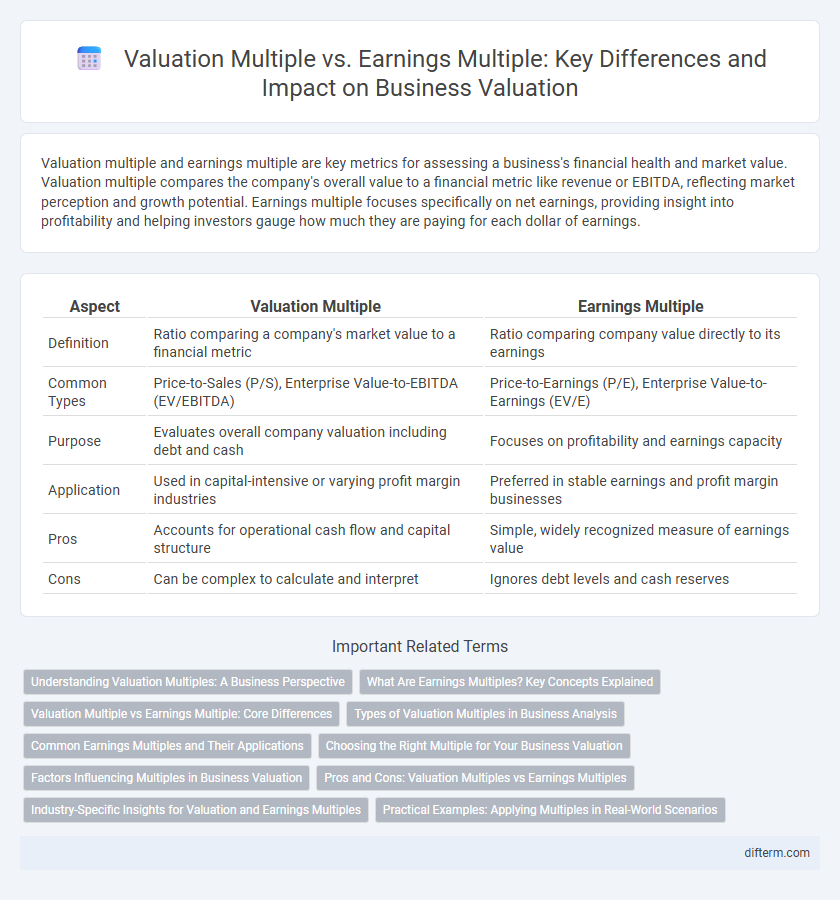

Valuation multiple and earnings multiple are key metrics for assessing a business's financial health and market value. Valuation multiple compares the company's overall value to a financial metric like revenue or EBITDA, reflecting market perception and growth potential. Earnings multiple focuses specifically on net earnings, providing insight into profitability and helping investors gauge how much they are paying for each dollar of earnings.

Table of Comparison

| Aspect | Valuation Multiple | Earnings Multiple |

|---|---|---|

| Definition | Ratio comparing a company's market value to a financial metric | Ratio comparing company value directly to its earnings |

| Common Types | Price-to-Sales (P/S), Enterprise Value-to-EBITDA (EV/EBITDA) | Price-to-Earnings (P/E), Enterprise Value-to-Earnings (EV/E) |

| Purpose | Evaluates overall company valuation including debt and cash | Focuses on profitability and earnings capacity |

| Application | Used in capital-intensive or varying profit margin industries | Preferred in stable earnings and profit margin businesses |

| Pros | Accounts for operational cash flow and capital structure | Simple, widely recognized measure of earnings value |

| Cons | Can be complex to calculate and interpret | Ignores debt levels and cash reserves |

Understanding Valuation Multiples: A Business Perspective

Valuation multiples, such as enterprise value-to-EBITDA (EV/EBITDA) and price-to-earnings (P/E) ratios, provide critical insights into a company's market value relative to key financial metrics. These multiples enable investors to compare businesses across industries by standardizing valuation against earnings, revenues, or cash flows, highlighting operational efficiency and growth potential. Understanding the differences between enterprise value multiples and earnings multiples is essential for accurate business valuation and investment decision-making.

What Are Earnings Multiples? Key Concepts Explained

Earnings multiples are financial metrics used to evaluate a company's value relative to its earnings, commonly expressed as the Price-to-Earnings (P/E) ratio. These multiples provide investors with a standardized way to compare profitability and valuation across different companies or industries by relating market price to net income figures. Understanding earnings multiples is essential for assessing investment attractiveness, as they reflect expectations about future growth and risk levels embedded in current market prices.

Valuation Multiple vs Earnings Multiple: Core Differences

Valuation multiple measures a company's market value relative to a financial metric, such as Enterprise Value to EBITDA, encompassing both debt and equity components. Earnings multiple, often represented by Price to Earnings (P/E) ratio, focuses solely on equity value relative to net income, highlighting shareholder perspective. The core difference lies in valuation multiple reflecting the entire capital structure, while earnings multiple isolates profitability relative to equity investors.

Types of Valuation Multiples in Business Analysis

Valuation multiples are financial metrics used to assess a company's value by comparing it against a specific financial measure such as earnings, sales, or book value, with common types including Price-to-Earnings (P/E), Enterprise Value-to-EBITDA (EV/EBITDA), and Price-to-Sales (P/S) ratios. Earnings multiples, particularly the P/E ratio, focus exclusively on net income to evaluate profitability relative to market price, while broader valuation multiples incorporate different aspects of financial performance and capital structure. Analysts use these multiples to benchmark companies within industries, adjusting for growth potential and risk factors to determine relative valuation and inform investment decisions.

Common Earnings Multiples and Their Applications

Common earnings multiples such as the Price-to-Earnings (P/E) ratio, Enterprise Value-to-EBITDA (EV/EBITDA), and Price-to-Book (P/B) are essential tools in business valuation for comparing companies within the same industry. The P/E ratio measures a company's current share price relative to its per-share earnings, while EV/EBITDA accounts for debt and cash to provide a more comprehensive view of company value. These multiples enable investors and analysts to assess profitability, growth potential, and relative market value to inform acquisition decisions, investment strategies, and financial performance benchmarks.

Choosing the Right Multiple for Your Business Valuation

Selecting the appropriate multiple for business valuation depends on the industry and company financial metrics, with valuation multiples like EV/EBITDA providing a more comprehensive view by accounting for debt, while earnings multiples such as P/E focus directly on net income relative to share price. Analyzing key performance indicators, market conditions, and capital structure ensures a more accurate valuation that aligns with investor expectations and business realities. Employing the most relevant multiple improves decision-making in mergers, acquisitions, and investment strategies.

Factors Influencing Multiples in Business Valuation

Factors influencing valuation multiples in business valuation include industry growth rates, market conditions, and company-specific risks such as management quality and operational efficiency. Earnings multiples are significantly affected by profitability trends, cash flow stability, and potential for future earnings growth, while broader valuation multiples also reflect investor sentiment and macroeconomic indicators like interest rates. Understanding these variables enables more accurate assessments of a company's market value relative to its financial performance.

Pros and Cons: Valuation Multiples vs Earnings Multiples

Valuation multiples, such as Price-to-Sales (P/S) or Enterprise Value-to-EBITDA (EV/EBITDA), offer a broad market perspective and are less susceptible to accounting differences but may overlook profitability nuances. Earnings multiples like Price-to-Earnings (P/E) reflect a company's profitability and are useful for comparison within the same industry but can be distorted by one-time earnings or accounting policies. Choosing between valuation multiples and earnings multiples depends on the company's financial stability, industry characteristics, and the specific context of the analysis.

Industry-Specific Insights for Valuation and Earnings Multiples

Valuation multiples such as EV/EBITDA and P/E ratios vary significantly across industries due to differing capital structures, growth prospects, and risk profiles. For example, tech companies often exhibit higher earnings multiples driven by rapid growth and scalability, whereas manufacturing firms tend to have lower multiples reflecting stable but slower growth. Understanding these industry-specific patterns enables more accurate benchmarking and informed investment decisions based on sector dynamics.

Practical Examples: Applying Multiples in Real-World Scenarios

Valuation multiples such as Price-to-Earnings (P/E) ratio and Enterprise Value-to-EBITDA (EV/EBITDA) are critical tools for assessing company worth in practical business scenarios. For instance, a technology firm with a high growth rate may command a higher P/E multiple compared to a mature manufacturing company where EBITDA multiples are more reliable due to differing capital structures. Applying these multiples correctly enables investors to benchmark companies within industries, adjust for growth prospects, and make more informed acquisition or investment decisions.

Valuation Multiple vs Earnings Multiple Infographic

difterm.com

difterm.com