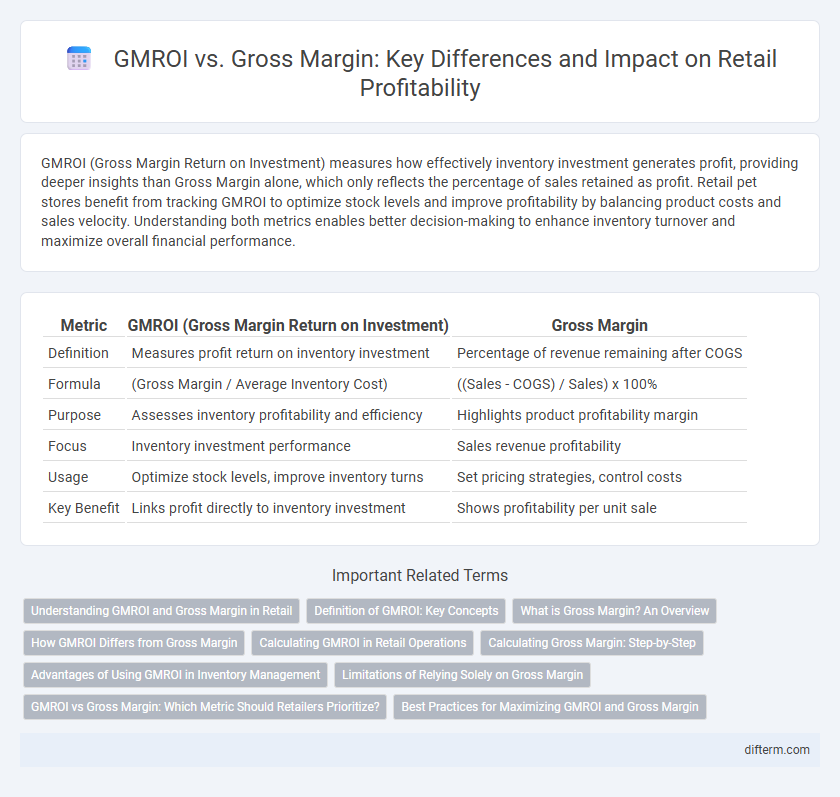

GMROI (Gross Margin Return on Investment) measures how effectively inventory investment generates profit, providing deeper insights than Gross Margin alone, which only reflects the percentage of sales retained as profit. Retail pet stores benefit from tracking GMROI to optimize stock levels and improve profitability by balancing product costs and sales velocity. Understanding both metrics enables better decision-making to enhance inventory turnover and maximize overall financial performance.

Table of Comparison

| Metric | GMROI (Gross Margin Return on Investment) | Gross Margin |

|---|---|---|

| Definition | Measures profit return on inventory investment | Percentage of revenue remaining after COGS |

| Formula | (Gross Margin / Average Inventory Cost) | ((Sales - COGS) / Sales) x 100% |

| Purpose | Assesses inventory profitability and efficiency | Highlights product profitability margin |

| Focus | Inventory investment performance | Sales revenue profitability |

| Usage | Optimize stock levels, improve inventory turns | Set pricing strategies, control costs |

| Key Benefit | Links profit directly to inventory investment | Shows profitability per unit sale |

Understanding GMROI and Gross Margin in Retail

GMROI (Gross Margin Return on Investment) measures the profitability of inventory by comparing gross margin to average inventory cost, helping retailers assess how well inventory generates profit. Gross margin represents the difference between sales revenue and the cost of goods sold, indicating the basic profitability of products. Understanding both GMROI and gross margin is essential for retail businesses to optimize inventory investment and maximize overall financial performance.

Definition of GMROI: Key Concepts

GMROI (Gross Margin Return on Investment) measures the profitability of inventory by comparing gross margin to the cost of inventory investment, providing insight into how efficiently inventory generates profit. Unlike gross margin, which only reflects the percentage of sales revenue retained after subtracting cost of goods sold, GMROI incorporates inventory cost to evaluate the return on each dollar invested in stock. Retailers use GMROI to optimize inventory management, ensuring product assortment and purchasing decisions maximize profitability and turnover.

What is Gross Margin? An Overview

Gross Margin represents the percentage of total sales revenue that exceeds the cost of goods sold (COGS), highlighting how much profit a retailer makes after covering product costs. It is calculated by subtracting COGS from total sales and dividing the result by total sales, expressed as a percentage. This metric provides insight into pricing strategies and the overall profitability of retail operations without considering inventory efficiency like GMROI does.

How GMROI Differs from Gross Margin

GMROI (Gross Margin Return on Investment) measures the profit generated from inventory investment, highlighting both margin and inventory turnover efficiency, while Gross Margin solely reflects the percentage of sales revenue remaining after cost of goods sold. GMROI provides insights into the effectiveness of inventory management by combining profitability and turnover into a single metric, whereas Gross Margin focuses only on profit margin without accounting for inventory levels. Retailers use GMROI to optimize stock allocation and maximize returns on inventory investment beyond what Gross Margin can reveal.

Calculating GMROI in Retail Operations

GMROI (Gross Margin Return on Investment) measures the profitability of inventory by comparing gross margin to the cost of inventory, calculated as GMROI = Gross Margin / Average Inventory Cost. This metric helps retailers evaluate the efficiency of their inventory investment by showing how many dollars of gross margin are earned for every dollar spent on inventory. Unlike gross margin alone, GMROI integrates both profitability and inventory turnover, providing a more comprehensive insight into retail operations and inventory management.

Calculating Gross Margin: Step-by-Step

Calculating gross margin in retail involves subtracting the cost of goods sold (COGS) from total sales revenue and dividing the result by total sales revenue, then multiplying by 100 to express it as a percentage. This metric highlights the percentage of sales revenue remaining after covering the direct costs of inventory, essential for pricing and profitability analysis. Understanding gross margin provides critical insights for comparing with Gross Margin Return on Investment (GMROI), which incorporates inventory investment efficiency.

Advantages of Using GMROI in Inventory Management

GMROI (Gross Margin Return on Investment) offers a powerful metric for retailers to evaluate inventory profitability by directly linking gross margin to the investment in stock, enabling more precise allocation of capital to high-performing products. Unlike gross margin alone, GMROI accounts for inventory turnover, helping retailers optimize stock levels and reduce holding costs. This metric enhances decision-making by identifying which items generate the best return relative to their cost, improving overall inventory efficiency and profitability.

Limitations of Relying Solely on Gross Margin

Gross Margin alone can be misleading as it ignores the cost of inventory and sales velocity, which are critical for retail profitability. GMROI (Gross Margin Return on Investment) provides a more comprehensive measure by incorporating both profit margin and inventory turnover, revealing how well inventory investment generates profit. Retailers relying solely on Gross Margin risk overestimating profitability if slow-moving stock inflates margins without translating into cash flow.

GMROI vs Gross Margin: Which Metric Should Retailers Prioritize?

GMROI (Gross Margin Return on Investment) measures the profit return on inventory investment, emphasizing how well inventory generates profit relative to its cost, while Gross Margin focuses solely on the percentage difference between sales and cost of goods sold. Retailers should prioritize GMROI for a comprehensive view of inventory efficiency and profitability, as it balances margin and turnover factors crucial for decision-making. Although Gross Margin highlights profitability, GMROI provides actionable insights for optimizing stock levels and maximizing overall retail performance.

Best Practices for Maximizing GMROI and Gross Margin

Optimizing GMROI requires precise inventory management and strategic product assortment to align stock levels with consumer demand, avoiding overstock and stockouts. Focusing on high-margin products with strong turnover rates enhances gross margin while improving overall profitability. Effective pricing strategies, combined with regular sales analysis, enable retailers to balance margins and inventory investment for sustained financial growth.

GMROI vs Gross Margin Infographic

difterm.com

difterm.com