Sell-in refers to the quantity of pet products that retailers purchase from suppliers, while sell-through measures the actual sales of these products to end customers. Monitoring both sell-in and sell-through rates helps retailers optimize inventory levels and ensure popular pet items consistently meet consumer demand. Balancing these metrics reduces overstock risks and enhances profitability in the competitive retail pet market.

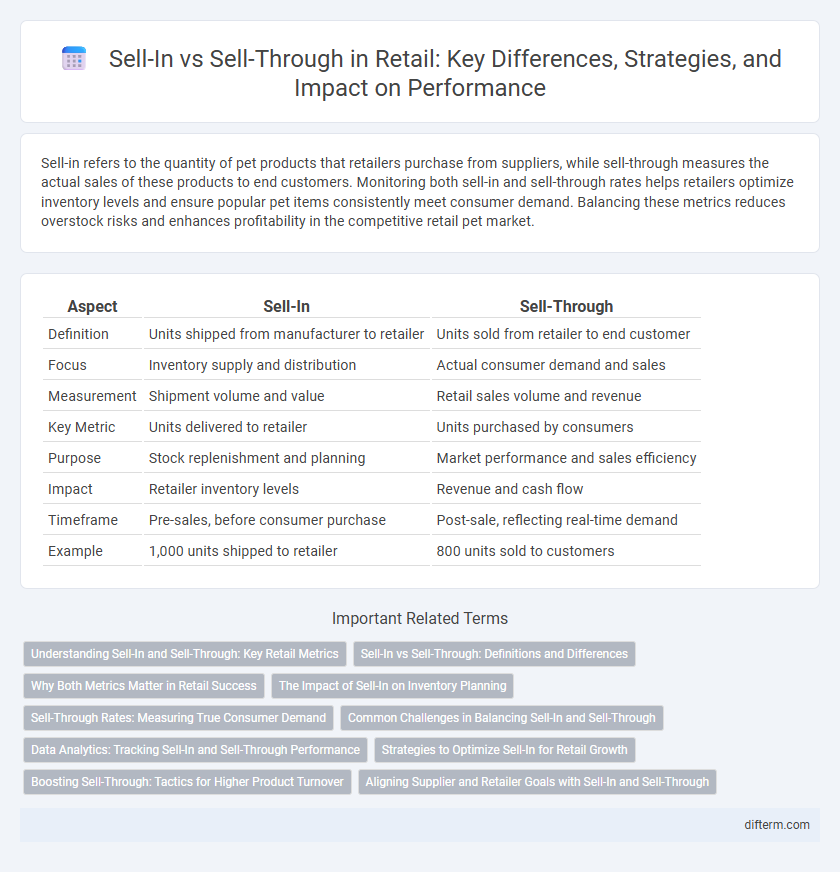

Table of Comparison

| Aspect | Sell-In | Sell-Through |

|---|---|---|

| Definition | Units shipped from manufacturer to retailer | Units sold from retailer to end customer |

| Focus | Inventory supply and distribution | Actual consumer demand and sales |

| Measurement | Shipment volume and value | Retail sales volume and revenue |

| Key Metric | Units delivered to retailer | Units purchased by consumers |

| Purpose | Stock replenishment and planning | Market performance and sales efficiency |

| Impact | Retailer inventory levels | Revenue and cash flow |

| Timeframe | Pre-sales, before consumer purchase | Post-sale, reflecting real-time demand |

| Example | 1,000 units shipped to retailer | 800 units sold to customers |

Understanding Sell-In and Sell-Through: Key Retail Metrics

Sell-in represents the quantity of products a retailer purchases from suppliers, indicating initial inventory levels and supplier demand. Sell-through measures the percentage of sold inventory from that received stock, reflecting consumer demand and product performance on shelves. Tracking both metrics enables retailers to optimize stock levels, reduce excess inventory, and improve supply chain efficiency.

Sell-In vs Sell-Through: Definitions and Differences

Sell-in refers to the quantity of products a manufacturer ships to retailers, indicating initial supply levels, while sell-through measures the actual sales made to consumers from those retailers, reflecting market demand and inventory efficiency. Understanding the difference between sell-in and sell-through is crucial for retailers and suppliers to manage stock levels, forecast demand accurately, and optimize supply chain performance. High sell-in with low sell-through suggests overstocking or weak consumer demand, whereas balanced sell-in and sell-through indicate effective product distribution and sales alignment.

Why Both Metrics Matter in Retail Success

Sell-in measures the quantity of products supplied from manufacturers to retailers, reflecting inventory availability, while sell-through tracks the actual sales from retailers to consumers, indicating customer demand and product performance. Monitoring both metrics enables retailers to balance stock levels, reduce overstock or stockouts, and optimize supply chain efficiency. Effective management of sell-in and sell-through data drives smarter purchasing decisions, enhances revenue forecasting, and supports sustained retail growth.

The Impact of Sell-In on Inventory Planning

Sell-in data significantly influences inventory planning by providing retailers with early indicators of product demand and delivery schedules from suppliers. Accurate sell-in forecasting helps avoid overstocking and stockouts, optimizing warehouse space and cash flow efficiency. Understanding sell-in trends enables retailers to align replenishment strategies with market demand, enhancing overall supply chain responsiveness.

Sell-Through Rates: Measuring True Consumer Demand

Sell-through rates provide a precise metric for gauging actual consumer demand by comparing the quantity of products sold to customers against the inventory received from suppliers. This rate highlights retail performance, revealing how quickly products move off shelves and identifying stock issues or popular items. Tracking sell-through rates enables retailers to optimize inventory levels, reduce markdowns, and align procurement strategies with market trends.

Common Challenges in Balancing Sell-In and Sell-Through

Retailers often struggle to balance sell-in and sell-through due to inaccurate demand forecasting, leading to overstock or stockouts. Excessive sell-in can result in high inventory holding costs and increased markdowns, while insufficient sell-in limits product availability and lost sales opportunities. Aligning supplier shipments with real-time consumer demand remains a critical challenge for optimizing inventory turnover and profitability.

Data Analytics: Tracking Sell-In and Sell-Through Performance

Data analytics plays a crucial role in tracking sell-in and sell-through performance by providing detailed insights into inventory movement and sales trends. By analyzing point-of-sale data and supplier shipments, retailers can optimize stock levels, minimize overstock or stockouts, and improve demand forecasting accuracy. Advanced analytics tools enable real-time monitoring and predictive modeling, enhancing decision-making and boosting overall retail efficiency.

Strategies to Optimize Sell-In for Retail Growth

Optimizing sell-in requires accurate demand forecasting and aligning inventory levels with market trends to prevent overstocking and stockouts. Collaborating closely with suppliers enables flexible replenishment cycles and personalized product assortments tailored to target customers. Leveraging data analytics enhances promotional planning and shelf space allocation, driving higher sell-through rates and sustainable retail growth.

Boosting Sell-Through: Tactics for Higher Product Turnover

Boosting sell-through in retail involves optimizing inventory levels, enhancing product placement, and employing targeted promotions to increase customer purchase rates. Leveraging data analytics to predict demand accurately ensures orders align with real-time sales trends, minimizing overstock and stockouts. Engaging in seasonal markdowns and personalized marketing campaigns can accelerate turnover, improve cash flow, and reduce holding costs effectively.

Aligning Supplier and Retailer Goals with Sell-In and Sell-Through

Aligning supplier and retailer goals with sell-in and sell-through metrics enhances inventory management and demand forecasting accuracy. Sell-in data tracks the volume of products delivered to retailers, while sell-through measures the actual consumer purchases, providing critical insights for optimizing supply chain efficiency. Jointly analyzing these metrics fosters collaboration, minimizes stockouts and overstocks, and drives revenue growth in the retail sector.

Sell-in vs Sell-through Infographic

difterm.com

difterm.com