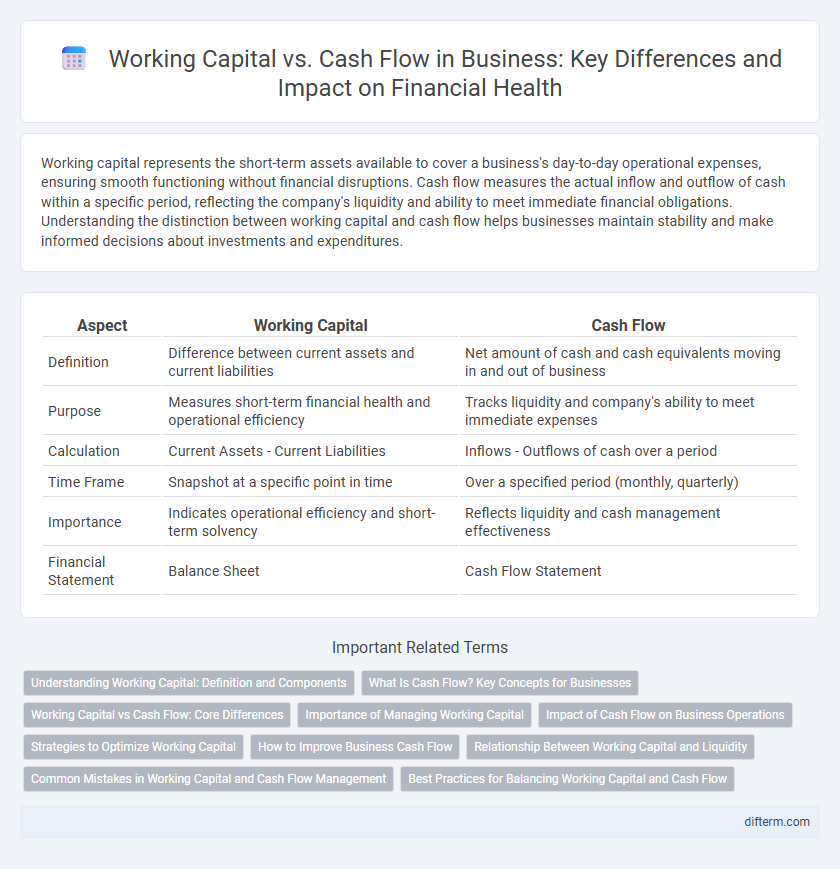

Working capital represents the short-term assets available to cover a business's day-to-day operational expenses, ensuring smooth functioning without financial disruptions. Cash flow measures the actual inflow and outflow of cash within a specific period, reflecting the company's liquidity and ability to meet immediate financial obligations. Understanding the distinction between working capital and cash flow helps businesses maintain stability and make informed decisions about investments and expenditures.

Table of Comparison

| Aspect | Working Capital | Cash Flow |

|---|---|---|

| Definition | Difference between current assets and current liabilities | Net amount of cash and cash equivalents moving in and out of business |

| Purpose | Measures short-term financial health and operational efficiency | Tracks liquidity and company's ability to meet immediate expenses |

| Calculation | Current Assets - Current Liabilities | Inflows - Outflows of cash over a period |

| Time Frame | Snapshot at a specific point in time | Over a specified period (monthly, quarterly) |

| Importance | Indicates operational efficiency and short-term solvency | Reflects liquidity and cash management effectiveness |

| Financial Statement | Balance Sheet | Cash Flow Statement |

Understanding Working Capital: Definition and Components

Working capital represents the difference between a company's current assets and current liabilities, serving as a key indicator of short-term financial health. It includes components such as accounts receivable, inventory, accounts payable, and cash equivalents, which collectively impact a company's ability to pay off its immediate obligations. Analyzing working capital helps businesses optimize operational efficiency and maintain liquidity without disrupting day-to-day activities.

What Is Cash Flow? Key Concepts for Businesses

Cash flow represents the net amount of cash being transferred into and out of a business, crucial for maintaining daily operations and meeting financial obligations. It includes operating cash flow, investing cash flow, and financing cash flow, each reflecting different aspects of business activities. Understanding cash flow enables businesses to assess liquidity, plan budgets effectively, and ensure solvency.

Working Capital vs Cash Flow: Core Differences

Working capital represents the difference between current assets and current liabilities, indicating a company's short-term financial health and operational efficiency. Cash flow measures the net amount of cash moving in and out of a business over a period, reflecting liquidity and cash availability for expenses and investments. Understanding the core differences between working capital and cash flow is crucial for managing day-to-day operations and ensuring sustainable business growth.

Importance of Managing Working Capital

Effective management of working capital is crucial for maintaining business liquidity and operational efficiency, ensuring that current assets sufficiently cover current liabilities. Proper control of inventory, receivables, and payables directly impacts cash flow stability, enabling timely payments to suppliers and avoiding costly borrowing. Businesses with optimized working capital exhibit improved financial health, reduced risks of insolvency, and enhanced capacity to invest in growth opportunities.

Impact of Cash Flow on Business Operations

Cash flow directly influences business operations by ensuring liquidity to cover day-to-day expenses such as payroll, inventory, and supplier payments. Strong positive cash flow enables timely investments in growth opportunities and helps avoid costly short-term financing. Without adequate cash flow, even profitable companies may struggle to maintain smooth operations and meet financial obligations.

Strategies to Optimize Working Capital

Effective strategies to optimize working capital include accelerating accounts receivable collections and extending accounts payable without damaging supplier relationships. Implementing inventory management techniques such as just-in-time (JIT) can reduce excess stock and free up cash. Regularly reviewing and forecasting cash flow ensures sufficient liquidity while minimizing unnecessary capital lock-up in operational processes.

How to Improve Business Cash Flow

Improving business cash flow requires optimizing accounts receivable by shortening payment terms and actively pursuing overdue invoices to accelerate incoming cash. Managing accounts payable strategically by negotiating longer payment periods with suppliers helps retain cash longer while maintaining good vendor relationships. Implementing regular cash flow forecasting enables proactive decision-making to ensure liquidity and avoid unexpected shortfalls.

Relationship Between Working Capital and Liquidity

Working capital represents the difference between a company's current assets and current liabilities, serving as a key indicator of short-term financial health. Liquidity refers to a company's ability to convert assets into cash quickly to meet immediate obligations, with working capital directly influencing this capability. Effective management of working capital ensures sufficient liquidity, reducing the risk of cash shortages and enabling smooth operational continuity.

Common Mistakes in Working Capital and Cash Flow Management

Common mistakes in working capital and cash flow management include overestimating receivables, underestimating payables, and neglecting inventory turnover, which can lead to liquidity issues. Businesses often confuse working capital with cash flow, failing to monitor short-term financial health accurately. Poor forecasting and lack of real-time financial data also impair effective management, resulting in missed opportunities and operational disruptions.

Best Practices for Balancing Working Capital and Cash Flow

Effective management of working capital and cash flow requires closely monitoring receivables, payables, and inventory turnover to maintain liquidity while minimizing costs. Implementing just-in-time inventory systems and negotiating favorable payment terms improves cash flow without straining working capital. Regular cash flow forecasting and scenario analysis enable businesses to anticipate shortfalls and adjust working capital strategies proactively for sustained financial stability.

Working Capital vs Cash Flow Infographic

difterm.com

difterm.com