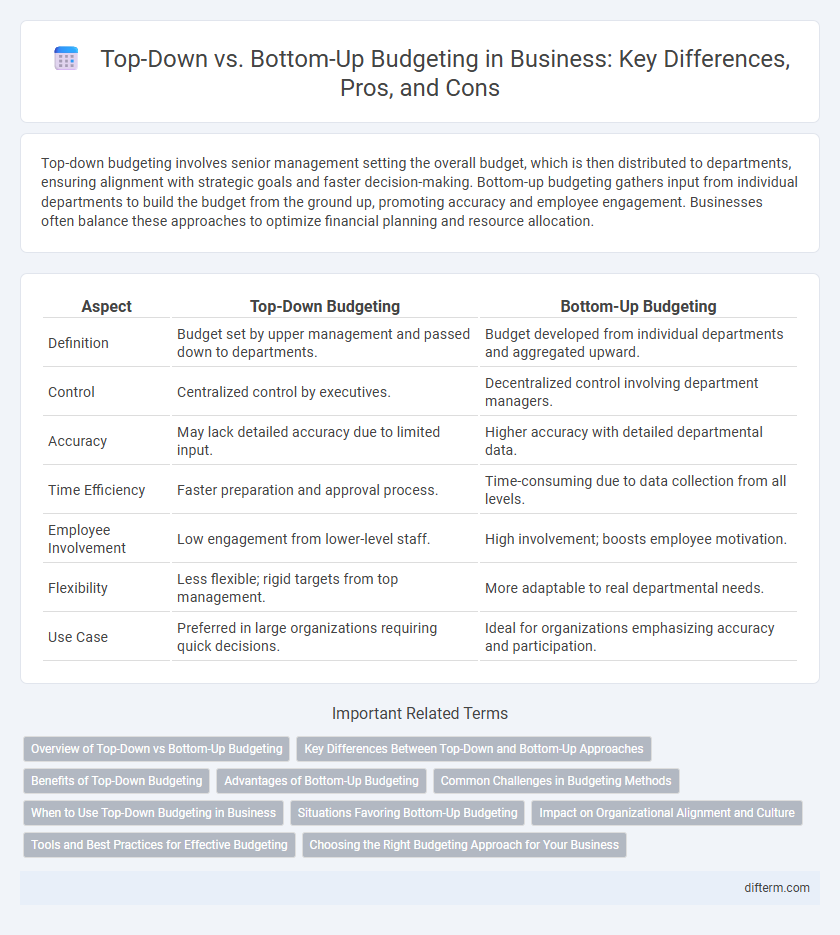

Top-down budgeting involves senior management setting the overall budget, which is then distributed to departments, ensuring alignment with strategic goals and faster decision-making. Bottom-up budgeting gathers input from individual departments to build the budget from the ground up, promoting accuracy and employee engagement. Businesses often balance these approaches to optimize financial planning and resource allocation.

Table of Comparison

| Aspect | Top-Down Budgeting | Bottom-Up Budgeting |

|---|---|---|

| Definition | Budget set by upper management and passed down to departments. | Budget developed from individual departments and aggregated upward. |

| Control | Centralized control by executives. | Decentralized control involving department managers. |

| Accuracy | May lack detailed accuracy due to limited input. | Higher accuracy with detailed departmental data. |

| Time Efficiency | Faster preparation and approval process. | Time-consuming due to data collection from all levels. |

| Employee Involvement | Low engagement from lower-level staff. | High involvement; boosts employee motivation. |

| Flexibility | Less flexible; rigid targets from top management. | More adaptable to real departmental needs. |

| Use Case | Preferred in large organizations requiring quick decisions. | Ideal for organizations emphasizing accuracy and participation. |

Overview of Top-Down vs Bottom-Up Budgeting

Top-down budgeting involves senior management setting the overall budget limits, which are then allocated downward to departments, ensuring alignment with strategic goals and tighter control over expenses. Bottom-up budgeting requires individual departments to estimate their financial needs and submit proposals, promoting accuracy and employee engagement through detailed input. Comparing both methods, top-down budgeting offers faster implementation and centralized control, whereas bottom-up budgeting enhances precision and accountability with granular data collection from operational levels.

Key Differences Between Top-Down and Bottom-Up Approaches

Top-down budgeting relies on senior management setting the overall budget, which is then allocated to departments, ensuring alignment with strategic goals but potentially overlooking departmental insights. Bottom-up budgeting involves input from various departments to build the budget from detailed operational data, fostering greater accuracy and ownership but requiring more time and coordination. The key differences lie in control, accuracy, and engagement, with top-down approaches emphasizing control and speed, while bottom-up approaches prioritize detailed insights and employee involvement.

Benefits of Top-Down Budgeting

Top-down budgeting accelerates the planning process by establishing clear financial targets set by senior management, ensuring alignment with strategic objectives. This method facilitates efficient resource allocation and enforces tighter cost control across departments, promoting organizational discipline. It also enhances accountability by providing departments with defined budget constraints, reducing the risk of overspending.

Advantages of Bottom-Up Budgeting

Bottom-up budgeting enhances accuracy by involving department managers who possess detailed knowledge of their specific operational needs, leading to more realistic and achievable budget allocations. This approach fosters greater employee engagement and accountability, as team members participate directly in the financial planning process. Organizations benefit from improved communication and collaboration across departments, resulting in a budget that reflects actual resource requirements and supports strategic goals effectively.

Common Challenges in Budgeting Methods

Top-down budgeting often faces challenges like unrealistic targets and limited employee engagement, leading to potential misalignment between corporate goals and departmental needs. Bottom-up budgeting can struggle with time-consuming processes and overestimation risks due to input from multiple stakeholders lacking a unified strategic perspective. Both methods require balancing accuracy, communication, and adaptability to ensure effective resource allocation and organizational performance.

When to Use Top-Down Budgeting in Business

Top-down budgeting is ideal for businesses that require quick decision-making and centralized financial control, especially in large organizations with multiple departments. This method streamlines budget allocation based on overarching corporate goals and strategic priorities set by senior management. Companies facing tight deadlines or needing to align expenditures with high-level objectives often benefit from implementing top-down budgeting to ensure consistency and efficiency.

Situations Favoring Bottom-Up Budgeting

Bottom-up budgeting excels in organizations with complex operations requiring detailed input from various departments to improve accuracy and ownership of budget estimates. This approach favors situations where frontline managers possess the most relevant knowledge about resource needs and constraints, ensuring the budget reflects practical realities. It is particularly beneficial in dynamic environments demanding adaptability, such as startups or industries experiencing rapid change.

Impact on Organizational Alignment and Culture

Top-down budgeting fosters alignment by setting clear organizational priorities from leadership but may limit employee engagement and reduce innovation. Bottom-up budgeting enhances organizational culture through participative decision-making, boosting morale and ownership but risks misalignment with strategic goals. Balancing both methods can optimize alignment and cultivate a collaborative, adaptable business environment.

Tools and Best Practices for Effective Budgeting

Top-down budgeting relies on executive-driven financial targets and centralized tools like ERP systems and strategic dashboards to align budgets with organizational goals. Bottom-up budgeting uses collaborative platforms such as cloud-based budgeting software that facilitate department-level input and granular data analysis for accuracy. Best practices include integrating real-time data visualization tools, fostering cross-functional communication, and applying scenario planning techniques to enhance precision and adaptability in budget forecasts.

Choosing the Right Budgeting Approach for Your Business

Top-down budgeting streamlines decision-making by setting financial targets at the executive level, ensuring alignment with strategic goals and faster implementation. Bottom-up budgeting promotes accuracy and employee engagement by incorporating detailed input from departments, capturing on-the-ground insights and operational realities. Selecting the appropriate budgeting approach depends on your company's size, organizational culture, and the need for control versus flexibility in financial planning.

top-down budgeting vs bottom-up budgeting Infographic

difterm.com

difterm.com