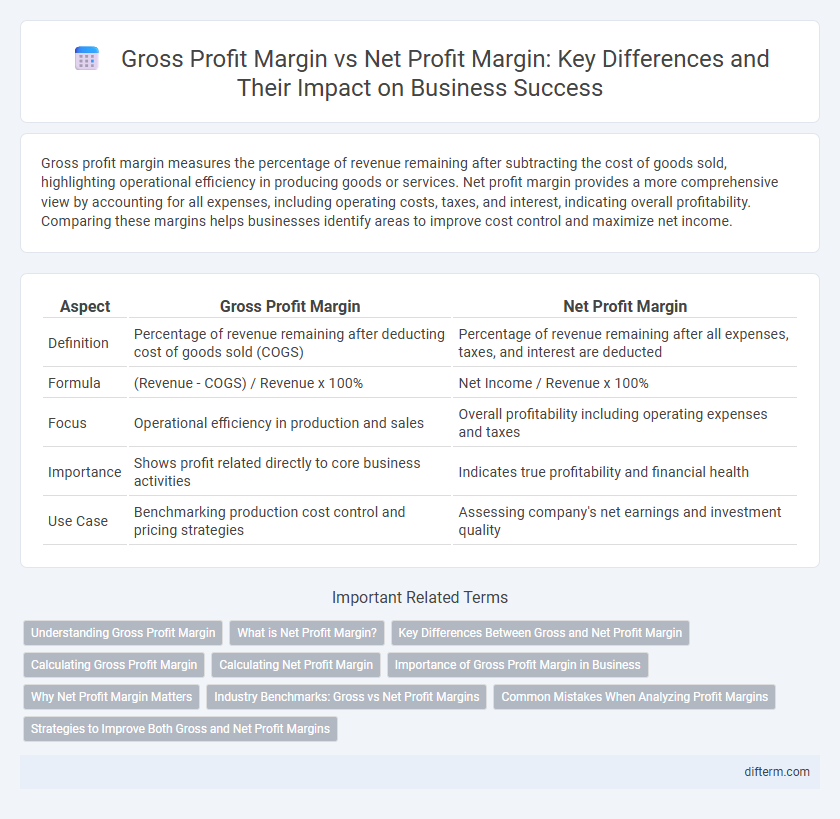

Gross profit margin measures the percentage of revenue remaining after subtracting the cost of goods sold, highlighting operational efficiency in producing goods or services. Net profit margin provides a more comprehensive view by accounting for all expenses, including operating costs, taxes, and interest, indicating overall profitability. Comparing these margins helps businesses identify areas to improve cost control and maximize net income.

Table of Comparison

| Aspect | Gross Profit Margin | Net Profit Margin |

|---|---|---|

| Definition | Percentage of revenue remaining after deducting cost of goods sold (COGS) | Percentage of revenue remaining after all expenses, taxes, and interest are deducted |

| Formula | (Revenue - COGS) / Revenue x 100% | Net Income / Revenue x 100% |

| Focus | Operational efficiency in production and sales | Overall profitability including operating expenses and taxes |

| Importance | Shows profit related directly to core business activities | Indicates true profitability and financial health |

| Use Case | Benchmarking production cost control and pricing strategies | Assessing company's net earnings and investment quality |

Understanding Gross Profit Margin

Gross profit margin measures the percentage of revenue remaining after deducting the cost of goods sold (COGS), providing insight into a company's production efficiency and core profitability. It excludes operating expenses, taxes, and interest, making it a key indicator for assessing the direct costs associated with revenue generation. Understanding gross profit margin helps businesses identify pricing strategies and cost control effectiveness before considering net profit margin, which accounts for all expenses and financial activities.

What is Net Profit Margin?

Net profit margin measures the percentage of revenue remaining after all operating expenses, interest, taxes, and other costs have been deducted from total sales, reflecting the company's overall profitability. This key financial metric indicates how efficiently a business converts revenue into actual profit, providing insight beyond gross profit margin, which only accounts for direct costs. A higher net profit margin demonstrates stronger financial health and operational efficiency, critical for sustainable business growth and investor confidence.

Key Differences Between Gross and Net Profit Margin

Gross profit margin measures the percentage of revenue remaining after deducting the cost of goods sold, highlighting the efficiency of production and core business activities. Net profit margin reflects the overall profitability by accounting for all expenses, including operating costs, interest, and taxes, providing a comprehensive view of financial health. Understanding the key differences between these margins helps businesses assess operational efficiency versus total profitability for strategic decision-making.

Calculating Gross Profit Margin

Calculating gross profit margin involves subtracting the cost of goods sold (COGS) from total revenue and dividing the result by total revenue, then expressing it as a percentage. This metric reflects the efficiency of production and pricing strategies by showing how much of each dollar of revenue is retained after covering direct costs. Businesses use gross profit margin to assess operational performance before accounting for operating expenses, taxes, and interest, which are included in net profit margin calculations.

Calculating Net Profit Margin

Net profit margin is calculated by dividing net profit, which is total revenue minus all expenses including operating costs, taxes, and interest, by total revenue, then multiplying by 100 to express it as a percentage. This metric reveals the actual profitability of a business after accounting for all costs, providing a comprehensive view of financial health. Comparing net profit margin with gross profit margin, which only considers direct production costs, highlights the impact of operating expenses on overall profitability.

Importance of Gross Profit Margin in Business

Gross profit margin measures the efficiency of a company in producing goods and services by indicating the percentage of revenue exceeding the cost of goods sold, directly impacting pricing strategies and cost management decisions. It serves as a critical indicator for businesses to assess operational performance before deducting operating expenses, taxes, and interest, helping identify areas for improvement in production processes. Maintaining a healthy gross profit margin enables companies to sustain profitability and fund essential activities such as marketing, research, and expansion.

Why Net Profit Margin Matters

Net profit margin reveals the true profitability of a business by accounting for all expenses, including operating costs, taxes, and interest, unlike gross profit margin which only considers revenue minus cost of goods sold. This metric provides investors and management with a comprehensive view of financial health and operational efficiency. A higher net profit margin indicates better cost control and stronger potential for sustainable growth.

Industry Benchmarks: Gross vs Net Profit Margins

Industry benchmarks reveal that gross profit margins typically range from 20% to 40% across sectors, reflecting production efficiency and pricing strategy. Net profit margins are generally lower, often between 5% and 15%, as they account for all operating expenses, taxes, and interest. Comparing these margins helps businesses assess operational effectiveness and financial health relative to competitors within the same industry.

Common Mistakes When Analyzing Profit Margins

Confusing gross profit margin with net profit margin is a common mistake, as gross profit margin only accounts for direct costs of production while net profit margin includes all expenses, taxes, and interest. Overlooking operating expenses when evaluating profit margins can lead to an inflated perception of profitability. Many analysts fail to adjust profit margins for industry-specific factors, resulting in misleading comparisons across different business sectors.

Strategies to Improve Both Gross and Net Profit Margins

Implement cost control measures and optimize supply chain management to enhance gross profit margins by reducing direct expenses. Improve net profit margins through efficiency in operational workflows, minimizing overhead costs, and implementing strategic pricing models that reflect market demand and value. Leverage technology and data analytics to identify profit leakages and areas for margin improvement across the entire value chain.

gross profit margin vs net profit margin Infographic

difterm.com

difterm.com