GMROI measures the profitability of inventory by assessing gross margin relative to the cost of inventory, highlighting how well each dollar invested in stock generates profit. Inventory turnover focuses on the frequency at which inventory is sold and replaced within a given period, indicating the efficiency of inventory management. Balancing a high GMROI with optimal inventory turnover is crucial for retail pet businesses to maximize profits while minimizing holding costs and stock obsolescence.

Table of Comparison

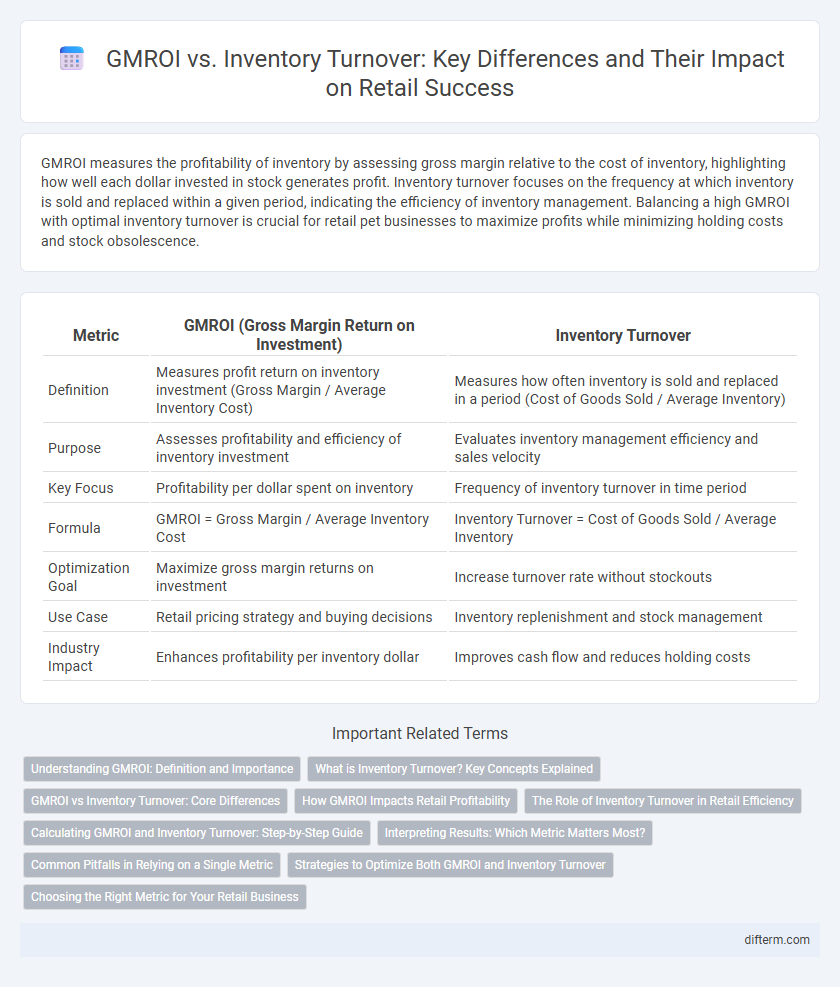

| Metric | GMROI (Gross Margin Return on Investment) | Inventory Turnover |

|---|---|---|

| Definition | Measures profit return on inventory investment (Gross Margin / Average Inventory Cost) | Measures how often inventory is sold and replaced in a period (Cost of Goods Sold / Average Inventory) |

| Purpose | Assesses profitability and efficiency of inventory investment | Evaluates inventory management efficiency and sales velocity |

| Key Focus | Profitability per dollar spent on inventory | Frequency of inventory turnover in time period |

| Formula | GMROI = Gross Margin / Average Inventory Cost | Inventory Turnover = Cost of Goods Sold / Average Inventory |

| Optimization Goal | Maximize gross margin returns on investment | Increase turnover rate without stockouts |

| Use Case | Retail pricing strategy and buying decisions | Inventory replenishment and stock management |

| Industry Impact | Enhances profitability per inventory dollar | Improves cash flow and reduces holding costs |

Understanding GMROI: Definition and Importance

GMROI (Gross Margin Return on Investment) measures the profit earned on inventory investment, essential for evaluating retail profitability. Inventory turnover indicates how often stock is sold and replaced during a period, reflecting inventory efficiency. Understanding GMROI provides deeper insights into product margin performance combined with turnover rates, guiding optimized inventory management and maximizing retail revenue.

What is Inventory Turnover? Key Concepts Explained

Inventory Turnover measures how often a retailer sells and replaces its stock within a specific period, indicating the efficiency of inventory management and sales performance. It is calculated by dividing the Cost of Goods Sold (COGS) by the average inventory value, providing insights into product demand and inventory liquidity. A higher Inventory Turnover ratio typically signals strong sales and effective stock control, crucial for optimizing cash flow and minimizing holding costs in retail operations.

GMROI vs Inventory Turnover: Core Differences

GMROI (Gross Margin Return on Investment) measures the profit generated for every dollar invested in inventory, highlighting profitability efficiency, whereas Inventory Turnover evaluates how frequently inventory is sold and replaced within a specific period, emphasizing sales velocity and stock management. GMROI integrates gross margin data, providing insights into both sales performance and profit margins, while Inventory Turnover focuses solely on the rate of inventory movement without considering profitability. Retailers use GMROI to assess the financial effectiveness of their inventory investments, whereas Inventory Turnover guides decisions around stock levels and replenishment frequency.

How GMROI Impacts Retail Profitability

GMROI (Gross Margin Return on Investment) measures the profit generated per dollar invested in inventory, directly reflecting how effectively a retailer turns stock into gross margin. Higher GMROI indicates efficient inventory management and pricing strategies that boost profitability without merely increasing turnover rates. Retailers optimizing GMROI can achieve better financial performance by prioritizing high-margin products and balancing inventory levels to maximize return on invested capital.

The Role of Inventory Turnover in Retail Efficiency

Inventory turnover is a critical metric in retail efficiency, measuring how quickly stock is sold and replaced within a given period. A higher inventory turnover indicates effective demand forecasting and reduced holding costs, directly impacting cash flow and profitability. Unlike GMROI, which assesses profit relative to inventory investment, inventory turnover emphasizes operational agility and the ability to minimize obsolete stock.

Calculating GMROI and Inventory Turnover: Step-by-Step Guide

Calculating GMROI involves dividing gross margin by average inventory cost, providing insight into profit earned per dollar of inventory. Inventory turnover is calculated by dividing the cost of goods sold (COGS) by average inventory, indicating how often inventory is sold and replaced over a period. Both metrics help retailers optimize inventory management by balancing profitability and stock efficiency.

Interpreting Results: Which Metric Matters Most?

GMROI measures profitability by evaluating gross margin return on inventory investment, while Inventory Turnover assesses how quickly stock is sold within a period. High GMROI indicates strong profit per unit of inventory, essential for margin-focused retailers, whereas high Inventory Turnover signals operational efficiency and cash flow management, critical for high-volume businesses. The choice depends on retail strategy: margin-driven retailers prioritize GMROI, and volume-driven retailers emphasize Inventory Turnover for optimal inventory performance.

Common Pitfalls in Relying on a Single Metric

Relying solely on GMROI can mask inventory inefficiencies, while focusing only on inventory turnover might ignore profitability per item. Both metrics present partial views: high turnover with low GMROI indicates fast sales but poor margins, whereas high GMROI with low turnover may signal overstocked, slow-moving products. Balanced analysis using GMROI and inventory turnover together prevents misinformed decisions that can lead to lost revenue or excess stock.

Strategies to Optimize Both GMROI and Inventory Turnover

Balancing GMROI and inventory turnover requires strategic assortment planning and dynamic pricing models that maximize profitability per unit while accelerating stock movement. Retailers should leverage data analytics to forecast demand accurately, minimizing overstock and markdowns, and implement vendor-managed inventory programs to enhance replenishment efficiency. Integrating cross-functional collaboration between merchandising, supply chain, and sales teams ensures optimized product flow that enhances overall financial performance.

Choosing the Right Metric for Your Retail Business

GMROI (Gross Margin Return on Investment) measures the profitability of inventory by evaluating how much gross profit is earned for every dollar invested, helping retailers prioritize high-margin products. Inventory Turnover indicates how quickly stock is sold and replenished, providing insights into product demand and inventory efficiency. Selecting the right metric depends on whether your retail business prioritizes profit maximization or operational efficiency to align inventory strategies with financial goals.

GMROI vs Inventory Turnover Infographic

difterm.com

difterm.com