Choosing between a sole proprietorship and an LLC impacts liability and tax obligations significantly; a sole proprietorship offers simplicity and direct control but exposes personal assets to business risks. An LLC provides limited liability protection, separating personal and business assets, while allowing flexible tax options that can reduce self-employment taxes. Business owners must evaluate their risk tolerance, growth plans, and administrative preferences to determine the optimal structure for their enterprise.

Table of Comparison

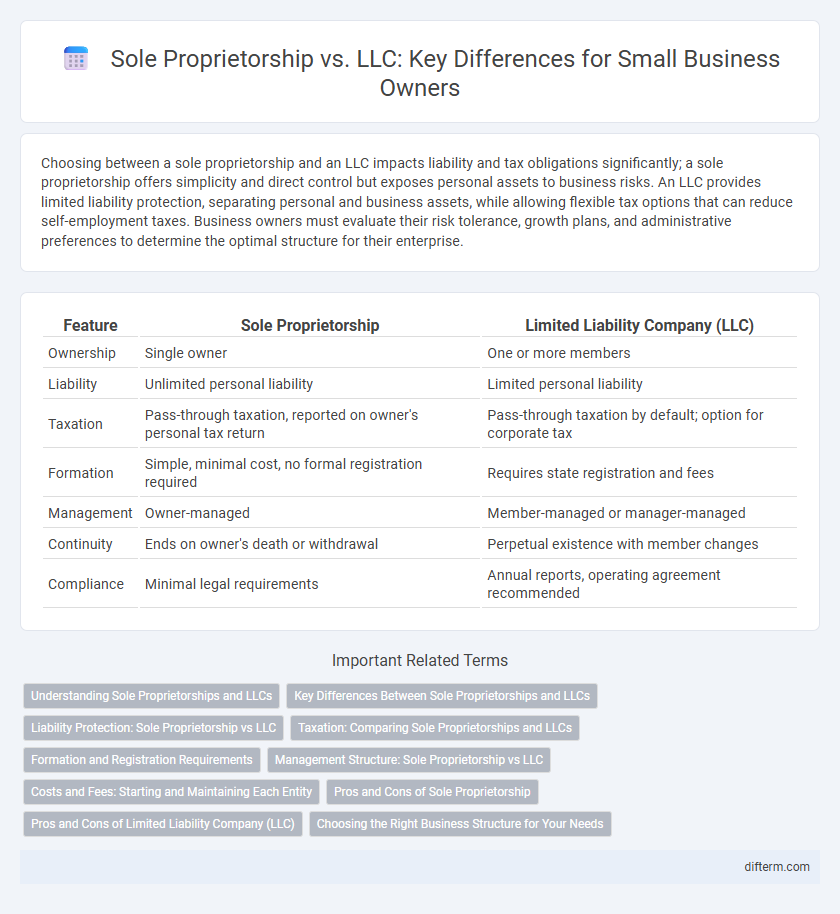

| Feature | Sole Proprietorship | Limited Liability Company (LLC) |

|---|---|---|

| Ownership | Single owner | One or more members |

| Liability | Unlimited personal liability | Limited personal liability |

| Taxation | Pass-through taxation, reported on owner's personal tax return | Pass-through taxation by default; option for corporate tax |

| Formation | Simple, minimal cost, no formal registration required | Requires state registration and fees |

| Management | Owner-managed | Member-managed or manager-managed |

| Continuity | Ends on owner's death or withdrawal | Perpetual existence with member changes |

| Compliance | Minimal legal requirements | Annual reports, operating agreement recommended |

Understanding Sole Proprietorships and LLCs

Sole proprietorships offer simple setup, full owner control, and direct tax benefits, but expose the individual to unlimited personal liability. LLCs provide liability protection by separating personal assets from business debts, with flexible management structures and pass-through taxation enhancing operational efficiency. Choosing between these entities depends on factors like risk tolerance, tax preferences, and long-term business goals.

Key Differences Between Sole Proprietorships and LLCs

Sole proprietorships offer simplicity with minimal regulatory requirements but expose owners to unlimited personal liability, whereas LLCs provide limited liability protection separating personal assets from business debts. LLCs require formal registration and compliance with state regulations, including operating agreements and annual reports, in contrast to the informal setup of sole proprietorships. Tax treatment also differs: sole proprietors report business income on personal tax returns, while LLCs can choose between pass-through taxation or corporate tax structures.

Liability Protection: Sole Proprietorship vs LLC

Sole proprietorships offer no personal liability protection, meaning owners are personally responsible for all business debts and legal obligations. LLCs provide limited liability protection, separating personal assets from business liabilities, which shields owners from being personally sued. This fundamental difference makes LLCs a preferred choice for entrepreneurs seeking to minimize financial risk.

Taxation: Comparing Sole Proprietorships and LLCs

Sole proprietorships report business income and expenses on the owner's personal tax return using Schedule C, resulting in pass-through taxation with profits taxed at individual income tax rates. LLCs also benefit from pass-through taxation by default but offer flexibility to be taxed as a sole proprietorship, partnership, S corporation, or C corporation, potentially reducing self-employment taxes. Understanding the specific tax implications and election options for LLCs can provide significant advantages compared to the straightforward but limited taxation structure of sole proprietorships.

Formation and Registration Requirements

Sole proprietorships require minimal formation steps, often only necessitating a local business license or permit, making registration straightforward and cost-effective. LLC formation involves filing Articles of Organization with the state and paying filing fees, alongside designating a registered agent and creating an operating agreement. These formal registration requirements grant LLCs legal recognition and liability protection absent in sole proprietorships.

Management Structure: Sole Proprietorship vs LLC

Sole proprietorships feature a simple management structure where the owner holds full control and decision-making authority, allowing for quick and direct oversight of daily operations. In contrast, LLCs offer a flexible management framework that can be member-managed or manager-managed, enabling shared responsibilities and strategic delegation among members or appointed managers. This distinction impacts operational efficiency, liability protection, and the ability to attract investors or partners.

Costs and Fees: Starting and Maintaining Each Entity

Starting a sole proprietorship typically incurs minimal costs, often limited to local business licenses and permits, while an LLC requires filing fees with the state that can range from $50 to $500 depending on the jurisdiction. Maintaining a sole proprietorship involves few ongoing expenses, usually just routine renewals and taxes, whereas an LLC must pay annual franchise taxes or fees and may need to file annual reports, adding to the overall operational costs. Insurance premiums, professional service fees, and compliance costs tend to be higher for LLCs due to their formal structure and liability protections.

Pros and Cons of Sole Proprietorship

A sole proprietorship offers simplicity in setup and full control to the owner, making it ideal for small businesses with minimal regulatory burdens. However, it carries unlimited personal liability, meaning the owner's personal assets are at risk if the business incurs debts or legal issues. Taxation is straightforward as profits are reported on the owner's personal income tax return, but the lack of separation between personal and business finances can complicate liability protection and growth opportunities.

Pros and Cons of Limited Liability Company (LLC)

Limited Liability Companies (LLCs) offer personal asset protection by separating business debts from owners' personal finances, reducing personal liability risks compared to sole proprietorships. LLCs provide flexible management structures and pass-through taxation, allowing profits to avoid double taxation typically seen in corporations. However, LLCs involve higher formation costs, ongoing state compliance requirements, and varied regulations across states, potentially complicating business operations.

Choosing the Right Business Structure for Your Needs

Choosing the right business structure depends on factors like liability protection, tax implications, and management flexibility. A sole proprietorship offers simplicity and direct control but lacks liability protection, exposing personal assets to business risks. An LLC provides limited liability protection and potential tax benefits, making it ideal for entrepreneurs seeking to separate personal and business liabilities while maintaining operational flexibility.

Sole Proprietorship vs LLC Infographic

difterm.com

difterm.com