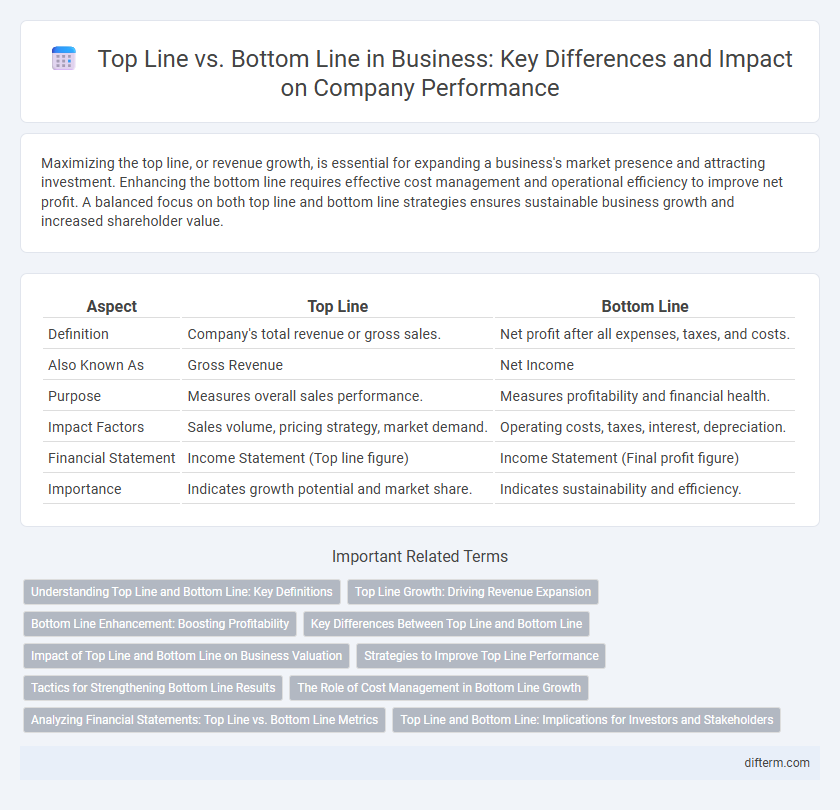

Maximizing the top line, or revenue growth, is essential for expanding a business's market presence and attracting investment. Enhancing the bottom line requires effective cost management and operational efficiency to improve net profit. A balanced focus on both top line and bottom line strategies ensures sustainable business growth and increased shareholder value.

Table of Comparison

| Aspect | Top Line | Bottom Line |

|---|---|---|

| Definition | Company's total revenue or gross sales. | Net profit after all expenses, taxes, and costs. |

| Also Known As | Gross Revenue | Net Income |

| Purpose | Measures overall sales performance. | Measures profitability and financial health. |

| Impact Factors | Sales volume, pricing strategy, market demand. | Operating costs, taxes, interest, depreciation. |

| Financial Statement | Income Statement (Top line figure) | Income Statement (Final profit figure) |

| Importance | Indicates growth potential and market share. | Indicates sustainability and efficiency. |

Understanding Top Line and Bottom Line: Key Definitions

Top line refers to a company's gross revenue or sales, indicating overall business growth and market demand. Bottom line represents net profit, reflecting operational efficiency and cost management after expenses and taxes. Understanding both metrics is crucial for assessing financial health and guiding strategic decisions.

Top Line Growth: Driving Revenue Expansion

Top line growth represents the increase in a company's gross sales or revenue, serving as a critical indicator of market demand and business expansion. Companies prioritize strategies such as product innovation, market penetration, and sales optimization to drive top line growth and enhance overall revenue streams. Effective top line growth fuels sustainability and investor confidence by signaling robust business performance and competitive positioning.

Bottom Line Enhancement: Boosting Profitability

Bottom line enhancement concentrates on increasing net profit by optimizing operational efficiencies and reducing expenses without compromising product quality or customer experience. Strategies such as cost control, revenue diversification, and investing in technology are crucial for maximizing profitability and shareholder value. Firms focusing on bottom line performance often achieve sustainable growth by balancing expense management with strategic investments.

Key Differences Between Top Line and Bottom Line

Top line refers to a company's gross revenue or sales, representing total income generated from business operations before any expenses are deducted. Bottom line denotes net income or profit, reflecting the company's earnings after all costs, taxes, and expenses are subtracted from the top line. Understanding these key differences helps analyze financial performance, where top line growth indicates sales effectiveness, while bottom line growth highlights profitability and cost management efficiency.

Impact of Top Line and Bottom Line on Business Valuation

Top line growth, representing increased revenue, directly enhances business valuation by signaling robust demand and market expansion potential. Bottom line improvements, reflecting net profit, indicate operational efficiency and profitability, attracting investors focused on sustainable earnings. Both metrics are critical; strong top line growth fuels scale, while a healthy bottom line ensures financial stability, collectively boosting overall company worth.

Strategies to Improve Top Line Performance

Enhancing top line performance requires targeted strategies such as expanding market reach through digital marketing, launching innovative products to meet evolving customer demands, and optimizing pricing strategies to maximize revenue. Leveraging data analytics enables businesses to identify high-growth segments and personalize customer experiences, driving increased sales. Strengthening partnerships and exploring new distribution channels further amplify revenue streams critical for sustainable top line growth.

Tactics for Strengthening Bottom Line Results

Implement cost control measures such as reducing operational expenses and optimizing supply chain efficiency to enhance bottom line profitability. Invest in technology and automation to increase productivity while minimizing labor costs, driving stronger net income growth. Focus on high-margin products and services through targeted pricing strategies to maximize profit margins and improve overall financial performance.

The Role of Cost Management in Bottom Line Growth

Cost management directly influences bottom line growth by reducing expenses and improving operational efficiency, thereby increasing net profit margins. Strategic expense control in areas such as supply chain, production, and overhead minimizes financial waste without sacrificing product quality or customer satisfaction. Effective cost management enables businesses to reinvest savings into innovation and market expansion, driving sustainable profitability.

Analyzing Financial Statements: Top Line vs. Bottom Line Metrics

Top line and bottom line metrics provide critical insights into a company's financial performance by focusing on revenue and net income, respectively. Analyzing financial statements reveals how top line growth indicates sales expansion, while bottom line improvement reflects profitability after expenses. Investors and analysts use these metrics to assess operational efficiency, cost management, and overall business health.

Top Line and Bottom Line: Implications for Investors and Stakeholders

Top line refers to a company's gross revenue or sales, indicating overall market demand and growth potential, while the bottom line represents net profit after all expenses, reflecting operational efficiency and financial health. Investors prioritize top line growth to gauge market expansion and revenue opportunities, whereas stakeholders focus on bottom line improvements to assess profitability and sustainable management practices. Understanding the balance between top line and bottom line performance is crucial for making informed investment decisions and evaluating long-term business viability.

top line vs bottom line Infographic

difterm.com

difterm.com