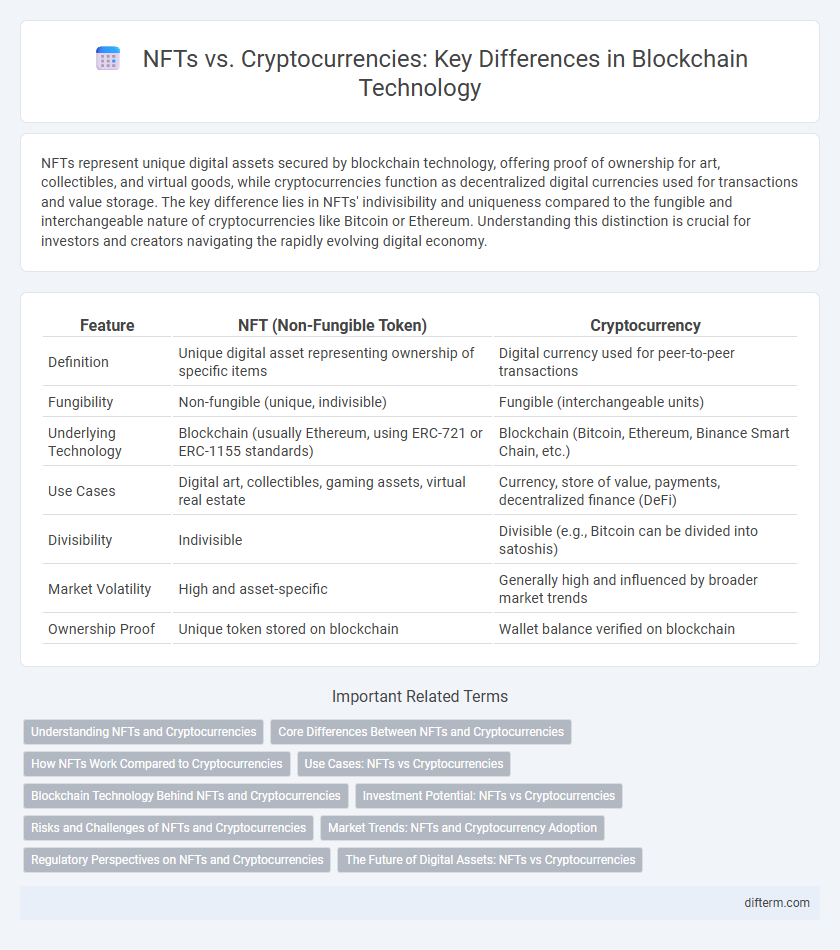

NFTs represent unique digital assets secured by blockchain technology, offering proof of ownership for art, collectibles, and virtual goods, while cryptocurrencies function as decentralized digital currencies used for transactions and value storage. The key difference lies in NFTs' indivisibility and uniqueness compared to the fungible and interchangeable nature of cryptocurrencies like Bitcoin or Ethereum. Understanding this distinction is crucial for investors and creators navigating the rapidly evolving digital economy.

Table of Comparison

| Feature | NFT (Non-Fungible Token) | Cryptocurrency |

|---|---|---|

| Definition | Unique digital asset representing ownership of specific items | Digital currency used for peer-to-peer transactions |

| Fungibility | Non-fungible (unique, indivisible) | Fungible (interchangeable units) |

| Underlying Technology | Blockchain (usually Ethereum, using ERC-721 or ERC-1155 standards) | Blockchain (Bitcoin, Ethereum, Binance Smart Chain, etc.) |

| Use Cases | Digital art, collectibles, gaming assets, virtual real estate | Currency, store of value, payments, decentralized finance (DeFi) |

| Divisibility | Indivisible | Divisible (e.g., Bitcoin can be divided into satoshis) |

| Market Volatility | High and asset-specific | Generally high and influenced by broader market trends |

| Ownership Proof | Unique token stored on blockchain | Wallet balance verified on blockchain |

Understanding NFTs and Cryptocurrencies

NFTs represent unique digital assets verified using blockchain technology, distinguishing them from cryptocurrencies, which are fungible digital currencies like Bitcoin or Ethereum. Unlike cryptocurrencies that can be exchanged on a one-to-one basis, NFTs hold distinct value due to their indivisibility and uniqueness, often linked to digital art, collectibles, or intellectual property. Understanding the fundamental difference lies in NFTs serving as proof of ownership and authenticity for a specific item, whereas cryptocurrencies function primarily as decentralized mediums of exchange or stores of value.

Core Differences Between NFTs and Cryptocurrencies

NFTs represent unique digital assets verified using blockchain technology, primarily used for digital art, collectibles, and ownership proof, while cryptocurrencies function as decentralized digital currencies facilitating peer-to-peer transactions and store of value. Unlike cryptocurrencies such as Bitcoin or Ethereum, which are fungible and interchangeable, NFTs are non-fungible, meaning each token has distinct properties and cannot be exchanged on a one-to-one basis. The core difference lies in fungibility, use cases, and the type of value they represent within the blockchain ecosystem.

How NFTs Work Compared to Cryptocurrencies

NFTs operate as unique digital tokens representing ownership of distinct assets on a blockchain, using standards like ERC-721 or ERC-1155, whereas cryptocurrencies function as fungible tokens primarily serving as digital currency or payment methods, based on standards such as ERC-20. NFTs embed metadata and provenance to ensure indivisibility and uniqueness, enabling applications in digital art, collectibles, and virtual real estate. Cryptocurrencies rely on consensus mechanisms like proof-of-work or proof-of-stake to maintain transaction integrity and liquidity across decentralized networks.

Use Cases: NFTs vs Cryptocurrencies

NFTs primarily serve as unique digital assets representing ownership of art, collectibles, and virtual real estate on blockchain platforms, enabling creators to monetize original content securely. Cryptocurrencies function as decentralized digital currencies used for peer-to-peer transactions, store of value, and as a means of payment within various ecosystems. While NFTs emphasize provenance and uniqueness in digital item ownership, cryptocurrencies focus on facilitating seamless financial transactions and value exchange across global markets.

Blockchain Technology Behind NFTs and Cryptocurrencies

Blockchain technology underpins both NFTs and cryptocurrencies, providing a decentralized ledger that ensures security and transparency. Cryptocurrencies rely on blockchain to facilitate peer-to-peer transactions with digital tokens like Bitcoin or Ethereum, while NFTs utilize blockchain to authenticate the uniqueness and ownership of digital assets through smart contracts. This shared technology enables immutable records and trustless exchanges, distinguishing NFTs as unique digital collectibles versus interchangeable cryptocurrency units.

Investment Potential: NFTs vs Cryptocurrencies

NFTs offer unique digital ownership with potential for high-value appreciation driven by rarity and cultural relevance, appealing to collectors and art investors. Cryptocurrencies provide liquidity, widespread adoption, and volatility that enables active trading and long-term growth based on network adoption and utility. Investment potential in NFTs depends on asset uniqueness and market trends, while cryptocurrencies rely on technological development and macroeconomic factors.

Risks and Challenges of NFTs and Cryptocurrencies

NFTs face significant risks including market volatility, lack of regulation, and potential copyright infringement issues. Cryptocurrencies encounter challenges such as security vulnerabilities, regulatory uncertainties, and scalability problems. Both digital assets are susceptible to fraud, hacking, and sudden value fluctuations, complicating investor protection and market stability.

Market Trends: NFTs and Cryptocurrency Adoption

NFTs have surged in popularity, with the global NFT market surpassing $40 billion in 2023, driven by increasing interest from artists, gamers, and collectors. Cryptocurrency adoption continues to expand, with over 400 million users worldwide and growing acceptance by major financial institutions. Market trends indicate a shift towards integrating NFTs and cryptocurrencies into mainstream digital economies, boosting overall blockchain technology adoption.

Regulatory Perspectives on NFTs and Cryptocurrencies

Regulatory perspectives on NFTs and cryptocurrencies differ significantly due to their distinct legal classifications and use cases. Cryptocurrencies like Bitcoin and Ethereum are often regulated as financial assets or securities by agencies such as the SEC and CFTC, requiring compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. NFTs face emerging regulatory scrutiny focused on intellectual property rights, consumer protection, and potential securities law violations when NFTs are marketed as investment products.

The Future of Digital Assets: NFTs vs Cryptocurrencies

NFTs and cryptocurrencies represent distinct facets of digital assets, with NFTs providing unique digital ownership of art, music, and collectibles, while cryptocurrencies function primarily as decentralized digital currencies. The future of digital assets is likely to see increased integration, where blockchain technology enhances the utility and value of both NFTs and cryptocurrencies in sectors such as gaming, finance, and virtual real estate. Innovations in smart contracts and interoperability protocols will drive broader adoption and create new economic models within the evolving digital economy.

NFT vs Cryptocurrency Infographic

difterm.com

difterm.com