Understanding the relationship between runway and burn rate is crucial for managing a business's financial health effectively. Runway refers to the amount of time a company can operate before exhausting its cash reserves, calculated by dividing the available cash by the monthly burn rate. Monitoring and optimizing burn rate ensures sufficient runway to achieve key milestones and attract further investment.

Table of Comparison

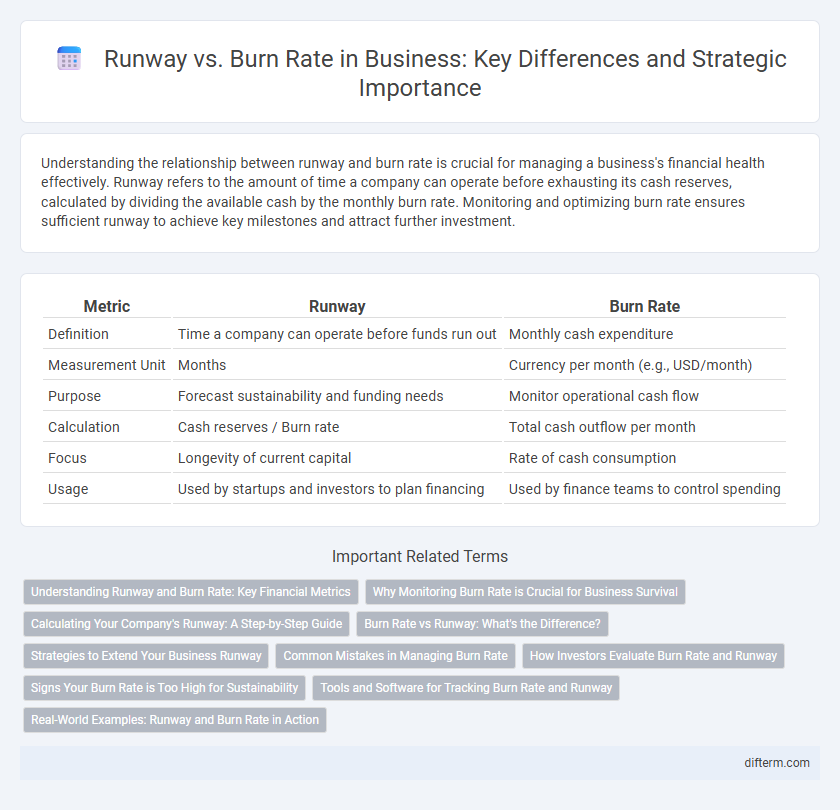

| Metric | Runway | Burn Rate |

|---|---|---|

| Definition | Time a company can operate before funds run out | Monthly cash expenditure |

| Measurement Unit | Months | Currency per month (e.g., USD/month) |

| Purpose | Forecast sustainability and funding needs | Monitor operational cash flow |

| Calculation | Cash reserves / Burn rate | Total cash outflow per month |

| Focus | Longevity of current capital | Rate of cash consumption |

| Usage | Used by startups and investors to plan financing | Used by finance teams to control spending |

Understanding Runway and Burn Rate: Key Financial Metrics

Runway measures the amount of time a startup can operate before exhausting its cash reserves, calculated by dividing current cash by the burn rate. Burn rate represents the monthly cash expenditure, reflecting how quickly a company spends its available capital. Both metrics are essential for financial planning, helping businesses assess sustainability and plan fundraising strategies effectively.

Why Monitoring Burn Rate is Crucial for Business Survival

Monitoring burn rate is crucial for business survival because it directly impacts how long a company can sustain operations before requiring additional funding. A high burn rate rapidly depletes cash reserves, increasing the risk of insolvency and limiting strategic flexibility. Accurate tracking enables proactive financial planning, ensuring sufficient runway to achieve key milestones and attract investors.

Calculating Your Company's Runway: A Step-by-Step Guide

Calculating your company's runway involves dividing your current cash reserves by your monthly burn rate to determine how many months your business can operate before running out of funds. Accurately tracking expenses and revenue streams ensures a precise burn rate, which is critical for financial planning and fundraising efforts. Monitoring runway metrics enables entrepreneurs to make informed decisions about budgeting, scaling, or pivoting strategies effectively.

Burn Rate vs Runway: What's the Difference?

Burn rate measures the rate at which a company spends its cash reserves, typically expressed monthly, and directly impacts the financial runway--the duration a business can operate before depleting its funds. Runway is calculated by dividing the available cash balance by the burn rate, providing a critical timeline for startups and businesses to achieve profitability or secure additional funding. Understanding the difference between burn rate and runway enables entrepreneurs to manage expenses strategically and make informed decisions about scaling operations.

Strategies to Extend Your Business Runway

Extending your business runway requires meticulously managing your burn rate by prioritizing essential expenses and eliminating non-critical costs to conserve cash flow. Implementing revenue-generating activities such as diversifying product lines or enhancing sales channels can improve financial stability and lengthen operational longevity. Regularly reviewing financial metrics and adjusting budget forecasts ensures adaptive strategies, optimizing resources to sustain growth and delay capital depletion.

Common Mistakes in Managing Burn Rate

Mismanaging burn rate often stems from underestimating operational expenses and overprojecting revenue growth, which leads to inaccurate runway calculations. Many startups fail to regularly update their burn rate metrics, causing delayed responses to financial strain and increased risk of premature cash depletion. Ignoring indirect costs like marketing and administrative expenses further distorts burn rate estimations, jeopardizing sustainable business growth and investor confidence.

How Investors Evaluate Burn Rate and Runway

Investors evaluate burn rate and runway to assess a startup's financial health and sustainability before further funding. Burn rate indicates the monthly cash expenditure, revealing how quickly capital is consumed, while runway estimates the time remaining before funds are exhausted based on the current burn rate. Accurate analysis of these metrics helps investors determine the urgency of additional investment and the company's operational efficiency.

Signs Your Burn Rate is Too High for Sustainability

A burn rate exceeding monthly revenue by 20% or more signals unsustainable cash flow that rapidly depletes runway. When operational expenses consistently outpace capital inflows, it indicates a mismatch jeopardizing long-term viability. Declining runway under six months coupled with frequent emergency fundraising highlights critical financial imbalance requiring immediate strategic adjustments.

Tools and Software for Tracking Burn Rate and Runway

Accurate tracking of burn rate and runway is essential for financial viability in business, facilitated by tools like QuickBooks, LivePlan, and Pulse. These software solutions offer real-time cash flow analysis, expense monitoring, and predictive modeling to forecast runway duration effectively. Integrating such tools helps startups and enterprises optimize budgeting decisions, ensuring sustained operational funding.

Real-World Examples: Runway and Burn Rate in Action

Startups like Airbnb demonstrated how a low burn rate combined with a sizable runway allowed them to survive early market volatility and scale effectively. Companies such as WeWork, facing a high burn rate, rapidly depleted their runway, leading to urgent funding rounds and restructuring. Real-world cases highlight the critical balance between burn rate management and runway length to ensure sustainable growth and operational longevity.

Runway vs Burn Rate Infographic

difterm.com

difterm.com