Consignment allows retailers to sell products without upfront inventory costs, sharing profits only when items are sold, while wholesale requires purchasing stock in bulk, offering immediate payment but higher financial risk. Consignment benefits small businesses by reducing capital investment, whereas wholesale suits companies with established cash flow and storage capabilities. Choosing between consignment and wholesale depends on cash flow, inventory management, and risk tolerance.

Table of Comparison

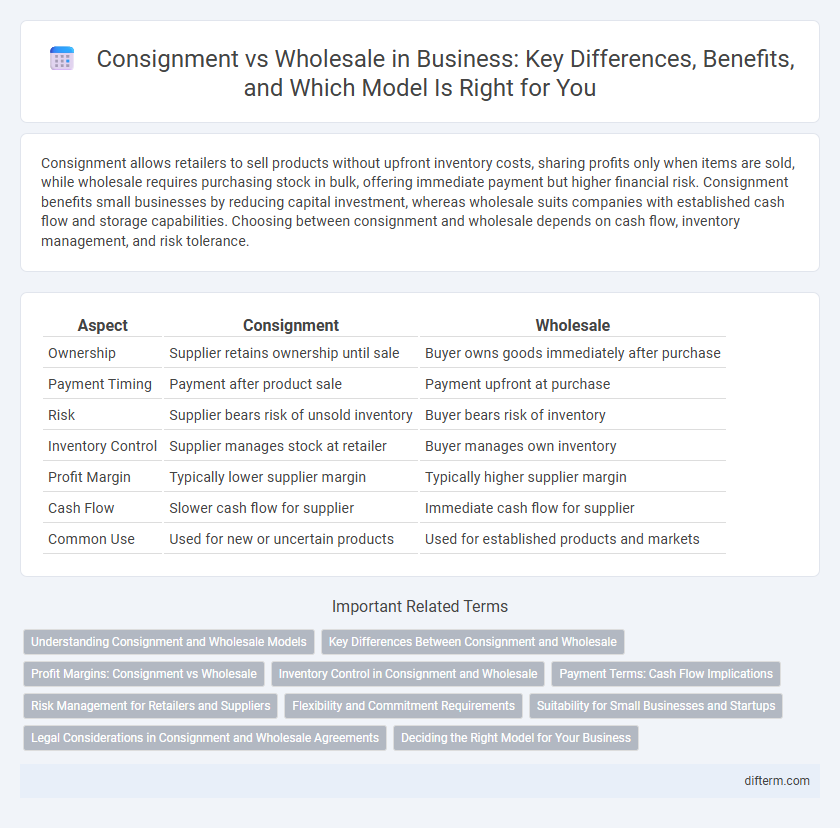

| Aspect | Consignment | Wholesale |

|---|---|---|

| Ownership | Supplier retains ownership until sale | Buyer owns goods immediately after purchase |

| Payment Timing | Payment after product sale | Payment upfront at purchase |

| Risk | Supplier bears risk of unsold inventory | Buyer bears risk of inventory |

| Inventory Control | Supplier manages stock at retailer | Buyer manages own inventory |

| Profit Margin | Typically lower supplier margin | Typically higher supplier margin |

| Cash Flow | Slower cash flow for supplier | Immediate cash flow for supplier |

| Common Use | Used for new or uncertain products | Used for established products and markets |

Understanding Consignment and Wholesale Models

Consignment involves retailers selling products on behalf of suppliers without upfront payment, allowing risk-sharing and inventory flexibility. Wholesale requires retailers to purchase goods upfront at a discounted rate, giving control over pricing and inventory management. Understanding the cash flow implications and inventory risks is essential when choosing between consignment and wholesale models.

Key Differences Between Consignment and Wholesale

Consignment involves a retailer selling products on behalf of a supplier, with payment made only after the sale, whereas wholesale requires upfront payment for bulk goods. Inventory ownership remains with the supplier in consignment, while wholesale transfers ownership to the buyer immediately. Risk exposure is lower in consignment due to delayed payment, contrasting with wholesale's higher financial commitment and inventory control.

Profit Margins: Consignment vs Wholesale

Consignment typically offers lower profit margins per unit compared to wholesale, as sellers only earn revenue once items are sold, but it reduces upfront inventory costs and risks. Wholesale allows businesses to purchase stock at a discounted rate, enabling higher profit margins by setting retail prices; however, it requires significant upfront investment and inventory management. Evaluating profit margins between consignment and wholesale hinges on balancing risk tolerance, cash flow, and sales velocity to maximize overall business profitability.

Inventory Control in Consignment and Wholesale

Inventory control in consignment allows retailers to minimize upfront costs and reduce holding risks since suppliers retain ownership until sale, facilitating flexible stock management and lower capital investment. Wholesale inventory control requires retailers to purchase stock upfront, assuming full ownership and responsibility for unsold goods, which demands accurate demand forecasting and efficient turnover strategies. Effective inventory management in wholesale depends on balancing stock levels to prevent overstocking or stockouts, whereas consignment optimizes cash flow by synchronizing stock replenishment with actual sales.

Payment Terms: Cash Flow Implications

Consignment involves payment to the supplier only after the goods are sold, improving cash flow by reducing upfront inventory costs but potentially delaying revenue recognition. Wholesale requires immediate payment for inventory, which can strain cash flow but ensures inventory ownership and control. Businesses must evaluate their cash flow capacity and risk tolerance when choosing between consignment's flexible payment terms and wholesale's upfront costs.

Risk Management for Retailers and Suppliers

Consignment allows retailers to minimize financial risk by only paying suppliers for sold inventory, reducing upfront capital investment and unsold stock losses. Wholesale shifts more risk onto retailers, who purchase inventory upfront and bear the burden of excess, making inventory forecasting and cash flow management critical. Suppliers prefer consignment to maintain control over stock and reduce return logistics, while wholesale favors faster revenue realization despite higher inventory risk.

Flexibility and Commitment Requirements

Consignment offers greater flexibility as retailers only pay for goods after they are sold, reducing upfront investment and risk. Wholesale requires full payment upfront, creating a higher commitment but allowing for greater control over inventory and pricing. Businesses seeking to minimize financial exposure often prefer consignment, while those prioritizing bulk purchasing discounts and immediate product ownership lean toward wholesale.

Suitability for Small Businesses and Startups

Consignment is highly suitable for small businesses and startups due to its low upfront costs and reduced inventory risk, allowing entrepreneurs to test product demand before committing capital. Wholesale requires purchasing inventory outright, which can strain limited budgets but offers greater control over stock and pricing. Small businesses often prefer consignment when cash flow is tight, while wholesale may be chosen for faster turnaround and predictable margins.

Legal Considerations in Consignment and Wholesale Agreements

Consignment agreements require clear terms on ownership retention and risk transfer until goods are sold, ensuring legal protection for consignors. Wholesale contracts must address warranty clauses, liability for defective products, and payment obligations to mitigate disputes. Both agreement types benefit from explicit termination conditions and jurisdiction specifications to avoid legal ambiguities.

Deciding the Right Model for Your Business

Choosing between consignment and wholesale depends on your cash flow needs, inventory risk tolerance, and control over pricing. Consignment allows retailers to pay only after sales, reducing upfront costs but limiting immediate revenue, while wholesale involves selling products upfront for immediate cash flow but requires holding inventory risks. Evaluate factors like market demand predictability, retailer relationships, and financial flexibility to determine the most suitable sales model for your business growth.

consignment vs wholesale Infographic

difterm.com

difterm.com