Burn rate measures how quickly a startup spends its capital, impacting its runway and financial sustainability. Churn rate reflects the percentage of customers lost over a specific period, directly affecting recurring revenue and growth potential. Understanding the balance between burn rate and churn rate is crucial for maintaining a healthy cash flow and scaling a business effectively.

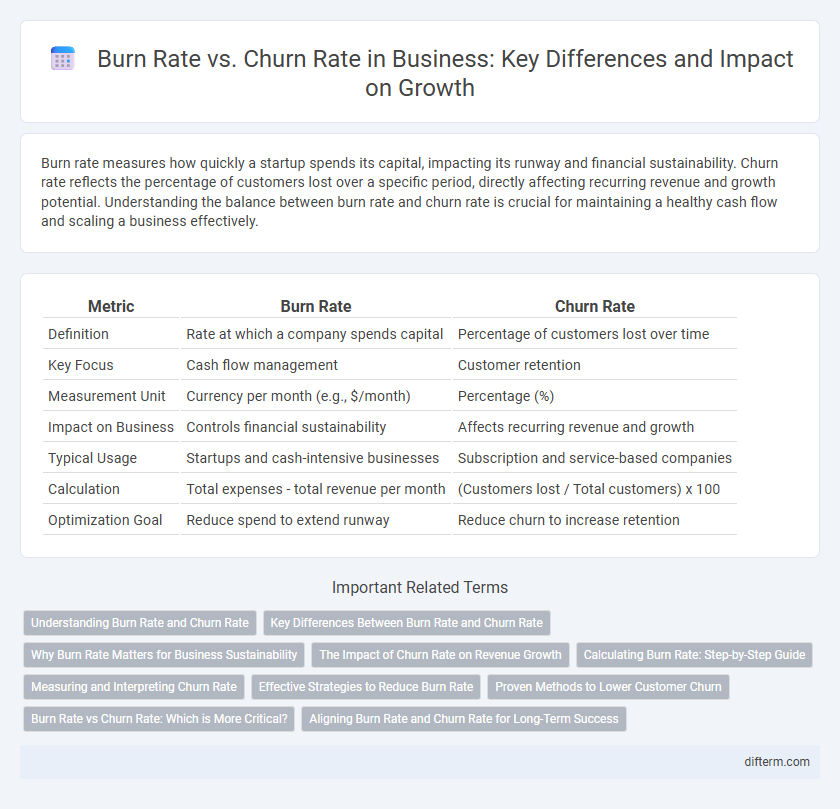

Table of Comparison

| Metric | Burn Rate | Churn Rate |

|---|---|---|

| Definition | Rate at which a company spends capital | Percentage of customers lost over time |

| Key Focus | Cash flow management | Customer retention |

| Measurement Unit | Currency per month (e.g., $/month) | Percentage (%) |

| Impact on Business | Controls financial sustainability | Affects recurring revenue and growth |

| Typical Usage | Startups and cash-intensive businesses | Subscription and service-based companies |

| Calculation | Total expenses - total revenue per month | (Customers lost / Total customers) x 100 |

| Optimization Goal | Reduce spend to extend runway | Reduce churn to increase retention |

Understanding Burn Rate and Churn Rate

Burn rate represents the speed at which a company spends its capital, crucial for managing cash flow and runway during growth or downturns. Churn rate measures the percentage of customers or subscribers who discontinue service within a given period, impacting revenue stability and growth projections. Understanding both metrics enables businesses to optimize financial health and customer retention strategies effectively.

Key Differences Between Burn Rate and Churn Rate

Burn rate measures the speed at which a company spends its capital, reflecting financial sustainability and runway, while churn rate quantifies the percentage of customers lost over a specific period, indicating customer retention and business growth challenges. Burn rate impacts cash flow management and fundraising needs, whereas churn rate directly affects revenue stability and long-term market share. Understanding these metrics helps businesses optimize operational efficiency and improve customer lifetime value.

Why Burn Rate Matters for Business Sustainability

Burn rate measures the speed at which a company spends its capital, directly impacting business sustainability by indicating how long it can operate before needing additional funding. Maintaining a manageable burn rate ensures that a startup or enterprise can weather market fluctuations and avoid premature insolvency. Unlike churn rate, which tracks customer attrition, burn rate reflects financial health and operational efficiency crucial for long-term viability.

The Impact of Churn Rate on Revenue Growth

Churn rate directly affects revenue growth by reducing the number of recurring customers, leading to decreased lifetime value and lower monthly recurring revenue (MRR). High churn rates necessitate increased acquisition costs to replace lost customers, impacting profitability and cash flow. Managing churn effectively is essential for sustainable revenue expansion and long-term business viability.

Calculating Burn Rate: Step-by-Step Guide

Calculating burn rate involves tracking the total monthly operating expenses and subtracting revenue to determine the net cash outflow, which reflects how quickly a business is spending its capital. This metric is crucial for startups and businesses managing runway, as it indicates the timeline before additional funding is required. Accurate burn rate calculation supports financial planning and helps in strategizing to minimize churn rate by allocating resources efficiently.

Measuring and Interpreting Churn Rate

Churn rate measures the percentage of customers who discontinue using a service over a specific period, reflecting customer retention and business sustainability. Accurate churn analysis involves tracking customer cancellations, product usage declines, and subscription lapses to identify patterns and inform retention strategies. Interpreting churn rate alongside metrics like customer lifetime value and acquisition cost enables businesses to optimize growth and improve revenue predictability.

Effective Strategies to Reduce Burn Rate

Effective strategies to reduce burn rate include optimizing operational expenses by automating processes and negotiating better vendor contracts to minimize cash outflows. Implementing data-driven budgeting and prioritizing high-ROI initiatives ensure capital is allocated efficiently, delaying the need for additional funding. Monitoring churn rate helps identify customer retention issues that, when addressed, improve recurring revenue streams and reduce overall financial pressure.

Proven Methods to Lower Customer Churn

Effective strategies to reduce customer churn include enhancing customer engagement through personalized communication and improving product satisfaction via continuous feedback loops. Implementing proactive support systems and leveraging predictive analytics to identify at-risk customers significantly lowers churn rates. Companies achieving a balanced burn rate while focusing on customer retention tend to sustain healthier revenue growth and operational efficiency.

Burn Rate vs Churn Rate: Which is More Critical?

Burn rate quantifies the speed at which a company spends its capital, directly impacting runway and financial sustainability. Churn rate measures customer attrition, affecting recurring revenue and growth potential. Prioritizing burn rate is crucial for early-stage startups to extend operational lifespan, while established businesses must focus on churn rate to maintain stable revenue streams and long-term profitability.

Aligning Burn Rate and Churn Rate for Long-Term Success

Aligning burn rate and churn rate is critical for sustainable business growth, as managing cash flow while retaining customers ensures operational stability. A high burn rate coupled with a high churn rate accelerates financial depletion and undermines recurring revenue streams, risking premature business failure. Prioritizing efficient spend alongside customer retention strategies enables companies to balance growth investments and profitability for long-term success.

burn rate vs churn rate Infographic

difterm.com

difterm.com