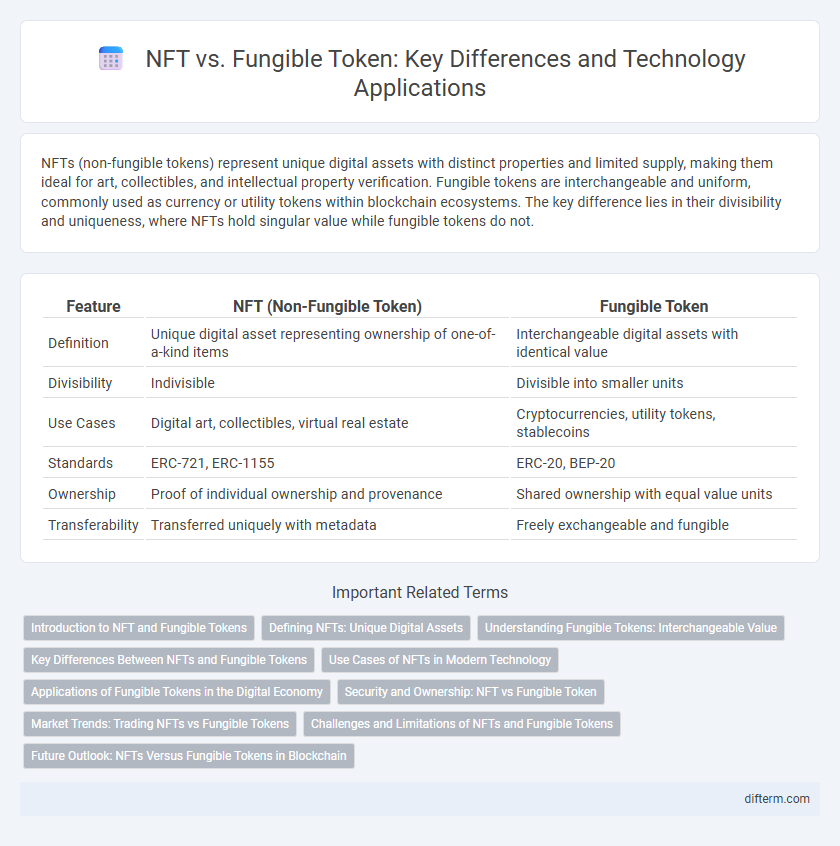

| Feature | NFT (Non-Fungible Token) | Fungible Token |

|---|---|---|

| Definition | Unique digital asset representing ownership of one-of-a-kind items | Interchangeable digital assets with identical value |

| Divisibility | Indivisible | Divisible into smaller units |

| Use Cases | Digital art, collectibles, virtual real estate | Cryptocurrencies, utility tokens, stablecoins |

| Standards | ERC-721, ERC-1155 | ERC-20, BEP-20 |

| Ownership | Proof of individual ownership and provenance | Shared ownership with equal value units |

| Transferability | Transferred uniquely with metadata | Freely exchangeable and fungible |

Introduction to NFT and Fungible Tokens

Non-fungible tokens (NFTs) represent unique digital assets secured by blockchain technology, enabling verified ownership of art, collectibles, and virtual real estate. Fungible tokens, such as cryptocurrencies like Bitcoin and Ethereum, are interchangeable units with equal value, facilitating standard transactions and currency exchange. NFTs differ fundamentally by providing indivisible and non-interchangeable proof of ownership, distinguishing them from the uniform and divisible nature of fungible tokens.

Defining NFTs: Unique Digital Assets

NFTs, or Non-Fungible Tokens, represent unique digital assets secured on a blockchain, each with distinct metadata and provenance that differentiate them from fungible tokens like cryptocurrencies. Unlike fungible tokens that are interchangeable and identical in value, NFTs are indivisible and hold exclusive ownership rights over digital art, collectibles, or virtual real estate. This uniqueness enables NFTs to establish verifiable scarcity and authenticity, driving their value in digital marketplaces.

Understanding Fungible Tokens: Interchangeable Value

Fungible tokens represent digital assets with interchangeable value, meaning each unit is identical and can be exchanged on a one-to-one basis, like cryptocurrencies such as Bitcoin or Ethereum. Unlike non-fungible tokens (NFTs), which are unique and indivisible, fungible tokens facilitate seamless transactions and liquidity in blockchain ecosystems. This interchangeability simplifies value transfer, supports fungible asset economies, and underpins decentralized finance (DeFi) applications.

Key Differences Between NFTs and Fungible Tokens

NFTs (Non-Fungible Tokens) are unique digital assets with distinct identifiers, making each token one-of-a-kind and non-interchangeable, unlike fungible tokens, which are uniform and can be exchanged on a one-to-one basis, such as cryptocurrencies like Bitcoin or Ethereum. NFTs primarily represent ownership of digital art, collectibles, or real estate, leveraging blockchain metadata to certify provenance and authenticity, whereas fungible tokens facilitate standard transactions, utility functions, or value representation within decentralized applications. The key differences include uniqueness, divisibility, and usage scope, where NFTs cannot be split or duplicated, while fungible tokens are divisible and widely used for currency and governance purposes in blockchain ecosystems.

Use Cases of NFTs in Modern Technology

NFTs enable unique digital asset ownership, revolutionizing industries such as art, gaming, and virtual real estate by providing verifiable scarcity and provenance. Unlike fungible tokens like cryptocurrencies, NFTs represent distinct items that cannot be exchanged on a one-to-one basis, making them ideal for digital collectibles and intellectual property rights management. Emerging use cases include tokenizing event tickets for fraud prevention, confirming authenticity in supply chain management, and enhancing user engagement through personalized content in augmented reality applications.

Applications of Fungible Tokens in the Digital Economy

Fungible tokens, such as cryptocurrencies like Bitcoin and Ethereum, enable seamless peer-to-peer transactions and serve as digital currency in decentralized finance (DeFi) applications. They facilitate liquidity and interoperability across various platforms, supporting activities like trading, staking, and lending. These tokens also power in-game economies and reward systems, driving user engagement and monetization in digital ecosystems.

Security and Ownership: NFT vs Fungible Token

Non-fungible tokens (NFTs) provide enhanced security through unique cryptographic signatures that verify individual ownership and prevent duplication, contrasting with fungible tokens that offer interchangeable units without distinct identity. NFTs enable immutable proof of provenance and exclusive control over digital assets, ensuring authenticity and traceability on blockchain networks like Ethereum. Fungible tokens, while secure for value transfer, lack item-specific metadata, making them less suitable for representing unique digital collectibles or rights.

Market Trends: Trading NFTs vs Fungible Tokens

NFTs have surged in popularity due to their unique digital ownership, attracting artists and collectors, while fungible tokens remain dominant in liquidity and tradability across decentralized finance platforms. Market trends reveal NFTs command higher price volatility and speculative interest, contrasted with fungible tokens' stable volume transactions and integration in payment systems. Trading volume data indicates fungible tokens experience consistent daily turnover, whereas NFT marketplaces show episodic spikes tied to high-profile drops and exclusive releases.

Challenges and Limitations of NFTs and Fungible Tokens

NFTs face challenges such as high transaction fees, scalability issues, and limited interoperability across blockchain platforms, which hinder widespread adoption. Fungible tokens encounter limitations including price volatility, regulatory uncertainty, and potential centralization risks due to token distribution. Both asset types also struggle with environmental concerns related to energy-intensive consensus mechanisms like Proof of Work.

Future Outlook: NFTs Versus Fungible Tokens in Blockchain

NFTs are poised to revolutionize digital ownership through unique, verifiable assets, driving growth in art, gaming, and virtual real estate markets. Fungible tokens will continue to dominate transactional and currency functions, supporting decentralized finance (DeFi) and broader blockchain interoperability. Innovations in cross-chain technology and regulatory frameworks will further shape the scalability and adoption of both NFTs and fungible tokens in the evolving blockchain ecosystem.

NFT vs fungible token Infographic

difterm.com

difterm.com