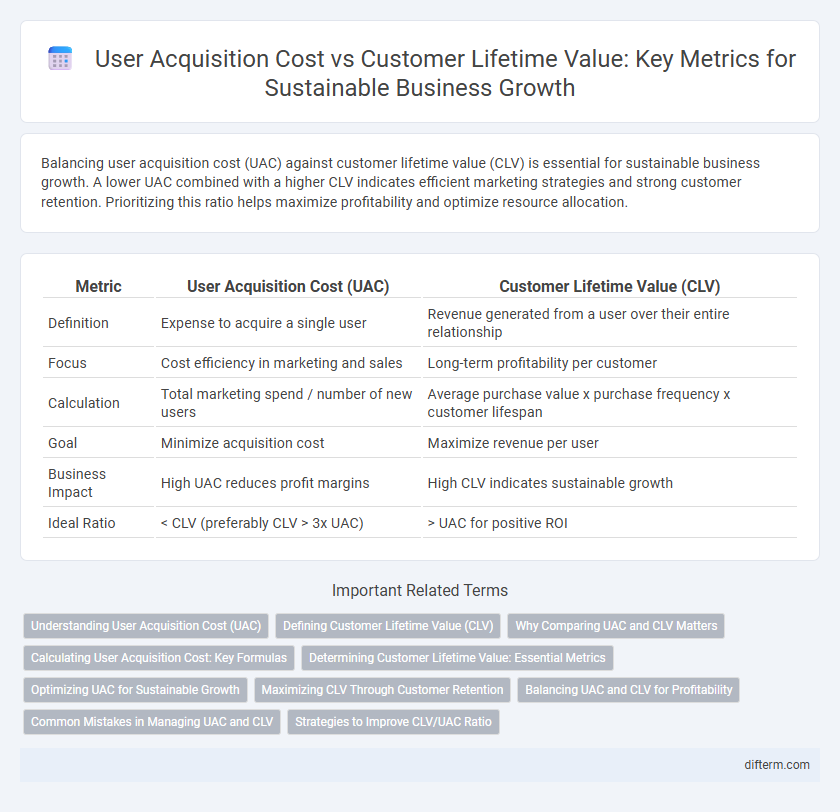

Balancing user acquisition cost (UAC) against customer lifetime value (CLV) is essential for sustainable business growth. A lower UAC combined with a higher CLV indicates efficient marketing strategies and strong customer retention. Prioritizing this ratio helps maximize profitability and optimize resource allocation.

Table of Comparison

| Metric | User Acquisition Cost (UAC) | Customer Lifetime Value (CLV) |

|---|---|---|

| Definition | Expense to acquire a single user | Revenue generated from a user over their entire relationship |

| Focus | Cost efficiency in marketing and sales | Long-term profitability per customer |

| Calculation | Total marketing spend / number of new users | Average purchase value x purchase frequency x customer lifespan |

| Goal | Minimize acquisition cost | Maximize revenue per user |

| Business Impact | High UAC reduces profit margins | High CLV indicates sustainable growth |

| Ideal Ratio | < CLV (preferably CLV > 3x UAC) | > UAC for positive ROI |

Understanding User Acquisition Cost (UAC)

User Acquisition Cost (UAC) quantifies the average expense incurred to attract a new customer through marketing and sales efforts. Accurately tracking UAC involves analyzing expenses across channels such as social media advertising, search engine marketing, and influencer partnerships to optimize budget allocation. Comparing UAC against Customer Lifetime Value (CLV) enables businesses to evaluate profitability, ensuring that acquisition investments yield sustainable revenue growth.

Defining Customer Lifetime Value (CLV)

Customer Lifetime Value (CLV) quantifies the total revenue a business expects from a single customer throughout their entire relationship, serving as a critical metric for strategic decision-making. Accurately calculating CLV involves analyzing purchase frequency, average transaction value, and customer retention rates to predict long-term profitability. Understanding CLV enables companies to optimize marketing spend and improve customer acquisition strategies by ensuring acquisition costs remain below the projected value generated from each customer.

Why Comparing UAC and CLV Matters

Comparing User Acquisition Cost (UAC) and Customer Lifetime Value (CLV) is essential for assessing the profitability and sustainability of marketing strategies. A lower UAC relative to CLV indicates efficient spending that drives long-term revenue growth and maximizes return on investment. Understanding the balance between these metrics helps businesses optimize budget allocation, reduce churn, and enhance overall customer retention strategies.

Calculating User Acquisition Cost: Key Formulas

Calculating User Acquisition Cost (UAC) involves dividing total marketing expenses by the number of new users acquired within a specific period, using the formula UAC = Total Marketing Spend / Number of New Users. Accurately determining UAC is essential for assessing the efficiency of marketing campaigns and optimizing budget allocation. Comparing UAC with Customer Lifetime Value (CLV) allows businesses to evaluate profitability and ensure sustainable growth by maintaining a favorable CLV-to-UAC ratio.

Determining Customer Lifetime Value: Essential Metrics

Determining Customer Lifetime Value (CLV) requires analyzing essential metrics such as average purchase value, purchase frequency, and customer lifespan to estimate the total revenue a business can expect from a single customer. Accurate calculation of CLV helps businesses compare it against user acquisition cost (UAC) to optimize marketing budgets and ensure sustainable profitability. Tracking retention rates and gross margin per customer further refines CLV predictions, enabling strategic decision-making for customer acquisition and retention campaigns.

Optimizing UAC for Sustainable Growth

Optimizing User Acquisition Cost (UAC) relative to Customer Lifetime Value (CLV) is crucial for sustainable business growth. Lowering UAC while increasing CLV maximizes return on investment and ensures long-term profitability. Focusing on targeted marketing strategies and enhancing customer retention boosts CLV, enabling efficient allocation of acquisition budgets.

Maximizing CLV Through Customer Retention

Maximizing Customer Lifetime Value (CLV) requires a strategic focus on customer retention, which directly lowers User Acquisition Cost (UAC) by reducing the need for constantly acquiring new customers. Businesses that invest in personalized engagement, loyalty programs, and exceptional customer service see higher CLV as repeat buyers generate more revenue over time. Enhancing retention metrics improves profitability by increasing the average spend and purchase frequency, making customer retention a key driver for sustainable growth.

Balancing UAC and CLV for Profitability

Balancing User Acquisition Cost (UAC) and Customer Lifetime Value (CLV) is crucial for sustaining long-term profitability in business. Optimizing UAC to be significantly lower than CLV ensures that each new customer contributes positive net revenue, enhancing overall return on investment. Companies leveraging data analytics to monitor and adjust acquisition strategies can effectively maximize CLV while controlling UAC, driving scalable growth and financial health.

Common Mistakes in Managing UAC and CLV

Mismanaging User Acquisition Cost (UAC) often involves underestimating the Customer Lifetime Value (CLV), leading to unsustainable marketing budgets and poor ROI. Businesses frequently focus too heavily on short-term gains by lowering UAC without considering long-term customer retention and cross-selling opportunities that enhance CLV. Ignoring accurate segmentation and failing to align acquisition strategies with customer behavior insights result in inefficiencies that skew the balance between UAC and CLV.

Strategies to Improve CLV/UAC Ratio

Optimizing the CLV/UAC ratio requires targeted customer segmentation and personalized marketing campaigns that increase retention and reduce acquisition expenses. Investing in customer experience enhancements and loyalty programs drives repeat purchases, boostingCustomer Lifetime Value (CLV). Utilizing data analytics to refine advertising channels and optimize spend lowers User Acquisition Cost (UAC), improving overall profitability.

user acquisition cost vs customer lifetime value Infographic

difterm.com

difterm.com