Pre-seed and seed rounds serve distinct purposes in a startup's funding journey, with pre-seed typically focused on validating the business idea and initial product development, often supported by founders' savings or angel investors. Seed funding aims to scale product development, establish market fit, and build a core team, attracting early-stage venture capitalists or seed funds. Understanding the nuances between these funding stages helps entrepreneurs secure the right capital to propel their business growth effectively.

Table of Comparison

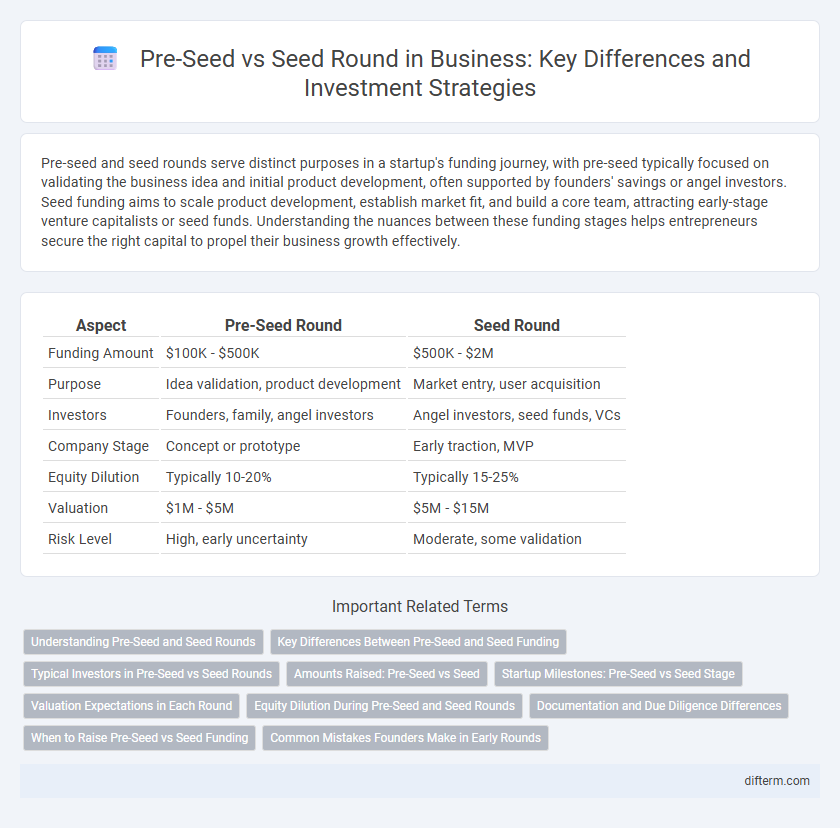

| Aspect | Pre-Seed Round | Seed Round |

|---|---|---|

| Funding Amount | $100K - $500K | $500K - $2M |

| Purpose | Idea validation, product development | Market entry, user acquisition |

| Investors | Founders, family, angel investors | Angel investors, seed funds, VCs |

| Company Stage | Concept or prototype | Early traction, MVP |

| Equity Dilution | Typically 10-20% | Typically 15-25% |

| Valuation | $1M - $5M | $5M - $15M |

| Risk Level | High, early uncertainty | Moderate, some validation |

Understanding Pre-Seed and Seed Rounds

Pre-seed and seed rounds represent crucial early-stage funding phases for startups, with pre-seed typically involving smaller investments to validate concepts and build prototypes, often from founders, friends, or angel investors. Seed rounds attract larger capital inflows aimed at product development, market research, and initial user acquisition, frequently led by venture capital firms or institutional investors. Recognizing the distinctions between these stages helps entrepreneurs effectively plan capitalization strategies and investor engagement to accelerate growth and scalability.

Key Differences Between Pre-Seed and Seed Funding

Pre-seed funding typically involves smaller capital amounts, often ranging from $50,000 to $500,000, aimed at developing a minimum viable product (MVP) or conducting market research. Seed funding tends to be larger, commonly between $500,000 and $2 million, focusing on scaling product development, customer acquisition, and initial team expansion. Pre-seed investors are usually angel investors or founders' networks, while seed rounds attract venture capital firms looking for startups with validated business models and early traction.

Typical Investors in Pre-Seed vs Seed Rounds

Typical investors in pre-seed rounds include angel investors, friends and family, and early-stage venture capital firms specializing in high-risk startups. Seed rounds attract a broader range of investors such as seed-stage venture capital funds, accelerators, incubators, and sometimes corporate investors looking for early innovations. The investment size typically increases from pre-seed to seed, reflecting growing investor confidence and validation of the startup's product and market potential.

Amounts Raised: Pre-Seed vs Seed

Pre-seed rounds typically raise between $100,000 and $1 million, focusing on early product development and market validation. Seed rounds generally secure larger investments, ranging from $1 million to $5 million, aimed at scaling operations and expanding teams. The significant difference in amounts reflects the transition from initial concept testing to growth acceleration in startup funding stages.

Startup Milestones: Pre-Seed vs Seed Stage

Pre-seed rounds typically fund early product development, market research, and forming a core team, marking the transition from idea to prototype. Seed stage financing supports achieving product-market fit, initial customer acquisition, and scaling operational capacities. Key startup milestones at the seed stage include validated business models, early revenue generation, and demonstrated traction in target markets.

Valuation Expectations in Each Round

Pre-seed rounds typically involve valuations ranging from $1 million to $5 million, reflecting the high risk and early-stage uncertainty faced by startups. Seed rounds see increased valuations, often between $5 million and $15 million, as companies demonstrate initial traction and product validation. Investors in seed rounds expect clearer milestones and scalable business models, leading to more robust valuation metrics compared to pre-seed.

Equity Dilution During Pre-Seed and Seed Rounds

Equity dilution during pre-seed and seed rounds varies significantly, with founders typically giving up 10-25% equity in pre-seed compared to 15-30% in seed rounds. Pre-seed investments often involve smaller capital amounts but higher dilution due to greater risk and less valuation clarity. Seed rounds, while larger in funding, tend to dilute equity less proportionally as startups have a more established product-market fit and higher valuation benchmarks.

Documentation and Due Diligence Differences

Pre-seed rounds typically involve minimal documentation, focusing on basic term sheets and founders' agreements due to the early stage and limited external investor involvement. Seed rounds require comprehensive due diligence, including detailed financial statements, market analysis, intellectual property reviews, and legal compliance to satisfy venture capitalists and angel investors. This increased scrutiny ensures transparency and risk assessment before larger capital commitments.

When to Raise Pre-Seed vs Seed Funding

Pre-seed funding is typically raised during the idea validation stage when founders focus on product development, market research, and building a minimum viable product (MVP). Seed funding comes after a startup demonstrates initial traction, such as user engagement or early revenue, and requires capital to scale operations and expand the team. Founders should raise pre-seed capital to validate assumptions and secure proof of concept before pursuing seed rounds aimed at accelerated growth and market penetration.

Common Mistakes Founders Make in Early Rounds

Founders often underestimate the importance of clear milestone planning in pre-seed versus seed rounds, leading to misaligned investor expectations and premature scaling. Overvaluing the startup during pre-seed stages can deter potential seed investors and reduce funding opportunities in later rounds. Neglecting to establish strong governance structures early results in operational inefficiencies and complicates due diligence processes during the seed round.

pre-seed vs seed round Infographic

difterm.com

difterm.com