Crowdfunding offers businesses a platform to raise capital from a large number of small investors, enabling rapid access to funds while testing market interest. Angel investment provides not only substantial funding from affluent individuals but also mentorship and strategic guidance, fostering growth and industry connections. Choosing between crowdfunding and angel investment depends on a company's funding needs, growth stage, and desire for investor involvement.

Table of Comparison

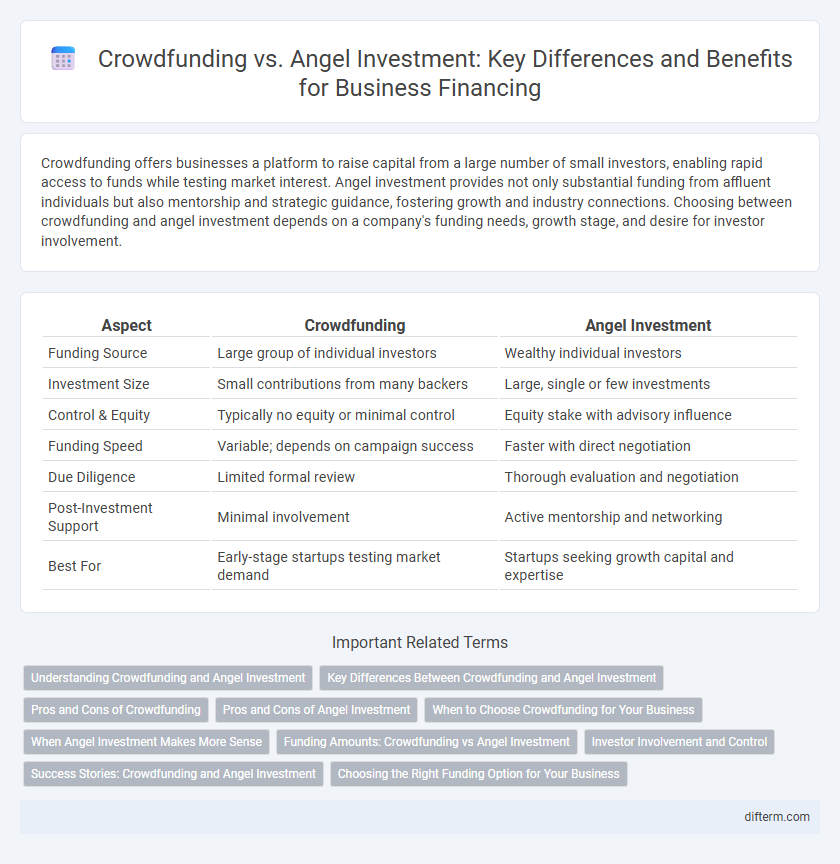

| Aspect | Crowdfunding | Angel Investment |

|---|---|---|

| Funding Source | Large group of individual investors | Wealthy individual investors |

| Investment Size | Small contributions from many backers | Large, single or few investments |

| Control & Equity | Typically no equity or minimal control | Equity stake with advisory influence |

| Funding Speed | Variable; depends on campaign success | Faster with direct negotiation |

| Due Diligence | Limited formal review | Thorough evaluation and negotiation |

| Post-Investment Support | Minimal involvement | Active mentorship and networking |

| Best For | Early-stage startups testing market demand | Startups seeking growth capital and expertise |

Understanding Crowdfunding and Angel Investment

Crowdfunding involves raising small amounts of capital from a large number of individuals, typically via online platforms like Kickstarter or Indiegogo, enabling businesses to access public funds without equity loss. Angel investment refers to funding from affluent individuals who provide capital in exchange for ownership equity or convertible debt, often bringing mentorship and industry expertise to startups. Understanding the distinct risk profiles, funding amounts, and investor involvement helps entrepreneurs choose between grassroots community support and tailored, high-value financial backing.

Key Differences Between Crowdfunding and Angel Investment

Crowdfunding involves raising small amounts of capital from a large number of individuals via online platforms, whereas angel investment entails funding from affluent individuals or groups who provide substantial capital and strategic support. Crowdfunding offers rapid access to diverse investors and marketing exposure, while angel investors bring expertise, mentorship, and often demand equity or convertible debt. The core difference lies in the scale, source, and level of investor involvement, influencing funding structure, control, and long-term business growth.

Pros and Cons of Crowdfunding

Crowdfunding enables entrepreneurs to raise capital from a large pool of small investors, providing access to funds without relinquishing significant equity or control. However, it demands substantial marketing efforts and exposes business ideas publicly, increasing the risk of idea theft and competition. While crowdfunding can validate market demand quickly, the unpredictable nature of campaign success and regulatory compliance challenges can limit its effectiveness compared to angel investment.

Pros and Cons of Angel Investment

Angel investment offers high-value funding from experienced investors who provide strategic guidance and industry connections, accelerating business growth. However, it often requires giving up equity and some level of control, which can limit the founder's decision-making power. The process can be time-consuming and competitive, with investors conducting thorough due diligence before committing funds.

When to Choose Crowdfunding for Your Business

Crowdfunding is ideal for businesses seeking to raise capital quickly while building a large community of early adopters and brand advocates. It works best for consumer-focused products with mass appeal, allowing validation of market demand without giving up equity. Startups with limited access to traditional funding and a strong marketing strategy benefit most from crowdfunding campaigns.

When Angel Investment Makes More Sense

Angel investment makes more sense when startups require substantial capital infusion alongside strategic mentorship and industry connections, which crowdfunding typically lacks. Early-stage companies with high growth potential benefit from angel investors who provide personalized guidance and long-term commitment beyond mere financial support. Crowdfunding suits idea validation and smaller funding needs, but angel investment drives scalable business expansion with experienced investor involvement.

Funding Amounts: Crowdfunding vs Angel Investment

Crowdfunding campaigns typically raise between $10,000 and $100,000, making them ideal for early-stage projects or consumer products seeking market validation. Angel investments usually range from $100,000 to $1 million, providing startups with substantial capital along with mentorship and industry connections. The significant difference in funding amounts affects the scale and speed of business growth achievable through each source.

Investor Involvement and Control

Crowdfunding offers investors limited control and involvement, as decision-making remains with the entrepreneur while contributors primarily receive rewards or equity without voting rights. Angel investment involves active investor participation, with angels often providing strategic guidance, mentorship, and influence over key business decisions. This direct engagement allows angels to shape the company's direction, contrasting with the passive role typical in crowdfunding scenarios.

Success Stories: Crowdfunding and Angel Investment

Crowdfunding platforms like Kickstarter have enabled startups such as Oculus VR to raise millions by tapping into a broad base of small investors, demonstrating the power of community-driven funding. Angel investors have fueled the growth of companies like Airbnb by providing not only capital but also mentorship and industry connections that accelerate business development. Both funding methods offer distinct advantages, with crowdfunding highlighting market validation and angel investment emphasizing strategic support for scalable ventures.

Choosing the Right Funding Option for Your Business

Selecting the right funding option for your business hinges on factors like control, capital needs, and growth trajectory. Crowdfunding offers access to many small investors and can validate market demand, while angel investment provides substantial capital and mentorship from experienced individuals. Entrepreneurs should evaluate equity dilution, funding speed, and long-term strategic goals when deciding between crowdfunding and angel investment.

Crowdfunding vs Angel Investment Infographic

difterm.com

difterm.com