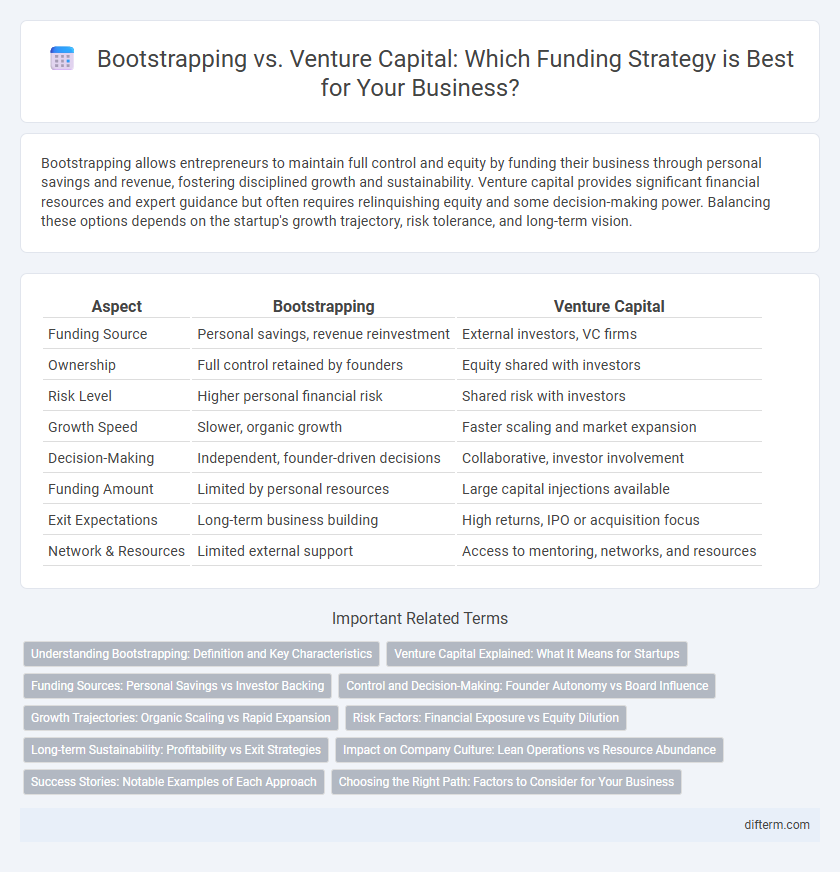

Bootstrapping allows entrepreneurs to maintain full control and equity by funding their business through personal savings and revenue, fostering disciplined growth and sustainability. Venture capital provides significant financial resources and expert guidance but often requires relinquishing equity and some decision-making power. Balancing these options depends on the startup's growth trajectory, risk tolerance, and long-term vision.

Table of Comparison

| Aspect | Bootstrapping | Venture Capital |

|---|---|---|

| Funding Source | Personal savings, revenue reinvestment | External investors, VC firms |

| Ownership | Full control retained by founders | Equity shared with investors |

| Risk Level | Higher personal financial risk | Shared risk with investors |

| Growth Speed | Slower, organic growth | Faster scaling and market expansion |

| Decision-Making | Independent, founder-driven decisions | Collaborative, investor involvement |

| Funding Amount | Limited by personal resources | Large capital injections available |

| Exit Expectations | Long-term business building | High returns, IPO or acquisition focus |

| Network & Resources | Limited external support | Access to mentoring, networks, and resources |

Understanding Bootstrapping: Definition and Key Characteristics

Bootstrapping refers to building a business using personal savings and revenue generated from operations without external funding. Key characteristics include maintaining full ownership, exercising strict cost control, and relying on organic growth to scale. Entrepreneurs often use bootstrapping to retain decision-making power while minimizing financial risk and dilution.

Venture Capital Explained: What It Means for Startups

Venture capital involves funding startups through investments from firms or individuals seeking equity stakes, enabling rapid growth and market expansion. Startups benefit from not only capital but also strategic guidance, networking opportunities, and industry expertise provided by venture capitalists. This form of financing accelerates scaling but typically requires relinquishing some control and shares in the company's ownership.

Funding Sources: Personal Savings vs Investor Backing

Bootstrapping relies primarily on personal savings and internal cash flow, allowing founders to maintain full control and equity while managing growth at a sustainable pace. Venture capital provides substantial external funding from institutional investors, enabling rapid expansion but often requiring equity dilution and strategic input from investors. Choosing between these funding sources impacts decision-making autonomy, growth trajectory, and long-term financial commitments.

Control and Decision-Making: Founder Autonomy vs Board Influence

Bootstrapping enables founders to maintain full control and autonomy over business decisions, preserving their vision without external interference. Venture capital introduces board influence, where investors often gain voting rights and decision-making power, potentially diluting founder control. This shift can impact strategic direction, operational choices, and long-term company goals depending on the terms of investment agreements.

Growth Trajectories: Organic Scaling vs Rapid Expansion

Bootstrapping fosters organic scaling by relying on internal cash flow and gradual reinvestment, leading to steady and sustainable growth trajectories. Venture capital enables rapid expansion by injecting significant external funds, allowing businesses to quickly capture market share and accelerate development. Companies choosing bootstrapping often prioritize control and long-term stability, while those leveraging venture capital focus on aggressive growth and scaling opportunities.

Risk Factors: Financial Exposure vs Equity Dilution

Bootstrapping limits financial exposure by relying on personal funds or operational revenue, reducing the risk of debt but potentially constraining growth. Venture capital involves significant equity dilution, transferring ownership stakes to investors in exchange for capital, which can lead to loss of control over business decisions. Entrepreneurs must weigh the trade-off between maintaining equity and scaling rapidly against the financial risks associated with self-funding.

Long-term Sustainability: Profitability vs Exit Strategies

Bootstrapping fosters long-term sustainability by prioritizing profitability and organic growth without external pressure for rapid returns. Venture capital often emphasizes exit strategies such as acquisitions or IPOs, which can shift focus away from steady profitability toward accelerated growth and market capture. Companies reliant on venture capital may face challenges balancing short-term valuation goals with sustainable business models.

Impact on Company Culture: Lean Operations vs Resource Abundance

Bootstrapping fosters a culture of lean operations where employees prioritize efficiency, innovation, and resourcefulness due to limited financial resources. Venture capital introduces resource abundance that enables rapid scaling, broader talent acquisition, and investment in growth initiatives but may also increase pressure for quick returns and influence company values. The choice between bootstrapping and venture capital significantly shapes organizational dynamics, decision-making, and long-term cultural identity.

Success Stories: Notable Examples of Each Approach

Bootstrapping success stories include companies like Mailchimp, which achieved profitability and growth without external funding by focusing on customer-driven product development and disciplined expense management. In contrast, venture capital-backed giants such as Airbnb and Uber leveraged significant funding to scale rapidly, capture market share, and innovate aggressively in highly competitive industries. These contrasting examples highlight how both bootstrapping and venture capital can lead to impactful business success depending on the company's vision, growth strategy, and market conditions.

Choosing the Right Path: Factors to Consider for Your Business

Choosing between bootstrapping and venture capital requires careful evaluation of your business's growth goals, financial needs, and control preferences. Bootstrapping offers full ownership and operational control but may limit rapid expansion due to constrained resources. Venture capital provides substantial funding and strategic support, often accelerating scaling efforts while necessitating equity sharing and potential influence from investors.

Bootstrapping vs Venture Capital Infographic

difterm.com

difterm.com