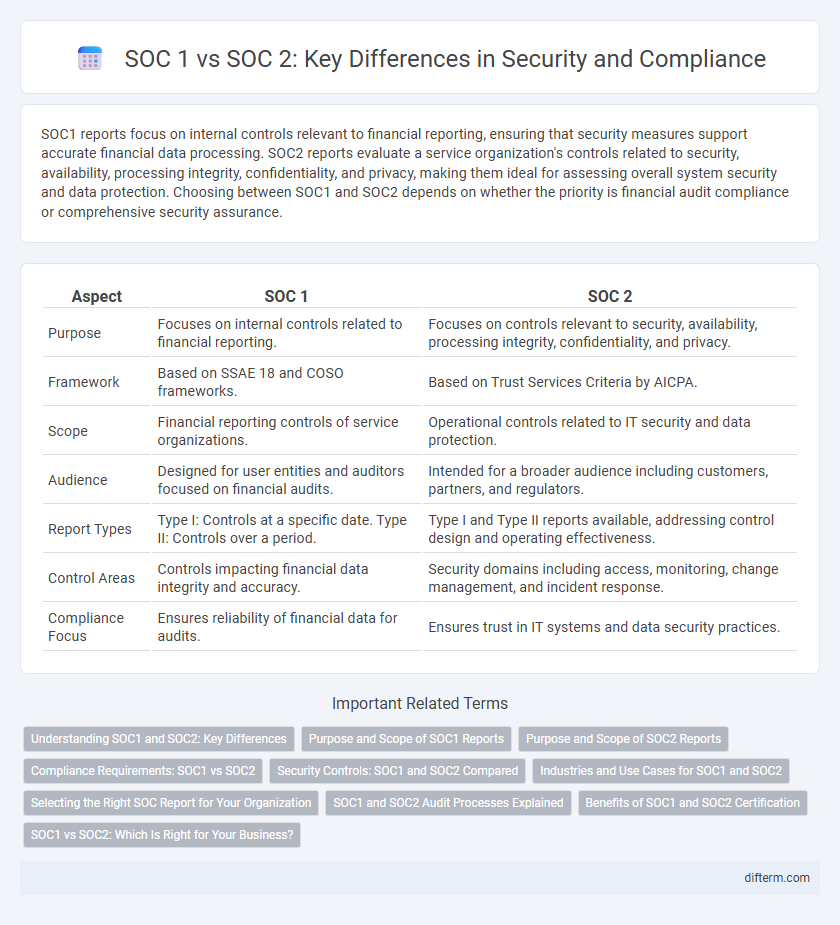

SOC1 reports focus on internal controls relevant to financial reporting, ensuring that security measures support accurate financial data processing. SOC2 reports evaluate a service organization's controls related to security, availability, processing integrity, confidentiality, and privacy, making them ideal for assessing overall system security and data protection. Choosing between SOC1 and SOC2 depends on whether the priority is financial audit compliance or comprehensive security assurance.

Table of Comparison

| Aspect | SOC 1 | SOC 2 |

|---|---|---|

| Purpose | Focuses on internal controls related to financial reporting. | Focuses on controls relevant to security, availability, processing integrity, confidentiality, and privacy. |

| Framework | Based on SSAE 18 and COSO frameworks. | Based on Trust Services Criteria by AICPA. |

| Scope | Financial reporting controls of service organizations. | Operational controls related to IT security and data protection. |

| Audience | Designed for user entities and auditors focused on financial audits. | Intended for a broader audience including customers, partners, and regulators. |

| Report Types | Type I: Controls at a specific date. Type II: Controls over a period. | Type I and Type II reports available, addressing control design and operating effectiveness. |

| Control Areas | Controls impacting financial data integrity and accuracy. | Security domains including access, monitoring, change management, and incident response. |

| Compliance Focus | Ensures reliability of financial data for audits. | Ensures trust in IT systems and data security practices. |

Understanding SOC1 and SOC2: Key Differences

SOC1 reports primarily address financial reporting controls relevant to user entities' internal controls over financial reporting (ICFR), while SOC2 reports focus on a service organization's controls related to security, availability, processing integrity, confidentiality, and privacy. SOC1 is designed to satisfy auditors and financial stakeholders, whereas SOC2 targets technology-oriented risks and is critical for service providers handling sensitive customer data. Understanding these distinctions helps organizations select the appropriate compliance framework based on their operational and regulatory priorities.

Purpose and Scope of SOC1 Reports

SOC1 reports primarily focus on evaluating and reporting on the effectiveness of a service organization's internal controls relevant to financial reporting. These reports are essential for service organizations that impact their clients' financial statements, ensuring compliance with auditing standards such as SSAE 18. The scope of SOC1 centers on controls that directly affect the accuracy and reliability of financial transactions and data processing.

Purpose and Scope of SOC2 Reports

SOC2 reports are designed to evaluate an organization's controls related to security, availability, processing integrity, confidentiality, and privacy of data, specifically focusing on the suitability and effectiveness of these controls over a defined period. Unlike SOC1 reports, which assess financial reporting controls, SOC2 emphasizes operational and compliance aspects critical to technology and cloud service providers. The scope of SOC2 includes tests of systems and processes against Trust Services Criteria, ensuring organizations maintain stringent safeguards that protect client data and maintain trust.

Compliance Requirements: SOC1 vs SOC2

SOC1 compliance centers on internal controls relevant to financial reporting and is essential for service organizations impacting their clients' financial statements under SSAE 18 standards. SOC2 focuses on controls related to security, availability, processing integrity, confidentiality, and privacy, governed by the Trust Services Criteria tailored for technology and cloud-based service providers. Organizations pursuing SOC2 audits address broader data protection and operational compliance, while SOC1 audits primarily ensure financial data integrity and audit readiness.

Security Controls: SOC1 and SOC2 Compared

SOC1 reports focus primarily on internal controls related to financial reporting, assessing controls that impact client financial statements, while SOC2 reports emphasize security controls designed to protect data confidentiality, integrity, and availability based on Trust Service Criteria. SOC2 incorporates five key principles--security, availability, processing integrity, confidentiality, and privacy--making it more comprehensive for evaluating IT and data security environments. SOC1 is most relevant for service organizations influencing financial audits, whereas SOC2 provides assurance on cybersecurity practices and operational controls beyond financial processes.

Industries and Use Cases for SOC1 and SOC2

SOC 1 reports are primarily utilized by financial services, payroll processing, and healthcare industries to evaluate internal controls relevant to financial reporting, ensuring compliance with regulatory requirements such as SSAE 18. SOC 2 reports are widely adopted by technology, cloud computing, and SaaS companies to demonstrate robust security, availability, processing integrity, confidentiality, and privacy controls aligned with the Trust Services Criteria. Organizations handling sensitive customer data or providing managed IT services often leverage SOC 2 to assure clients of their operational security and data protection practices.

Selecting the Right SOC Report for Your Organization

Choosing between SOC1 and SOC2 reports depends on your organization's control objectives and stakeholder requirements; SOC1 focuses on financial reporting controls while SOC2 emphasizes security, availability, processing integrity, confidentiality, and privacy. Organizations handling sensitive customer data or requiring comprehensive IT security assurance typically prioritize SOC2 compliance. Evaluating specific regulatory demands and third-party audit expectations ensures the selection of the appropriate SOC report to demonstrate robust internal controls.

SOC1 and SOC2 Audit Processes Explained

SOC1 audits evaluate internal controls relevant to financial reporting by examining processes that impact financial data accuracy, ensuring compliance with the Statement on Standards for Attestation Engagements (SSAE) No. 18. SOC2 audits focus on controls related to security, availability, processing integrity, confidentiality, and privacy based on the Trust Services Criteria, involving rigorous testing of operational policies and system safeguards. Both audit processes require detailed documentation and continuous monitoring to verify control effectiveness, but SOC1 emphasizes financial controls while SOC2 targets broader IT and data security controls.

Benefits of SOC1 and SOC2 Certification

SOC1 certification primarily benefits organizations by validating internal controls related to financial reporting, enhancing trust with clients and auditors. SOC2 certification demonstrates robust security, availability, processing integrity, confidentiality, and privacy controls, crucial for protecting sensitive data and ensuring compliance with industry standards. Both certifications strengthen risk management frameworks and improve competitive advantage by showcasing a commitment to regulatory adherence and operational excellence.

SOC1 vs SOC2: Which Is Right for Your Business?

SOC1 reports focus on internal controls over financial reporting, making them essential for businesses in financial services and those requiring assurance on financial data accuracy. SOC2 reports emphasize security, availability, processing integrity, confidentiality, and privacy, ideal for technology and cloud service providers handling sensitive customer information. Choosing between SOC1 and SOC2 depends on whether your business needs to address financial reporting risks or demonstrate robust data security practices to clients and stakeholders.

SOC1 vs SOC2 Infographic

difterm.com

difterm.com