A profit center directly contributes to a company's revenue by generating income through sales or services, making it essential for driving business growth. In contrast, a cost center supports operations by managing expenses without directly creating profit, focusing on efficiency and resource management. Businesses prioritize profit centers to maximize earnings while maintaining cost centers to ensure smooth, cost-effective operations.

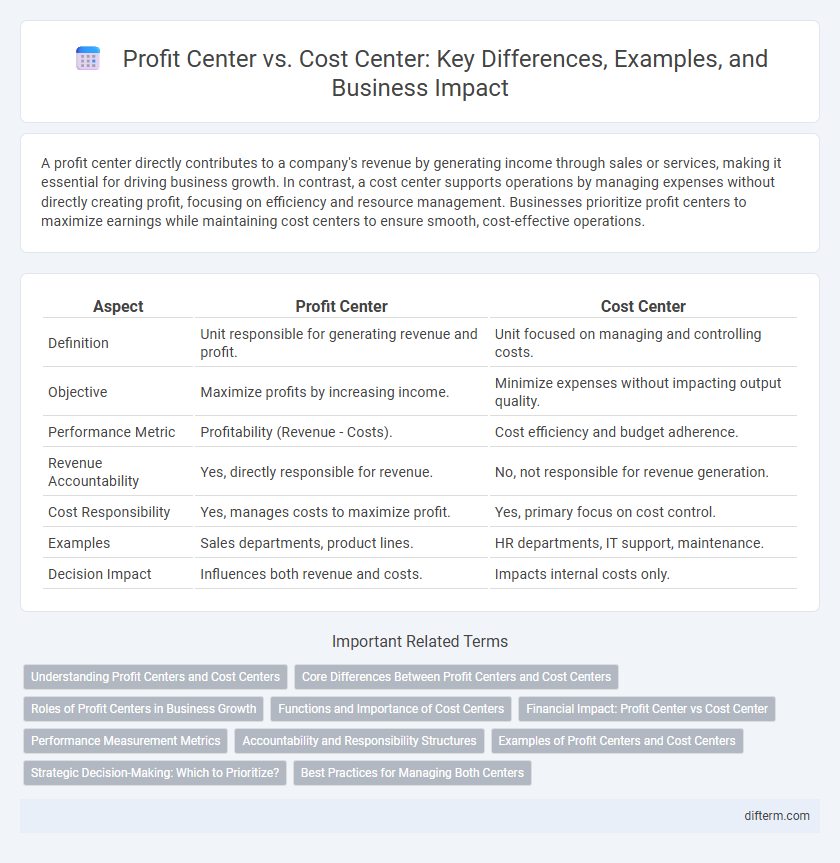

Table of Comparison

| Aspect | Profit Center | Cost Center |

|---|---|---|

| Definition | Unit responsible for generating revenue and profit. | Unit focused on managing and controlling costs. |

| Objective | Maximize profits by increasing income. | Minimize expenses without impacting output quality. |

| Performance Metric | Profitability (Revenue - Costs). | Cost efficiency and budget adherence. |

| Revenue Accountability | Yes, directly responsible for revenue. | No, not responsible for revenue generation. |

| Cost Responsibility | Yes, manages costs to maximize profit. | Yes, primary focus on cost control. |

| Examples | Sales departments, product lines. | HR departments, IT support, maintenance. |

| Decision Impact | Influences both revenue and costs. | Impacts internal costs only. |

Understanding Profit Centers and Cost Centers

Profit centers are business units or departments responsible for generating revenue and profits, allowing management to evaluate their financial performance independently. Cost centers focus on controlling expenses and operational efficiency without directly generating revenue, playing a critical role in budgeting and cost management. Understanding the distinction between profit centers and cost centers enables organizations to optimize resource allocation and improve financial accountability across different segments.

Core Differences Between Profit Centers and Cost Centers

Profit centers are business units responsible for generating revenue and managing both costs and profits, directly impacting the company's overall profitability. Cost centers focus solely on controlling and minimizing operational expenses without directly contributing to revenue generation. The core difference lies in profit centers having accountability for income and expenses, while cost centers are only accountable for monitoring and controlling costs.

Roles of Profit Centers in Business Growth

Profit centers drive business growth by generating revenue and managing profitability within specific divisions or units. They enable organizations to track income and expenses, fostering accountability and strategic decision-making. By focusing on profit generation, profit centers support resource allocation that maximizes overall corporate performance and competitive advantage.

Functions and Importance of Cost Centers

Cost centers primarily focus on managing and controlling expenses within a business unit, ensuring operational efficiency without directly generating revenue, unlike profit centers which are responsible for both revenues and costs. The importance of cost centers lies in their ability to monitor budget adherence, improve resource allocation, and identify cost-saving opportunities essential for sustaining profitability. Effective cost center management supports strategic decision-making by providing detailed financial insights that optimize overall business performance.

Financial Impact: Profit Center vs Cost Center

Profit centers directly contribute to a company's revenue generation by managing both income and expenses, enabling precise measurement of profitability and financial performance. Cost centers focus on controlling and minimizing expenses without generating direct revenue, serving as essential support units that impact overall budget efficiency. The financial impact of profit centers is reflected in net profit margins, while cost centers influence profitability indirectly through cost control and resource optimization.

Performance Measurement Metrics

Profit centers are evaluated using revenue generation, net income, and return on investment metrics to assess their ability to drive profitability and business growth. Cost centers primarily rely on budget adherence, cost variance, and efficiency ratios to measure operational effectiveness and expense control. Performance measurement in profit centers emphasizes financial contribution, whereas cost centers focus on cost management and resource utilization.

Accountability and Responsibility Structures

Profit centers are accountable for generating revenue and managing expenses to achieve profitability, emphasizing financial performance and growth. Cost centers focus solely on controlling and optimizing costs without direct revenue generation, holding responsibility for budget adherence and operational efficiency. Clear accountability in profit centers drives strategic decision-making, while cost centers maintain operational discipline and resource management.

Examples of Profit Centers and Cost Centers

Profit centers include divisions like sales departments, retail stores, and product lines that generate revenue and profits through direct customer sales or service delivery. Cost centers typically encompass support functions such as IT departments, human resources, and accounting, which control expenses without directly producing income. Understanding these distinctions helps businesses allocate resources effectively and measure financial performance accurately.

Strategic Decision-Making: Which to Prioritize?

Profit centers drive strategic decision-making by directly contributing to revenue generation and profitability, making them crucial for growth-oriented businesses. Cost centers focus on controlling expenses and improving operational efficiency but do not generate income, serving more as support functions. Prioritizing profit centers aligns resources with value creation, while managing cost centers ensures financial discipline and resource optimization.

Best Practices for Managing Both Centers

Effective management of profit centers involves setting clear revenue targets, monitoring performance through detailed financial reports, and encouraging entrepreneurial decision-making within teams to drive profitability. Cost center management best practices include implementing strict budget controls, regularly analyzing expense variances, and fostering a culture of cost-awareness to minimize unnecessary expenditures. Balancing these strategies allows businesses to optimize resource allocation, improve financial transparency, and enhance overall organizational efficiency.

Profit Center vs Cost Center Infographic

difterm.com

difterm.com