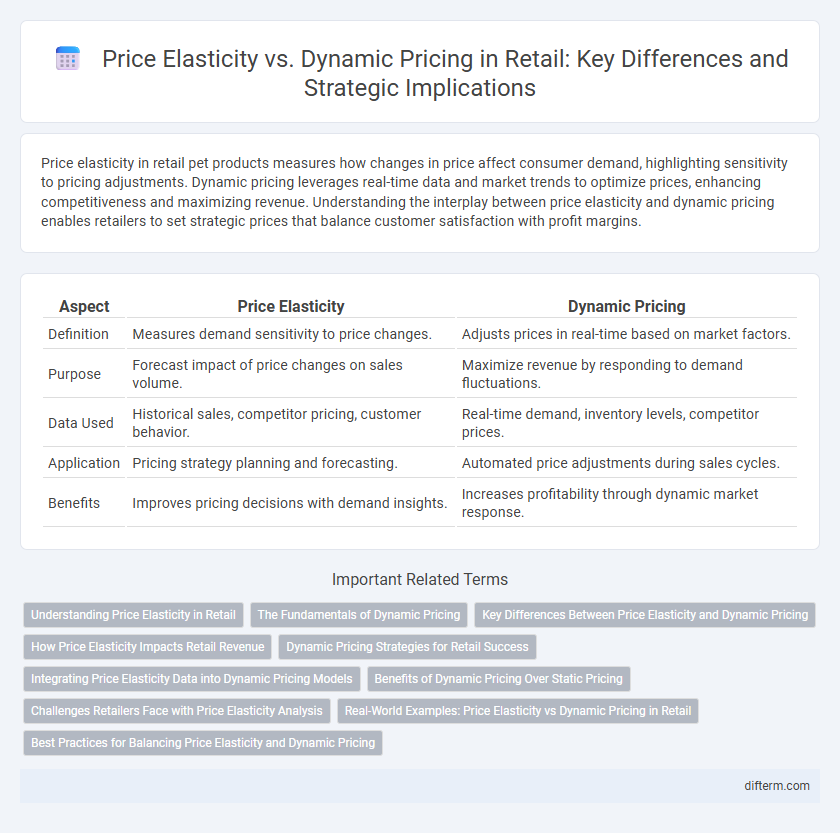

Price elasticity in retail pet products measures how changes in price affect consumer demand, highlighting sensitivity to pricing adjustments. Dynamic pricing leverages real-time data and market trends to optimize prices, enhancing competitiveness and maximizing revenue. Understanding the interplay between price elasticity and dynamic pricing enables retailers to set strategic prices that balance customer satisfaction with profit margins.

Table of Comparison

| Aspect | Price Elasticity | Dynamic Pricing |

|---|---|---|

| Definition | Measures demand sensitivity to price changes. | Adjusts prices in real-time based on market factors. |

| Purpose | Forecast impact of price changes on sales volume. | Maximize revenue by responding to demand fluctuations. |

| Data Used | Historical sales, competitor pricing, customer behavior. | Real-time demand, inventory levels, competitor prices. |

| Application | Pricing strategy planning and forecasting. | Automated price adjustments during sales cycles. |

| Benefits | Improves pricing decisions with demand insights. | Increases profitability through dynamic market response. |

Understanding Price Elasticity in Retail

Price elasticity in retail measures how consumer demand changes in response to price variations, guiding retailers in setting optimal prices to maximize revenue. Understanding price elasticity helps retailers predict sales volume shifts when adjusting prices, enabling more strategic inventory and promotional decisions. Accurate elasticity analysis supports dynamic pricing models by identifying products with elastic or inelastic demand for targeted price optimization.

The Fundamentals of Dynamic Pricing

Dynamic pricing leverages algorithms and real-time data to adjust prices based on demand, competition, and inventory levels, differentiating it from price elasticity, which measures consumer sensitivity to price changes. Retailers implementing dynamic pricing optimize revenue by responding instantaneously to market fluctuations, consumer behavior, and seasonal trends. The fundamentals of dynamic pricing involve analyzing big data, forecasting demand patterns, and employing machine learning models to set optimal prices that maximize profitability while maintaining competitive advantage.

Key Differences Between Price Elasticity and Dynamic Pricing

Price elasticity measures consumer sensitivity to price changes, quantifying how demand varies with price fluctuations in retail markets. Dynamic pricing involves real-time adjustment of prices based on market conditions, inventory levels, and competitor actions to optimize revenue. The key difference lies in price elasticity being a predictive metric for demand response, while dynamic pricing is a tactical approach to set prices dynamically.

How Price Elasticity Impacts Retail Revenue

Price elasticity significantly influences retail revenue by determining how sensitive customers are to price changes, directly affecting sales volume and profit margins. Retailers with high price elasticity products must carefully adjust prices to avoid large drops in demand, while dynamic pricing strategies use real-time data to optimize prices based on consumer behavior, competition, and inventory levels. Understanding price elasticity enables retailers to implement dynamic pricing models that maximize revenue by aligning prices with consumer willingness to pay.

Dynamic Pricing Strategies for Retail Success

Dynamic pricing strategies enable retailers to adjust product prices in real-time based on demand, competition, and inventory levels, maximizing revenue and enhancing competitive advantage. Leveraging advanced algorithms and data analytics, retailers can predict customer behavior and optimize pricing to capture consumer willingness to pay more effectively than static price models influenced by price elasticity. Implementing machine learning-driven dynamic pricing improves sales performance and customer satisfaction by ensuring prices reflect market conditions and individual purchasing patterns.

Integrating Price Elasticity Data into Dynamic Pricing Models

In retail, integrating price elasticity data into dynamic pricing models enhances revenue optimization by accurately predicting customer response to price changes. Price elasticity measures demand sensitivity, enabling retailers to adjust prices dynamically based on real-time market conditions and consumer behavior. This data-driven approach increases profitability while maintaining competitive advantage and customer satisfaction.

Benefits of Dynamic Pricing Over Static Pricing

Dynamic pricing leverages real-time market data and consumer behavior analytics to optimize prices, maximizing revenue and improving inventory turnover compared to static pricing. Retailers employing dynamic pricing adapt swiftly to demand fluctuations, competitor actions, and seasonal trends, resulting in enhanced profit margins and customer satisfaction. Static pricing lacks this flexibility, often leading to missed opportunities and inefficient stock management in competitive retail environments.

Challenges Retailers Face with Price Elasticity Analysis

Retailers face significant challenges with price elasticity analysis due to fluctuating consumer demand and diverse product categories, which complicate accurate elasticity estimation. Dynamic pricing systems require real-time data integration and advanced algorithms to adjust prices effectively, but inaccurate elasticity models can lead to suboptimal pricing strategies and lost revenue. Addressing these challenges demands robust predictive analytics and granular customer behavior insights to enhance price sensitivity understanding.

Real-World Examples: Price Elasticity vs Dynamic Pricing in Retail

Retailers leverage price elasticity to understand consumer sensitivity, adjusting prices to maximize profit without losing demand, as seen in grocery chains reducing prices on staple goods to increase volume sales. Dynamic pricing, used by online platforms like Amazon, modifies prices in real-time based on competitor pricing, inventory levels, and customer behavior, helping to capture value from different segments. Combining price elasticity insights with dynamic pricing algorithms enables retailers to optimize revenue while responding swiftly to market changes.

Best Practices for Balancing Price Elasticity and Dynamic Pricing

Effective retail strategies integrate price elasticity analysis with dynamic pricing systems to optimize revenue and customer satisfaction. Monitoring real-time demand fluctuations and competitor pricing allows retailers to adjust prices dynamically while respecting elasticity thresholds to avoid customer churn. Implementing AI-powered algorithms can balance price responsiveness and market sensitivity, ensuring prices remain competitive without eroding profit margins.

Price Elasticity vs Dynamic Pricing Infographic

difterm.com

difterm.com