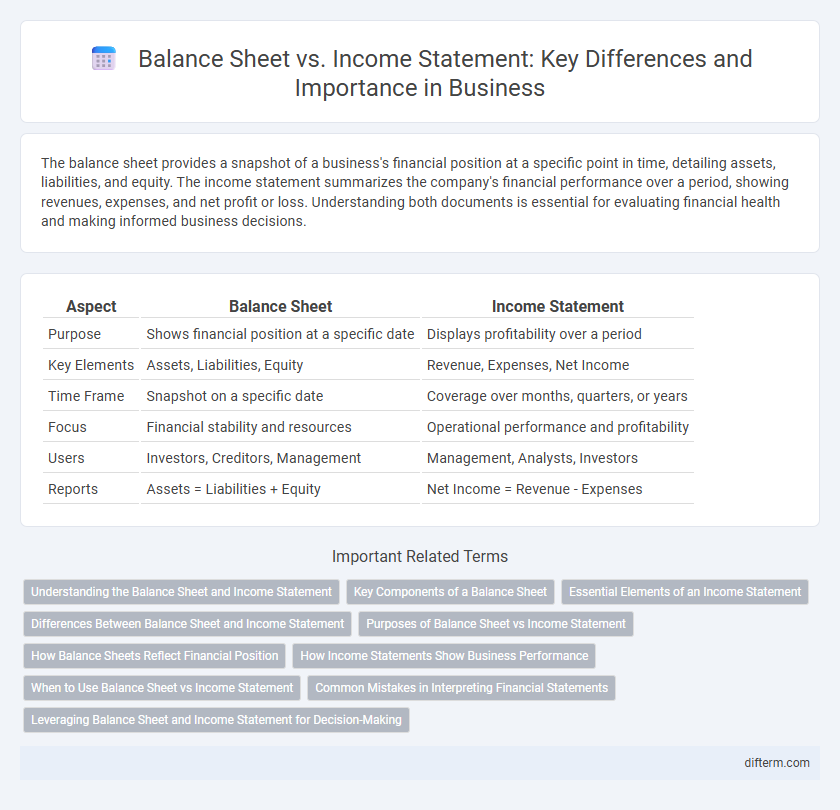

The balance sheet provides a snapshot of a business's financial position at a specific point in time, detailing assets, liabilities, and equity. The income statement summarizes the company's financial performance over a period, showing revenues, expenses, and net profit or loss. Understanding both documents is essential for evaluating financial health and making informed business decisions.

Table of Comparison

| Aspect | Balance Sheet | Income Statement |

|---|---|---|

| Purpose | Shows financial position at a specific date | Displays profitability over a period |

| Key Elements | Assets, Liabilities, Equity | Revenue, Expenses, Net Income |

| Time Frame | Snapshot on a specific date | Coverage over months, quarters, or years |

| Focus | Financial stability and resources | Operational performance and profitability |

| Users | Investors, Creditors, Management | Management, Analysts, Investors |

| Reports | Assets = Liabilities + Equity | Net Income = Revenue - Expenses |

Understanding the Balance Sheet and Income Statement

The balance sheet provides a snapshot of a company's financial position at a specific point in time, detailing assets, liabilities, and shareholders' equity. The income statement summarizes the company's financial performance over a period, highlighting revenues, expenses, and net profit or loss. Understanding these financial statements is essential for assessing liquidity, solvency, profitability, and overall business health.

Key Components of a Balance Sheet

The balance sheet provides a snapshot of a company's financial position, highlighting key components such as assets, liabilities, and shareholders' equity. Assets include current assets like cash and accounts receivable, as well as long-term assets such as property, plant, and equipment. Liabilities encompass current liabilities like accounts payable and long-term obligations, with shareholders' equity representing the residual interest after liabilities are subtracted from assets.

Essential Elements of an Income Statement

The income statement primarily highlights revenue, expenses, and net profit or loss, providing a clear view of a company's financial performance over a specific period. Key elements include gross revenue, cost of goods sold (COGS), operating expenses, and taxes, which collectively determine the net income. This financial report complements the balance sheet by detailing how revenues and costs drive profitability, essential for evaluating operational efficiency and business sustainability.

Differences Between Balance Sheet and Income Statement

The balance sheet provides a snapshot of a company's financial position at a specific point in time, detailing assets, liabilities, and shareholders' equity, whereas the income statement summarizes financial performance over a defined period, highlighting revenues, expenses, and net profit or loss. Unlike the income statement, which measures profitability by matching revenues with expenses, the balance sheet emphasizes liquidity and solvency through its representation of resources and obligations. Understanding these differences is critical for evaluating overall financial health and making informed business decisions.

Purposes of Balance Sheet vs Income Statement

The balance sheet provides a snapshot of a company's financial position at a specific point in time, detailing assets, liabilities, and shareholders' equity to assess liquidity and solvency. The income statement summarizes revenues, expenses, and profits over a reporting period to evaluate operational performance and profitability. Together, these financial statements offer a comprehensive view of a business's financial health and performance.

How Balance Sheets Reflect Financial Position

Balance sheets provide a snapshot of a company's financial position by detailing assets, liabilities, and shareholders' equity at a specific point in time. This statement enables stakeholders to assess the company's liquidity, solvency, and overall net worth, which are critical for making informed investment and credit decisions. Unlike income statements that show operational performance over a period, balance sheets reveal the foundational financial health and stability of a business.

How Income Statements Show Business Performance

Income statements reveal business performance by detailing revenues, expenses, and net profit over a specific period, providing insight into operational efficiency and profitability. Key metrics such as gross profit margin and operating income enable stakeholders to assess financial health and growth potential. This dynamic snapshot contrasts with balance sheets, which present static asset, liability, and equity positions at a single point in time.

When to Use Balance Sheet vs Income Statement

Use the balance sheet to assess a company's financial position at a specific point in time by examining assets, liabilities, and equity. Refer to the income statement to evaluate business performance over a reporting period, focusing on revenues, expenses, and net profit or loss. Balance sheets support decisions related to liquidity and solvency, while income statements guide profitability and operational efficiency analysis.

Common Mistakes in Interpreting Financial Statements

Misinterpreting balance sheets often arises from overlooking the distinction between current and long-term liabilities, leading to inaccurate assessments of a company's liquidity. Income statement errors frequently occur by confusing net income with cash flow, causing flawed evaluations of operational efficiency. Analysts must contextualize financial ratios within industry standards to avoid misleading conclusions when comparing balance sheet and income statement data.

Leveraging Balance Sheet and Income Statement for Decision-Making

Leveraging the balance sheet and income statement for decision-making involves analyzing assets, liabilities, and equity alongside revenues and expenses to assess financial health and profitability. Key ratios such as debt-to-equity and return on assets derived from these statements provide critical insights into risk management and operational efficiency. Effective use of both statements enables stakeholders to make informed strategic choices, optimize resource allocation, and enhance long-term value creation.

Balance Sheet vs Income Statement Infographic

difterm.com

difterm.com