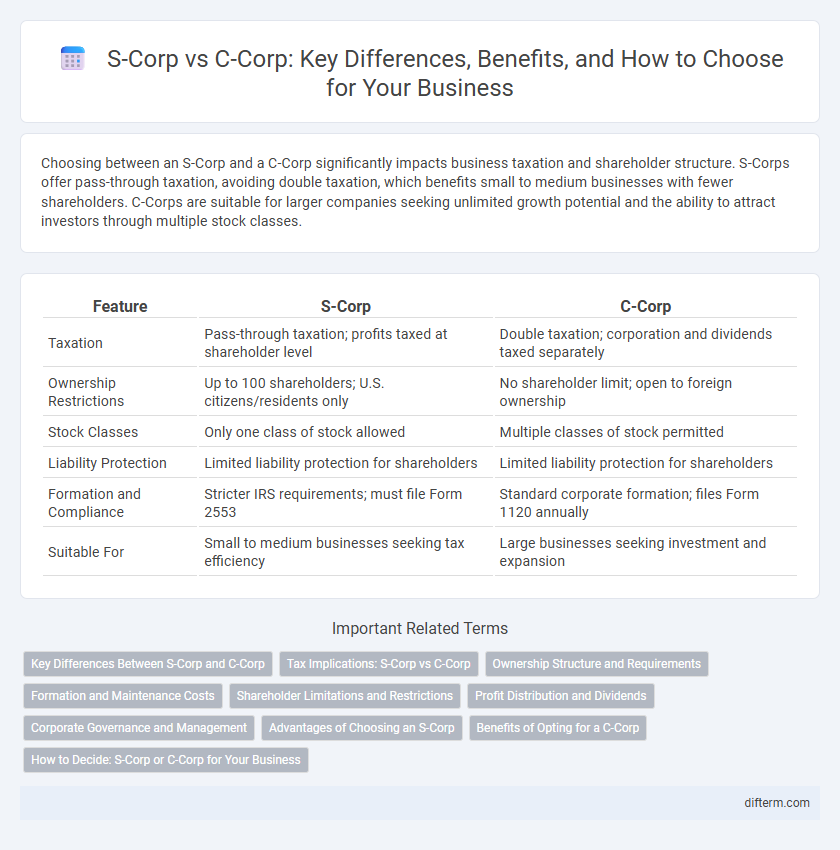

Choosing between an S-Corp and a C-Corp significantly impacts business taxation and shareholder structure. S-Corps offer pass-through taxation, avoiding double taxation, which benefits small to medium businesses with fewer shareholders. C-Corps are suitable for larger companies seeking unlimited growth potential and the ability to attract investors through multiple stock classes.

Table of Comparison

| Feature | S-Corp | C-Corp |

|---|---|---|

| Taxation | Pass-through taxation; profits taxed at shareholder level | Double taxation; corporation and dividends taxed separately |

| Ownership Restrictions | Up to 100 shareholders; U.S. citizens/residents only | No shareholder limit; open to foreign ownership |

| Stock Classes | Only one class of stock allowed | Multiple classes of stock permitted |

| Liability Protection | Limited liability protection for shareholders | Limited liability protection for shareholders |

| Formation and Compliance | Stricter IRS requirements; must file Form 2553 | Standard corporate formation; files Form 1120 annually |

| Suitable For | Small to medium businesses seeking tax efficiency | Large businesses seeking investment and expansion |

Key Differences Between S-Corp and C-Corp

S-Corps offer pass-through taxation, allowing income to be reported on shareholders' personal tax returns, while C-Corps face double taxation at the corporate and shareholder levels. Ownership restrictions differ, with S-Corps limited to 100 shareholders who must be U.S. citizens or residents, whereas C-Corps can have unlimited shareholders, including foreign investors and other corporations. Additionally, S-Corps avoid corporate income tax but limit stock classes to one, while C-Corps can issue multiple stock classes, providing greater flexibility for raising capital.

Tax Implications: S-Corp vs C-Corp

S-Corporations enable income, losses, deductions, and credits to pass through directly to shareholders, avoiding double taxation, whereas C-Corporations face corporate income tax and separate taxation on dividends paid to shareholders. S-Corp shareholders report income on personal tax returns, potentially lowering overall tax liability compared to C-Corp shareholders who pay taxes at both corporate and individual levels. The choice between S-Corp and C-Corp impacts tax planning strategies, affecting federal tax rates, self-employment taxes, and eligibility for certain deductions.

Ownership Structure and Requirements

S-Corp ownership is limited to 100 shareholders who must be U.S. citizens or residents, allowing for only one class of stock, which simplifies profit distribution and voting rights. In contrast, C-Corp ownership can include unlimited shareholders, including foreign investors and multiple classes of stock, providing greater flexibility for raising capital. S-Corps require stricter eligibility criteria and formalities, while C-Corps accommodate complex ownership structures suitable for large businesses and venture funding.

Formation and Maintenance Costs

S-Corp formation typically involves lower initial filing fees and simpler state-level requirements compared to C-Corp, which often faces higher incorporation fees and more complex state compliance regulations. Maintenance costs for S-Corps are generally reduced due to fewer formalities, while C-Corps incur ongoing expenses related to mandatory annual shareholder meetings, detailed record-keeping, and possible franchise taxes. Choosing between S-Corp and C-Corp formation hinges on balancing upfront costs with long-term administrative and compliance obligations.

Shareholder Limitations and Restrictions

S-Corps impose strict shareholder limitations, allowing no more than 100 shareholders who must be U.S. citizens or residents, and prohibit ownership by other corporations or partnerships. C-Corps have no restrictions on the number or type of shareholders, enabling unlimited foreign and institutional investors. These shareholder rules in S-Corps ensure pass-through taxation eligibility, while C-Corps accommodate broader capital-raising strategies through diverse investor bases.

Profit Distribution and Dividends

S-Corps distribute profits directly to shareholders without corporate-level taxation, allowing income to pass through and be taxed only at the individual level, which minimizes double taxation. C-Corps, however, retain profits within the corporation or distribute dividends to shareholders, with dividends subjected to double taxation at both the corporate and individual levels. This fundamental difference in profit distribution and dividend treatment significantly affects tax liabilities and cash flow strategies for business owners.

Corporate Governance and Management

S-Corps limit corporate governance complexity by restricting ownership to 100 shareholders, all of whom must be U.S. citizens or residents, fostering tighter management control often suited for smaller businesses. C-Corps offer broader governance structures with unlimited shareholders, enabling more diverse boards of directors and hierarchical management layers, which appeal to larger enterprises or those seeking venture capital. The management flexibility in C-Corps supports complex decision-making processes, while S-Corps prioritize streamlined operations and shareholder involvement.

Advantages of Choosing an S-Corp

Choosing an S-Corp offers significant tax benefits by allowing profits and losses to pass directly to shareholders, avoiding double taxation commonly seen in C-Corps. S-Corps also provide liability protection to owners while enabling income to be reported on personal tax returns, which can result in lower overall tax liability. Furthermore, S-Corps offer greater flexibility in profit distribution and simplified tax filing requirements compared to C-Corps.

Benefits of Opting for a C-Corp

C-Corporations offer significant advantages such as unlimited growth potential through the issuance of multiple classes of stock, attracting venture capital, and easier transfer of ownership. They benefit from a flat 21% corporate tax rate and potential tax deductions on employee benefits, making them appealing for businesses planning substantial reinvestment and expansion. The structure also provides limited liability protection for shareholders, separating personal assets from business liabilities, which is critical for risk management.

How to Decide: S-Corp or C-Corp for Your Business

Choosing between an S-Corp and a C-Corp hinges on factors like taxation, ownership structure, and business goals. S-Corps offer pass-through taxation to avoid double taxation, ideal for smaller businesses with fewer shareholders, while C-Corps allow unlimited shareholders and are favorable for businesses seeking venture capital or public offerings. Evaluate your company's size, future funding plans, and desire to avoid corporate tax to determine the optimal corporate structure.

S-Corp vs C-Corp Infographic

difterm.com

difterm.com