Top-line growth refers to increasing a company's revenue through higher sales or expanded market reach, driving overall business expansion. Bottom-line growth focuses on improving net income by optimizing costs, enhancing operational efficiency, and maximizing profit margins. Balancing both strategies is essential for sustainable business success and long-term financial health.

Table of Comparison

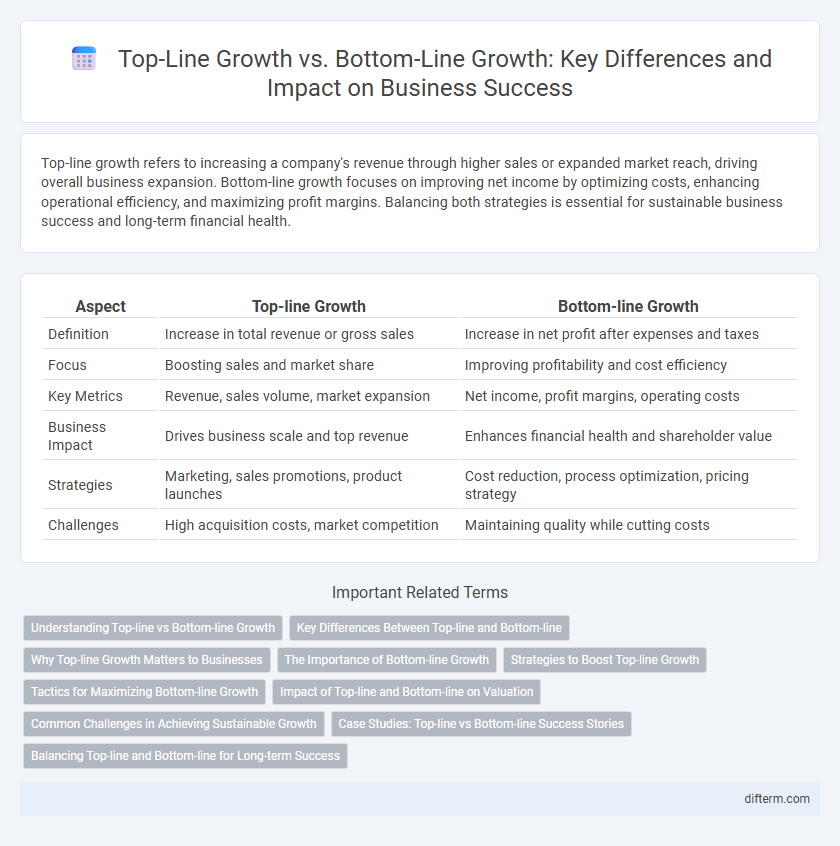

| Aspect | Top-line Growth | Bottom-line Growth |

|---|---|---|

| Definition | Increase in total revenue or gross sales | Increase in net profit after expenses and taxes |

| Focus | Boosting sales and market share | Improving profitability and cost efficiency |

| Key Metrics | Revenue, sales volume, market expansion | Net income, profit margins, operating costs |

| Business Impact | Drives business scale and top revenue | Enhances financial health and shareholder value |

| Strategies | Marketing, sales promotions, product launches | Cost reduction, process optimization, pricing strategy |

| Challenges | High acquisition costs, market competition | Maintaining quality while cutting costs |

Understanding Top-line vs Bottom-line Growth

Top-line growth refers to an increase in a company's gross revenue or sales, reflecting its ability to expand market share and attract more customers. Bottom-line growth, on the other hand, focuses on net profit, highlighting efficiency in managing costs and operational expenses to maximize earnings. Understanding the distinction between these metrics helps businesses balance revenue expansion with profitability to sustain long-term financial health.

Key Differences Between Top-line and Bottom-line

Top-line growth refers to the increase in a company's gross revenue or sales, representing overall business expansion and market demand. Bottom-line growth focuses on net income or profit after all expenses, highlighting operational efficiency and cost management. Key differences lie in top-line indicating revenue scale, while bottom-line reflects profitability and financial health.

Why Top-line Growth Matters to Businesses

Top-line growth represents an increase in a company's revenue, which is essential for expanding market share and attracting investors. Sustained revenue growth fuels investments in innovation, marketing, and talent acquisition, driving long-term business scalability. Without top-line expansion, companies risk stagnation, limiting their ability to improve profitability and competitive positioning.

The Importance of Bottom-line Growth

Bottom-line growth reflects a company's net profit, revealing its true financial health and operational efficiency, which directly impacts shareholder value and business sustainability. Prioritizing bottom-line improvements encourages cost management, productivity enhancements, and strategic investments that drive long-term profitability. Companies focusing solely on top-line growth risk overexpansion and reduced margins, whereas emphasizing bottom-line growth ensures balanced, scalable business success.

Strategies to Boost Top-line Growth

Top-line growth strategies prioritize increasing a company's gross sales through expanding market share, launching new products, and entering new markets to drive revenue. Effective marketing campaigns, strategic partnerships, and product innovation play crucial roles in attracting new customers and retaining existing ones, which directly enhance top-line performance. Investing in digital transformation and customer experience improvements can further accelerate sales growth by meeting evolving consumer demands and increasing brand loyalty.

Tactics for Maximizing Bottom-line Growth

Maximizing bottom-line growth relies on cost optimization strategies such as streamlining operational processes, reducing overhead expenses, and leveraging automation technologies to enhance efficiency. Implementing data-driven decision-making enables businesses to identify high-margin products and allocate resources effectively for profit maximization. Strengthening supplier negotiations and optimizing supply chain management further contributes to boosting net profit by lowering material and logistics costs.

Impact of Top-line and Bottom-line on Valuation

Top-line growth, reflecting increased revenues, significantly influences company valuation by signaling expanding market share and potential for scalability, which attracts investors seeking long-term growth. Bottom-line growth, indicating improved net profitability, enhances valuation through improved operational efficiency and cash flow generation, appealing to value-focused investors. Balanced growth in both top-line and bottom-line metrics drives sustainable valuation improvements by demonstrating revenue expansion alongside cost management.

Common Challenges in Achieving Sustainable Growth

Achieving sustainable top-line growth and bottom-line growth presents common challenges such as balancing revenue expansion with cost control and maintaining consistent cash flow while investing in innovation. Companies often struggle to scale operations efficiently, preventing margin erosion despite increasing sales. Effective data-driven strategies and agile resource allocation are crucial to overcoming market volatility and competitive pressures affecting both growth metrics.

Case Studies: Top-line vs Bottom-line Success Stories

Case studies of companies like Amazon illustrate top-line growth through aggressive revenue expansion by entering new markets and diversifying services, while Apple exemplifies bottom-line growth by focusing on operational efficiency and high-margin products to maximize profitability. Walmart demonstrates a bottom-line approach by streamlining supply chains and reducing costs, driving net profit without proportional revenue increase. These business examples highlight contrasting strategies where top-line growth prioritizes sales volume and market share, whereas bottom-line success emphasizes cost control and profit maximization.

Balancing Top-line and Bottom-line for Long-term Success

Balancing top-line growth, driven by increasing revenue through market expansion and sales strategies, with bottom-line growth, focused on improving net profit via cost management and operational efficiency, is crucial for sustainable business success. Companies that prioritize both revenue generation and profitability optimize resource allocation and ensure financial health over time. Strategic alignment of marketing, sales, and finance functions enables long-term value creation and competitive advantage.

Top-line Growth vs Bottom-line Growth Infographic

difterm.com

difterm.com