TAM (Total Addressable Market) represents the total revenue opportunity available if a business captures 100% of the market for its product or service. SAM (Serviceable Available Market) narrows this scope to the segment of TAM targeted by a company's products and marketing efforts, considering geographic and demographic limitations. Understanding the distinction between TAM and SAM helps businesses allocate resources effectively and prioritize market strategies for sustainable growth.

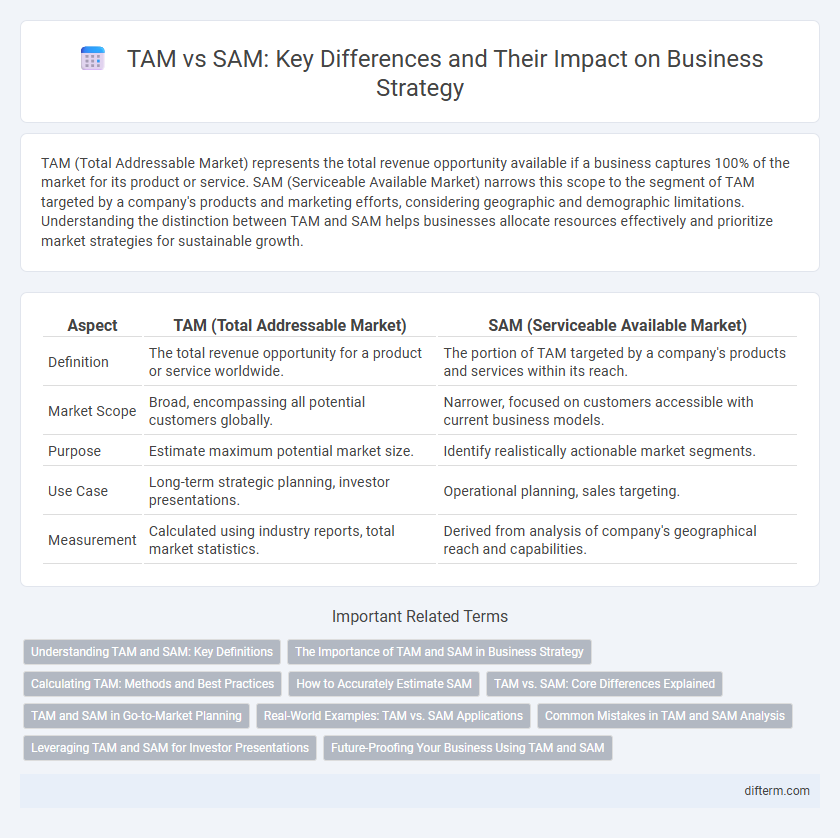

Table of Comparison

| Aspect | TAM (Total Addressable Market) | SAM (Serviceable Available Market) |

|---|---|---|

| Definition | The total revenue opportunity for a product or service worldwide. | The portion of TAM targeted by a company's products and services within its reach. |

| Market Scope | Broad, encompassing all potential customers globally. | Narrower, focused on customers accessible with current business models. |

| Purpose | Estimate maximum potential market size. | Identify realistically actionable market segments. |

| Use Case | Long-term strategic planning, investor presentations. | Operational planning, sales targeting. |

| Measurement | Calculated using industry reports, total market statistics. | Derived from analysis of company's geographical reach and capabilities. |

Understanding TAM and SAM: Key Definitions

Total Addressable Market (TAM) represents the entire revenue potential available for a product or service if achieved by capturing 100% of the market demand. Serviceable Available Market (SAM) narrows TAM down to the segment of the market that a company's products or services can realistically serve based on factors like geography, product features, or customer needs. Understanding TAM and SAM helps businesses prioritize market opportunities, allocate resources efficiently, and develop targeted strategies for sustainable growth.

The Importance of TAM and SAM in Business Strategy

TAM (Total Addressable Market) quantifies the overall revenue opportunity available for a product or service, guiding businesses on the maximum market size for strategic planning. SAM (Serviceable Available Market) refines this by identifying the segment of TAM that aligns with a company's operational capabilities and target customers, enabling focused resource allocation and realistic growth projections. Understanding both TAM and SAM is crucial for effective market entry, competitive positioning, and long-term business scalability.

Calculating TAM: Methods and Best Practices

Calculating Total Addressable Market (TAM) involves top-down, bottom-up, and value-theory approaches, each offering unique insights based on industry data, company-specific metrics, and customer value calculations. Accurate TAM estimation requires analyzing market size, customer segments, and revenue potential using reliable data sources like industry reports, government statistics, and sales data. Best practices include validating assumptions, using multiple data sources for cross-verification, and regularly updating TAM to reflect market changes and emerging trends.

How to Accurately Estimate SAM

Accurately estimating the Serviceable Available Market (SAM) requires analyzing specific customer segments within the broader Total Addressable Market (TAM) that your product or service can realistically serve. Utilize market research data, customer demographics, and geographic limitations to refine the target audience and exclude areas where penetration is not feasible. Incorporate competitive analysis and distribution channel assessments to ensure the SAM reflects a practical subset of TAM for strategic business planning.

TAM vs. SAM: Core Differences Explained

Total Addressable Market (TAM) represents the overall revenue opportunity available for a product or service if 100% market share is achieved, while Serviceable Available Market (SAM) defines the segment of TAM targeted by a company's products and services within its operational reach. Understanding the core difference between TAM and SAM is crucial for strategic business planning, as TAM highlights the full market potential and SAM focuses on realistic, actionable targets based on current capabilities and market constraints. Accurate estimation of TAM and SAM informs investment decisions, resource allocation, and growth strategies by distinguishing between aspiration and achievable market segments.

TAM and SAM in Go-to-Market Planning

TAM (Total Addressable Market) defines the overall revenue opportunity available for a product or service, representing the maximum market demand. SAM (Serviceable Available Market) narrows this focus to the segment of TAM targeted by a company's products and services within its reachable market. In Go-to-Market planning, accurately estimating TAM and SAM guides resource allocation and prioritizes target segments, optimizing market penetration and sales strategies.

Real-World Examples: TAM vs. SAM Applications

Market analysis often distinguishes Total Addressable Market (TAM) from Serviceable Available Market (SAM) to refine business strategy and resource allocation. For instance, Tesla's TAM includes the global automotive market valued at approximately $9 trillion, while its SAM narrows to the electric vehicle segment worth around $500 billion. This differentiation allows companies to target realistic revenue opportunities and tailor marketing efforts effectively within realistic operational boundaries.

Common Mistakes in TAM and SAM Analysis

Common mistakes in TAM and SAM analysis often include overestimating market size by relying on broad or outdated data, leading to unrealistic revenue projections. Ignoring market segmentation can cause confusion between Total Addressable Market (TAM) and Serviceable Available Market (SAM), resulting in inefficient resource allocation. Failing to validate assumptions with real customer insights or competitive analysis weakens strategic decisions and hampers growth potential.

Leveraging TAM and SAM for Investor Presentations

Leveraging Total Addressable Market (TAM) and Serviceable Available Market (SAM) data in investor presentations sharpens growth potential and competitive positioning narratives. Presenting quantified TAM highlights the expansive revenue opportunity, while SAM focuses on the realistic market share accessible based on current capabilities and product fit. Precise segmentation of these market sizes enables investors to gauge scalability and validates strategic business models, thereby enhancing funding prospects.

Future-Proofing Your Business Using TAM and SAM

TAM (Total Addressable Market) and SAM (Serviceable Addressable Market) provide critical insights for future-proofing your business by identifying the full revenue potential and realistic market segments to target. Leveraging TAM helps in strategic planning and long-term scalability, while SAM directs focused resource allocation to highest-potential, serviceable markets, enhancing competitiveness and adaptability. Integrating TAM and SAM into business models supports data-driven decisions that anticipate market shifts and technological advancements.

TAM vs SAM Infographic

difterm.com

difterm.com