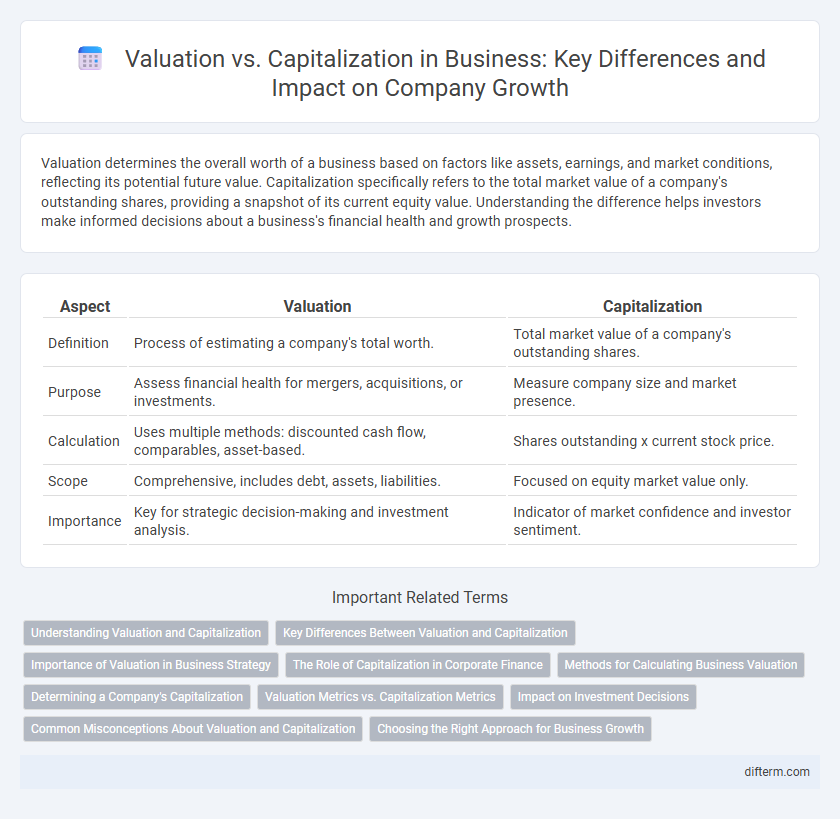

Valuation determines the overall worth of a business based on factors like assets, earnings, and market conditions, reflecting its potential future value. Capitalization specifically refers to the total market value of a company's outstanding shares, providing a snapshot of its current equity value. Understanding the difference helps investors make informed decisions about a business's financial health and growth prospects.

Table of Comparison

| Aspect | Valuation | Capitalization |

|---|---|---|

| Definition | Process of estimating a company's total worth. | Total market value of a company's outstanding shares. |

| Purpose | Assess financial health for mergers, acquisitions, or investments. | Measure company size and market presence. |

| Calculation | Uses multiple methods: discounted cash flow, comparables, asset-based. | Shares outstanding x current stock price. |

| Scope | Comprehensive, includes debt, assets, liabilities. | Focused on equity market value only. |

| Importance | Key for strategic decision-making and investment analysis. | Indicator of market confidence and investor sentiment. |

Understanding Valuation and Capitalization

Valuation measures a company's total worth based on factors like assets, earnings, and market conditions, providing a comprehensive assessment of its financial health. Capitalization refers specifically to the market value of a company's outstanding shares, reflecting its equity value at a given point in time. Understanding the distinction between valuation and capitalization is crucial for investors to evaluate investment potential and make informed financial decisions.

Key Differences Between Valuation and Capitalization

Valuation represents the estimated total worth of a business based on factors like assets, earnings, and market conditions, while capitalization refers to the total market value of a company's outstanding shares of stock. Valuation provides a comprehensive assessment often used for mergers, acquisitions, and investment analysis, whereas capitalization primarily reflects market perception and investor sentiment at a given time. Understanding these distinctions is crucial for accurate financial analysis and strategic decision-making in business finance.

Importance of Valuation in Business Strategy

Valuation provides a comprehensive assessment of a company's intrinsic worth, guiding strategic decisions such as mergers, acquisitions, and investment planning more effectively than simple capitalization metrics. Understanding valuation enables businesses to optimize capital allocation, enhance shareholder value, and navigate market fluctuations with data-driven precision. Accurate valuation models incorporate financial performance, growth potential, and risk factors, forming a critical foundation for sustainable competitive advantage in dynamic markets.

The Role of Capitalization in Corporate Finance

Capitalization plays a crucial role in corporate finance by determining a company's total value through the market value of its outstanding shares combined with its debt, influencing investment decisions and financial strategy. Unlike valuation, which estimates a company's intrinsic worth based on various financial metrics and projections, capitalization provides a real-time snapshot of a company's market standing and financial structure. Understanding capitalization aids in assessing risk, optimizing capital allocation, and aligning financing methods with corporate growth objectives.

Methods for Calculating Business Valuation

Business valuation methods primarily include discounted cash flow (DCF) analysis, comparable company analysis (CCA), and precedent transactions. DCF evaluates the present value of future cash flows, reflecting intrinsic worth, while CCA compares valuation multiples from similar companies to estimate market value. Capitalization, often simpler, divides expected earnings by a capitalization rate to determine value but may overlook growth potential and cash flow variability.

Determining a Company's Capitalization

Determining a company's capitalization involves calculating the total market value of its outstanding shares of stock, reflecting the firm's equity value at current market prices. Valuation, on the other hand, encompasses a broader analysis including assets, liabilities, earnings, and growth potential to estimate the company's intrinsic worth beyond just market capitalization. Understanding the distinction aids investors and analysts in making informed decisions regarding a company's financial health and investment potential.

Valuation Metrics vs. Capitalization Metrics

Valuation metrics such as price-to-earnings (P/E) ratio, enterprise value to EBITDA (EV/EBITDA), and discounted cash flow (DCF) analysis assess a company's intrinsic worth based on earnings, cash flow, and growth potential. Capitalization metrics, primarily market capitalization, reflect the total market value of a company's outstanding shares, representing investor sentiment and market conditions at a point in time. Understanding the distinction between valuation and capitalization metrics is crucial for accurate business assessment, investment decisions, and strategic financial planning.

Impact on Investment Decisions

Valuation provides a comprehensive estimate of a company's total worth based on future earning potential, which heavily influences strategic investment decisions and risk assessment. Capitalization, reflecting the market value of a company's outstanding shares, offers a real-time snapshot of investor sentiment and market confidence. Investors rely on both valuation and capitalization metrics to balance growth prospects with market stability when making informed investment choices.

Common Misconceptions About Valuation and Capitalization

Valuation is the process of estimating a company's overall worth based on factors like assets, earnings, and market conditions, whereas capitalization specifically refers to the total value of a company's outstanding shares multiplied by the share price. A common misconception is that market capitalization alone reflects a company's true value, ignoring liabilities, debt, and other financial metrics. Understanding the distinction between valuation and capitalization is crucial for making informed investment and business decisions.

Choosing the Right Approach for Business Growth

Valuation measures a company's overall worth based on factors like earnings, assets, and market potential, providing a comprehensive snapshot for investment decisions. Capitalization focuses specifically on the market value of outstanding equity and debt, reflecting current investor sentiment and liquidity. Selecting the appropriate method depends on business goals, with valuation guiding strategic growth investments and capitalization offering insights into market confidence and funding capacity.

valuation vs capitalization Infographic

difterm.com

difterm.com