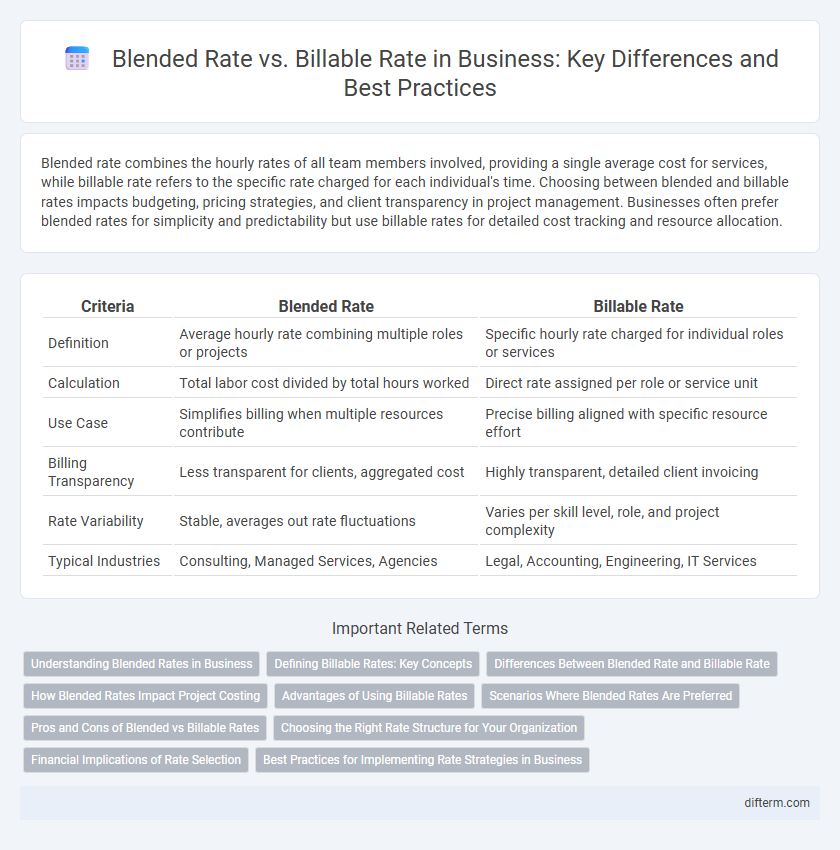

Blended rate combines the hourly rates of all team members involved, providing a single average cost for services, while billable rate refers to the specific rate charged for each individual's time. Choosing between blended and billable rates impacts budgeting, pricing strategies, and client transparency in project management. Businesses often prefer blended rates for simplicity and predictability but use billable rates for detailed cost tracking and resource allocation.

Table of Comparison

| Criteria | Blended Rate | Billable Rate |

|---|---|---|

| Definition | Average hourly rate combining multiple roles or projects | Specific hourly rate charged for individual roles or services |

| Calculation | Total labor cost divided by total hours worked | Direct rate assigned per role or service unit |

| Use Case | Simplifies billing when multiple resources contribute | Precise billing aligned with specific resource effort |

| Billing Transparency | Less transparent for clients, aggregated cost | Highly transparent, detailed client invoicing |

| Rate Variability | Stable, averages out rate fluctuations | Varies per skill level, role, and project complexity |

| Typical Industries | Consulting, Managed Services, Agencies | Legal, Accounting, Engineering, IT Services |

Understanding Blended Rates in Business

Blended rates in business combine various hourly rates into a single average rate, simplifying client billing and project cost management. Unlike billable rates, which apply to specific roles or services, blended rates provide a unified figure reflecting the overall cost of labor by averaging distinct billable rates. This approach enhances transparency and budgeting accuracy, especially in service industries with diverse skill sets.

Defining Billable Rates: Key Concepts

Billable rates represent the specific hourly charge applied to clients for services rendered, directly reflecting the cost of labor and expertise. These rates are calculated based on employee salaries, overhead costs, profit margins, and market standards within the industry. Distinguishing billable rates from blended rates is crucial, as billable rates are assigned per individual role or service, while blended rates combine multiple roles into a single average billing figure.

Differences Between Blended Rate and Billable Rate

Blended rate combines multiple employees' hourly rates into a single average used for project pricing, simplifying budgeting and invoicing. Billable rate reflects the specific cost charged for an individual employee's time, often varying by role, expertise, or task complexity. The key difference lies in blended rate offering a standardized cost across resources, while billable rate provides granular detail tied to each professional's contribution.

How Blended Rates Impact Project Costing

Blended rates, combining multiple roles into a single average hourly charge, simplify project costing by providing predictable expenses and reducing invoicing complexity. They enable businesses to allocate costs more efficiently across different tasks, improving budget accuracy and resource planning. Using blended rates can mask individual role costs, potentially impacting profitability analysis and financial decision-making.

Advantages of Using Billable Rates

Billable rates provide precise cost tracking by charging clients for actual hours worked, enhancing revenue accuracy and profitability analysis. Using billable rates improves transparency with clients, fostering trust through clear, itemized invoicing. This method supports better resource allocation and project management by directly linking time spent to specific tasks and deliverables.

Scenarios Where Blended Rates Are Preferred

Blended rates are preferred in project-based business scenarios where simplicity and predictability in billing are essential, such as fixed-price contracts or managed services agreements. These rates combine various skill levels and roles into a single hourly charge, streamlining invoicing and reducing client disputes over cost allocation. Companies with diverse teams often use blended rates to enhance transparency and improve budgeting accuracy for clients.

Pros and Cons of Blended vs Billable Rates

Blended rates simplify billing by averaging hourly charges across multiple services or employees, enhancing transparency and easing client budgeting but may obscure true costs for specialized tasks or high-level expertise. Billable rates allow precise charging based on individual roles and expertise, increasing profitability for specialized work yet complicating invoicing and potentially causing client dissatisfaction due to inconsistent pricing. Choosing between blended and billable rates depends on project complexity, client preferences, and the need for financial clarity versus operational simplicity.

Choosing the Right Rate Structure for Your Organization

Evaluating blended rates versus billable rates is crucial for optimizing your organization's financial strategy and improving project profitability. Blended rates combine multiple roles and skill levels into a single average rate, simplifying billing but potentially masking individual productivity and value. Billable rates, charged per specific role or service, provide greater transparency and precision, enabling more accurate forecasting and client negotiations.

Financial Implications of Rate Selection

Selecting a blended rate over a billable rate directly impacts revenue recognition and profitability, as blended rates average costs and can mask individual project margins. Billable rates provide greater financial precision by charging clients based on specific service costs and time allocation, enabling detailed profit analysis and cash flow management. Businesses choosing blended rates may simplify billing but risk underestimating project expenses, affecting budgeting accuracy and long-term financial planning.

Best Practices for Implementing Rate Strategies in Business

Implement tiered billing structures to balance blended rates reflecting average costs with billable rates tied to specific services or expertise, ensuring transparent client communication and accurate project cost forecasting. Leverage data analytics to monitor utilization and adjust rates dynamically, optimizing profitability while maintaining competitive pricing. Train sales and project management teams on the strategic application of rate models to align with business goals and client expectations effectively.

blended rate vs billable rate Infographic

difterm.com

difterm.com