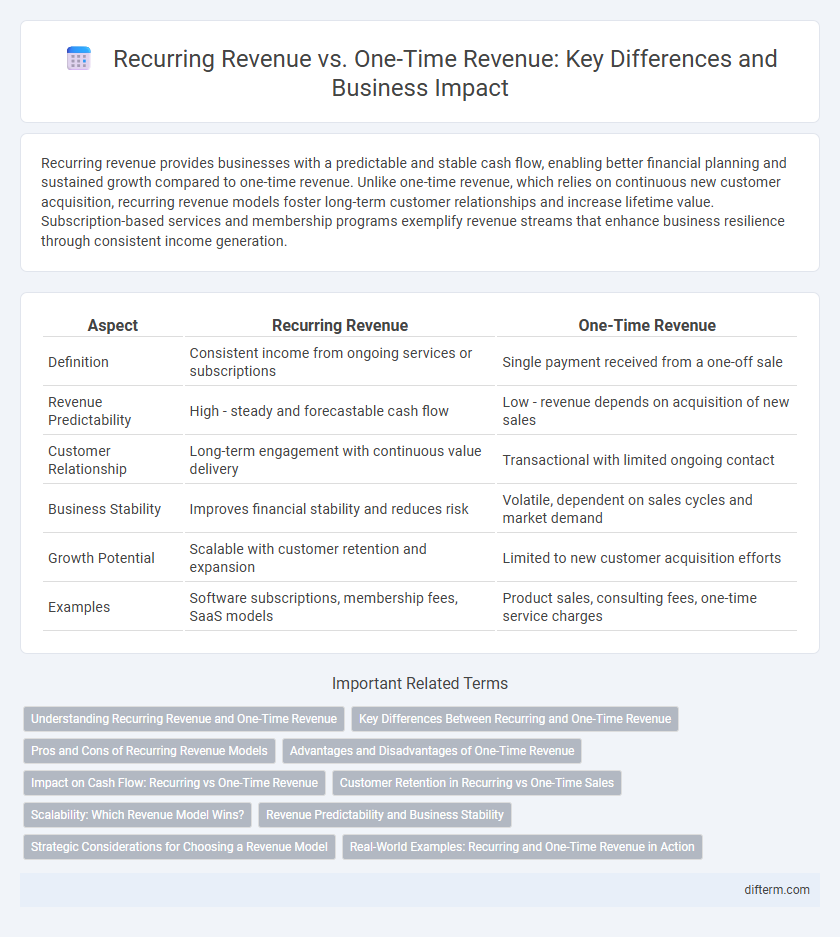

Recurring revenue provides businesses with a predictable and stable cash flow, enabling better financial planning and sustained growth compared to one-time revenue. Unlike one-time revenue, which relies on continuous new customer acquisition, recurring revenue models foster long-term customer relationships and increase lifetime value. Subscription-based services and membership programs exemplify revenue streams that enhance business resilience through consistent income generation.

Table of Comparison

| Aspect | Recurring Revenue | One-Time Revenue |

|---|---|---|

| Definition | Consistent income from ongoing services or subscriptions | Single payment received from a one-off sale |

| Revenue Predictability | High - steady and forecastable cash flow | Low - revenue depends on acquisition of new sales |

| Customer Relationship | Long-term engagement with continuous value delivery | Transactional with limited ongoing contact |

| Business Stability | Improves financial stability and reduces risk | Volatile, dependent on sales cycles and market demand |

| Growth Potential | Scalable with customer retention and expansion | Limited to new customer acquisition efforts |

| Examples | Software subscriptions, membership fees, SaaS models | Product sales, consulting fees, one-time service charges |

Understanding Recurring Revenue and One-Time Revenue

Recurring revenue refers to consistent, predictable income generated from ongoing customer subscriptions or services, ensuring financial stability and long-term growth. One-time revenue arises from single transactions or purchases, providing immediate cash flow but lacking sustainability over time. Businesses leverage recurring revenue models to enhance customer retention and forecast future earnings more accurately.

Key Differences Between Recurring and One-Time Revenue

Recurring revenue provides predictable cash flow by generating consistent income over time, while one-time revenue results from single transactions with no guaranteed future income. Recurring revenue models often include subscriptions, memberships, or service contracts, promoting customer loyalty and long-term business stability. One-time revenue typically arises from product sales or one-off services, leading to fluctuating income and increased dependence on continuous customer acquisition.

Pros and Cons of Recurring Revenue Models

Recurring revenue models provide businesses with predictable cash flow and increased customer lifetime value, fostering long-term financial stability. They require ongoing customer engagement and service quality to minimize churn, which can increase operational complexity and costs. While recurring revenue enhances valuation and scalability, it may limit immediate cash influx compared to one-time revenue models.

Advantages and Disadvantages of One-Time Revenue

One-time revenue provides an immediate cash influx, which can be crucial for funding specific projects or covering sudden expenses, but it lacks predictability and long-term financial stability. This revenue model simplifies accounting and reduces dependency on continuous customer engagement, yet it potentially limits growth opportunities as it doesn't capitalize on customer lifetime value. Businesses relying heavily on one-time sales may face challenges in forecasting revenue and sustaining steady cash flow compared to recurring revenue models.

Impact on Cash Flow: Recurring vs One-Time Revenue

Recurring revenue provides a steady and predictable cash flow, enabling businesses to forecast budgets and invest confidently in growth initiatives. One-time revenue generates immediate cash inflows but lacks sustainability, leading to potential fluctuations in liquidity and financial planning challenges. Consistent recurring revenue improves financial stability and supports long-term operational resilience.

Customer Retention in Recurring vs One-Time Sales

Recurring revenue models emphasize customer retention by fostering ongoing relationships and predictable income streams, which lead to higher lifetime customer value and reduced acquisition costs. One-time sales rely on continuous new customer acquisition, making retention less critical and revenue less predictable. Businesses prioritizing retention benefit from increased stability and smoother cash flow inherent in recurring revenue structures.

Scalability: Which Revenue Model Wins?

Recurring revenue models outperform one-time revenue models in scalability by providing predictable cash flow and enabling systematic growth through subscription or usage-based payments. This steady income stream supports reinvestment in customer acquisition and product development, driving exponential expansion without proportionate increases in cost. Enterprises leveraging recurring revenue thus achieve higher valuation multiples and sustainable competitive advantages due to consistent lifetime customer value.

Revenue Predictability and Business Stability

Recurring revenue ensures consistent cash flow and enhances revenue predictability by securing ongoing customer commitments, reducing dependency on fluctuating sales cycles. One-time revenue, while potentially high-value, introduces variability and unpredictability, making long-term financial forecasting challenging. Business stability significantly improves with a strong recurring revenue model, fostering investor confidence and enabling strategic growth planning.

Strategic Considerations for Choosing a Revenue Model

Choosing between recurring revenue and one-time revenue models involves evaluating long-term financial stability and cash flow predictability crucial for strategic business planning. Recurring revenue models, such as subscriptions or service contracts, enhance customer lifetime value and facilitate scalable growth through continuous engagement. One-time revenue models may suit businesses prioritizing immediate cash influx or project-based sales but often lack the consistency needed for sustained competitive advantage.

Real-World Examples: Recurring and One-Time Revenue in Action

Subscription-based companies like Netflix generate recurring revenue by charging customers monthly fees, ensuring steady cash flow and customer retention. In contrast, retailers such as Best Buy rely on one-time revenue from individual product sales, which can lead to fluctuating income based on market demand. SaaS businesses like Salesforce demonstrate the advantages of recurring revenue through predictable financial forecasts and scalable growth opportunities.

recurring revenue vs one-time revenue Infographic

difterm.com

difterm.com