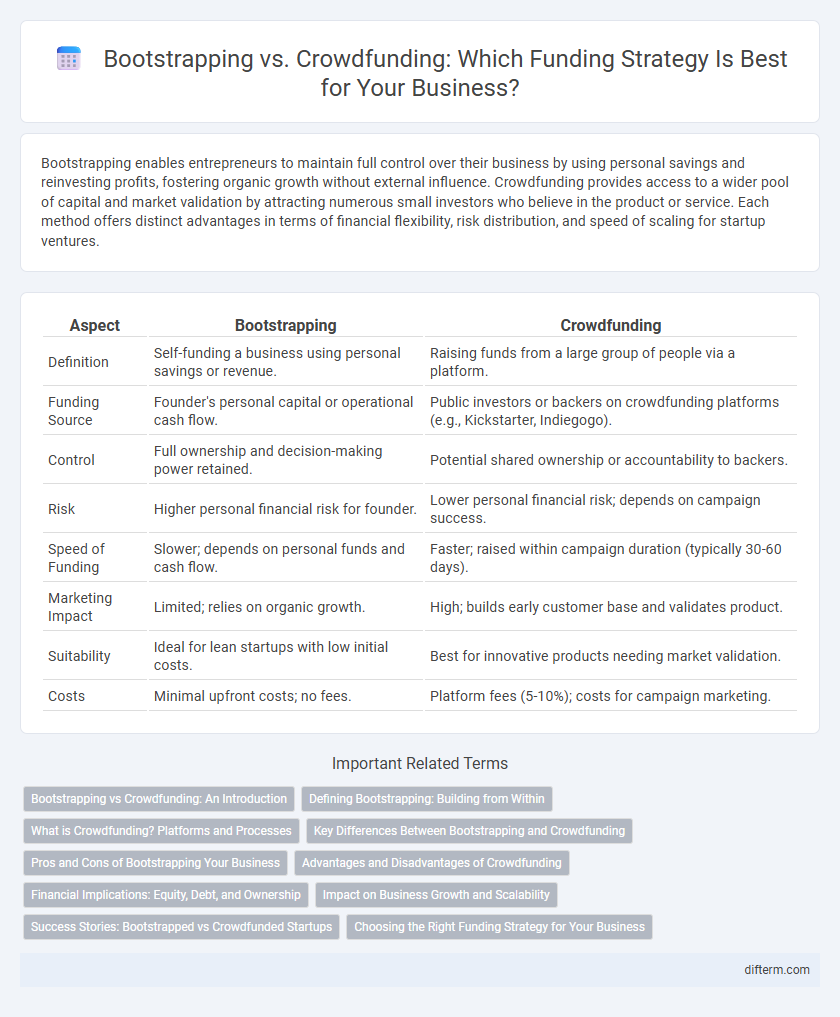

Bootstrapping enables entrepreneurs to maintain full control over their business by using personal savings and reinvesting profits, fostering organic growth without external influence. Crowdfunding provides access to a wider pool of capital and market validation by attracting numerous small investors who believe in the product or service. Each method offers distinct advantages in terms of financial flexibility, risk distribution, and speed of scaling for startup ventures.

Table of Comparison

| Aspect | Bootstrapping | Crowdfunding |

|---|---|---|

| Definition | Self-funding a business using personal savings or revenue. | Raising funds from a large group of people via a platform. |

| Funding Source | Founder's personal capital or operational cash flow. | Public investors or backers on crowdfunding platforms (e.g., Kickstarter, Indiegogo). |

| Control | Full ownership and decision-making power retained. | Potential shared ownership or accountability to backers. |

| Risk | Higher personal financial risk for founder. | Lower personal financial risk; depends on campaign success. |

| Speed of Funding | Slower; depends on personal funds and cash flow. | Faster; raised within campaign duration (typically 30-60 days). |

| Marketing Impact | Limited; relies on organic growth. | High; builds early customer base and validates product. |

| Suitability | Ideal for lean startups with low initial costs. | Best for innovative products needing market validation. |

| Costs | Minimal upfront costs; no fees. | Platform fees (5-10%); costs for campaign marketing. |

Bootstrapping vs Crowdfunding: An Introduction

Bootstrapping involves funding a business using personal savings or revenue without external investment, promoting total ownership and control but limiting capital availability. Crowdfunding raises funds from a large group of people, often via online platforms, enabling access to substantial capital and market validation but potentially diluting ownership. Understanding the trade-offs between bootstrapping's self-reliance and crowdfunding's community support is crucial for startup financial strategy.

Defining Bootstrapping: Building from Within

Bootstrapping involves funding a business using personal savings, reinvested profits, and internal resources without external investment. Entrepreneurs relying on bootstrapping maintain full ownership and control while emphasizing cost-efficiency and organic growth strategies. This approach fosters financial discipline, resilience, and sustainable scalability in early-stage startups.

What is Crowdfunding? Platforms and Processes

Crowdfunding is a financing method where businesses raise capital by collecting small amounts of money from a large number of individuals through online platforms like Kickstarter, Indiegogo, and GoFundMe. These platforms facilitate project creators to present their ideas, set funding goals, and offer rewards or equity in exchange for contributions. The process involves campaign creation, marketing to potential backers, and transparent communication to build trust and secure the required funds.

Key Differences Between Bootstrapping and Crowdfunding

Bootstrapping involves self-funding a business using personal resources, maintaining full ownership and control, while crowdfunding relies on raising capital from a large group of people, often through online platforms, in exchange for rewards or equity. Bootstrapping limits external dependencies and financial risk but may constrain growth, whereas crowdfunding can accelerate funding and market validation but requires effective campaign management and potential equity dilution. The key differences lie in funding sources, control retention, scalability potential, and investor engagement.

Pros and Cons of Bootstrapping Your Business

Bootstrapping a business allows entrepreneurs to retain full control and ownership, avoiding debt and equity dilution while fostering disciplined spending and resourcefulness. However, limited financial resources can restrict growth potential, delay scaling, and increase personal financial risk. The trade-off involves balancing independence against slower expansion compared to external funding options like crowdfunding.

Advantages and Disadvantages of Crowdfunding

Crowdfunding offers startups access to a vast pool of potential investors, enabling rapid capital generation without traditional loan obligations or equity dilution. This method enhances market validation and customer engagement through early backer feedback but requires significant marketing efforts to reach funding goals and carries the risk of idea exposure to competitors. However, failed campaigns may damage reputations and often involve platform fees, reducing the net funds received by entrepreneurs.

Financial Implications: Equity, Debt, and Ownership

Bootstrapping relies on personal savings and revenue, maintaining full ownership but limiting financial resources, while crowdfunding raises capital from a broad audience, often in exchange for equity, diluting ownership but providing substantial funds without debt obligations. Equity crowdfunding involves giving investors shares, which impacts control and future profits, whereas bootstrapping avoids external equity but may constrain growth potential. Debt-based crowdfunding introduces repayment obligations and interest, unlike bootstrapping, which lacks external debt but demands prudent cash flow management.

Impact on Business Growth and Scalability

Bootstrapping fosters organic business growth by relying on internal resources and profit reinvestment, promoting sustainable scalability without external influence. Crowdfunding accelerates business expansion by providing substantial external capital and market validation, enabling rapid scalability but often requiring equity sharing or product pre-commitments. The choice between bootstrapping and crowdfunding significantly affects control dynamics, growth speed, and scalability potential in startups.

Success Stories: Bootstrapped vs Crowdfunded Startups

Bootstrapped startups like Mailchimp and Spanx demonstrate that significant growth and profitability can be achieved without external funding by leveraging internal resources and customer revenue. In contrast, crowdfunded successes such as Oculus Rift and Pebble Watch show how community engagement and early customer validation can drive product development and market entry. Both funding approaches offer unique pathways to startup success based on financial strategy and market positioning.

Choosing the Right Funding Strategy for Your Business

Choosing the right funding strategy depends on your business goals, risk tolerance, and market readiness. Bootstrapping leverages personal savings and revenue, offering full control but limited capital, ideal for lean startups focusing on sustainable growth. Crowdfunding provides access to a broader pool of funds and early customer validation but requires significant marketing effort and may dilute equity or control.

Bootstrapping vs Crowdfunding Infographic

difterm.com

difterm.com