Bootstrapping a business emphasizes self-funding, allowing founders to maintain complete control and make decisions independently without external pressures. Venture-funded startups benefit from substantial capital influx, enabling rapid growth and access to valuable networks, but often require sharing equity and aligning with investor expectations. Choosing between bootstrapping and venture funding depends on growth goals, risk tolerance, and the desired level of operational control.

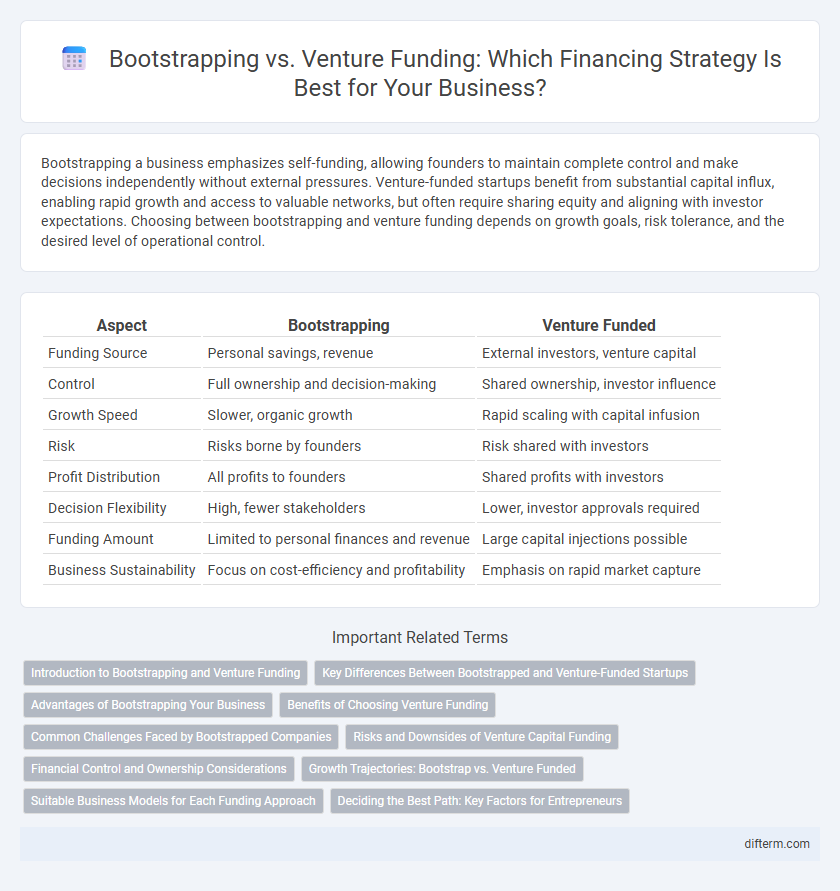

Table of Comparison

| Aspect | Bootstrapping | Venture Funded |

|---|---|---|

| Funding Source | Personal savings, revenue | External investors, venture capital |

| Control | Full ownership and decision-making | Shared ownership, investor influence |

| Growth Speed | Slower, organic growth | Rapid scaling with capital infusion |

| Risk | Risks borne by founders | Risk shared with investors |

| Profit Distribution | All profits to founders | Shared profits with investors |

| Decision Flexibility | High, fewer stakeholders | Lower, investor approvals required |

| Funding Amount | Limited to personal finances and revenue | Large capital injections possible |

| Business Sustainability | Focus on cost-efficiency and profitability | Emphasis on rapid market capture |

Introduction to Bootstrapping and Venture Funding

Bootstrapping involves launching and growing a business using personal savings, revenue, and minimal external funding, promoting full control and organic scalability. Venture funding provides significant capital from investors in exchange for equity, enabling rapid expansion but often requiring strategic alignment with stakeholder goals. Choosing between bootstrapping and venture funding depends on the entrepreneur's growth ambitions, risk tolerance, and desire for control over decision-making.

Key Differences Between Bootstrapped and Venture-Funded Startups

Bootstrapped startups rely primarily on personal savings and revenue to fuel growth, maintaining full ownership and control but often facing slower scaling due to limited capital. Venture-funded startups secure external investments from venture capitalists, enabling rapid expansion and access to strategic resources, albeit at the cost of equity dilution and increased investor influence. Key differences include funding sources, growth pace, control dynamics, and risk exposure, which critically impact strategic decision-making and long-term business sustainability.

Advantages of Bootstrapping Your Business

Bootstrapping your business allows for complete ownership and control, enabling founders to make decisions without external pressure from investors. It encourages disciplined cash flow management and fosters organic growth, which can lead to sustainable long-term success. Avoiding venture capital also means no equity dilution, preserving the entrepreneur's share and potential future profits.

Benefits of Choosing Venture Funding

Venture funding offers rapid access to significant capital, enabling accelerated business growth and market expansion. It provides strategic mentorship and industry connections from experienced investors that can enhance operational efficiency and open new opportunities. This approach also shares financial risk, reducing personal liability for founders compared to bootstrapping.

Common Challenges Faced by Bootstrapped Companies

Bootstrapped companies frequently encounter cash flow constraints that limit growth opportunities and operational scalability. Limited access to external funding often forces stringent budget management, impacting marketing and product development efforts. Founders must balance resource allocation carefully while maintaining long-term sustainability without the safety net of venture capital.

Risks and Downsides of Venture Capital Funding

Venture capital funding often exposes startups to significant risks including loss of control, as investors typically demand equity and influence over business decisions. The pressure to achieve rapid growth to meet investor expectations can lead to unsustainable scaling and compromised product quality. Moreover, failure to meet milestones may result in funding withdrawal or dilution of founders' ownership stakes.

Financial Control and Ownership Considerations

Bootstrapping allows entrepreneurs to maintain complete financial control and full ownership, avoiding dilution through external investors. Venture funding provides substantial capital but often requires ceding equity and decision-making authority, impacting long-term control. Founders must weigh the trade-off between growth acceleration and preserving ownership stakes when choosing between bootstrapping and venture capital.

Growth Trajectories: Bootstrap vs. Venture Funded

Bootstrap companies often experience steady, sustainable growth driven by revenue reinvestment and efficient resource management, resulting in slower but more controlled expansion. Venture-funded startups typically pursue rapid scaling fueled by large capital injections, enabling aggressive market penetration and faster user acquisition, albeit with higher risk and diluted ownership. Growth trajectories differ fundamentally, with bootstrapping favoring long-term stability while venture funding prioritizes rapid dominance and accelerated valuation increases.

Suitable Business Models for Each Funding Approach

Bootstrapping suits business models with low initial capital requirements, steady cash flow, and slower growth targets, such as service-based companies or niche e-commerce stores. Venture funding aligns with scalable, high-growth models like technology startups, SaaS platforms, and disruptive innovations that demand significant upfront investment and rapid market expansion. Each funding approach optimally supports distinct operational strategies and growth trajectories based on capital intensity and market dynamics.

Deciding the Best Path: Key Factors for Entrepreneurs

Entrepreneurs deciding between bootstrapping and venture funding must evaluate factors such as control, growth speed, and financial risk. Bootstrapping offers full ownership and slower, organic growth, while venture capital provides rapid scaling potential but involves equity dilution and external influence. Assessing market demands, capital needs, and long-term business goals is essential for choosing the optimal funding strategy.

bootstrapping vs venture funded Infographic

difterm.com

difterm.com