Chargeback fees are penalties retailers impose on suppliers for billing discrepancies or delivery issues, directly reducing the supplier's revenue. Markdown allowances are pre-negotiated discounts suppliers provide to support retailers in promoting products and clearing inventory, helping to maintain product competitiveness. Understanding the distinction between these tactics is essential for managing financial impacts and negotiating better terms in retail pet supply agreements.

Table of Comparison

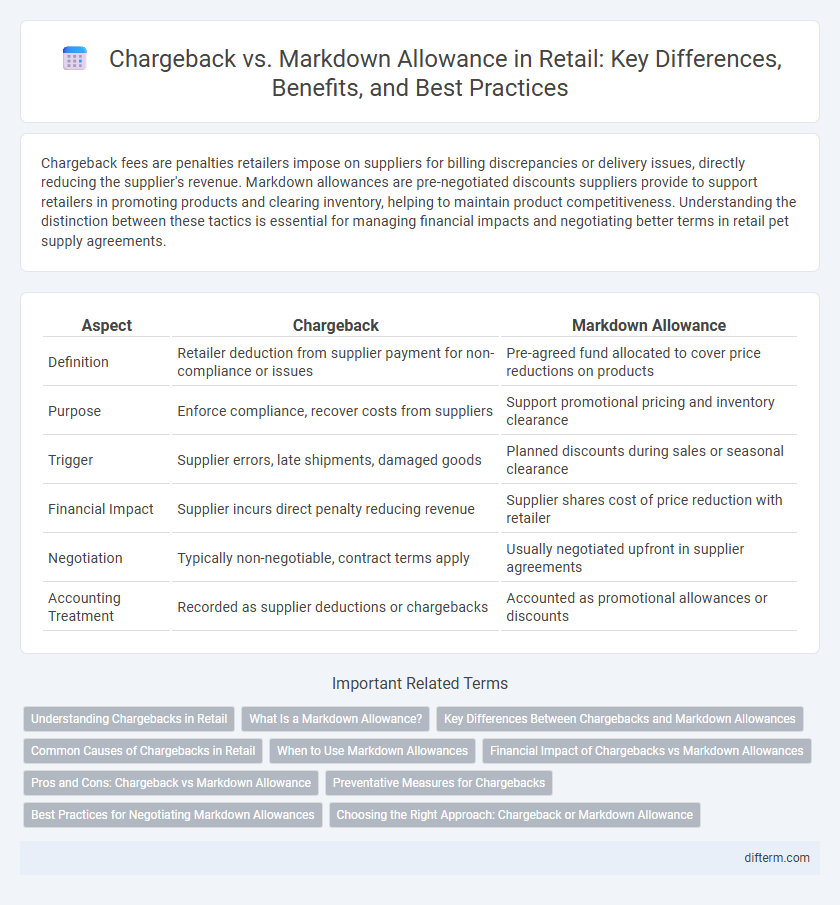

| Aspect | Chargeback | Markdown Allowance |

|---|---|---|

| Definition | Retailer deduction from supplier payment for non-compliance or issues | Pre-agreed fund allocated to cover price reductions on products |

| Purpose | Enforce compliance, recover costs from suppliers | Support promotional pricing and inventory clearance |

| Trigger | Supplier errors, late shipments, damaged goods | Planned discounts during sales or seasonal clearance |

| Financial Impact | Supplier incurs direct penalty reducing revenue | Supplier shares cost of price reduction with retailer |

| Negotiation | Typically non-negotiable, contract terms apply | Usually negotiated upfront in supplier agreements |

| Accounting Treatment | Recorded as supplier deductions or chargebacks | Accounted as promotional allowances or discounts |

Understanding Chargebacks in Retail

Chargebacks in retail are financial penalties imposed on suppliers when goods fail to meet agreed-upon terms, such as late delivery or incorrect shipments, directly impacting supplier revenue. These chargebacks incentivize compliance with contract standards and help retailers manage costs related to operational inefficiencies. Understanding the precise causes and documentation requirements of chargebacks is essential for suppliers to minimize financial losses and maintain strong retailer relationships.

What Is a Markdown Allowance?

A markdown allowance is a retailer's financial agreement with suppliers to cover price reductions on products, helping to manage inventory and stimulate sales. This allowance offsets losses from discounted items by providing suppliers a rebate or credit for markdown costs. Unlike chargebacks, which are penalties for non-compliance or operational issues, markdown allowances are proactive strategies to support promotional pricing and inventory clearance.

Key Differences Between Chargebacks and Markdown Allowances

Chargebacks are retailer-imposed fees on suppliers for non-compliance or product issues, whereas markdown allowances are financial agreements where suppliers fund price reductions to boost product sales. Chargebacks typically address operational errors or contractual breaches, impacting supplier margins directly, while markdown allowances support inventory management and promotional strategies. Understanding these distinctions helps retailers optimize supplier relations and manage cost recoveries effectively.

Common Causes of Chargebacks in Retail

Common causes of chargebacks in retail include billing errors, product returns without proper authorization, and discrepancies between shipped and invoiced items. Retailers often face chargebacks due to late shipments, incorrect pricing, and insufficient documentation supporting the transaction. Effective management of markdown allowances can help reduce chargeback occurrences by clearly defining price adjustments and promotional agreements with suppliers.

When to Use Markdown Allowances

Markdown allowances should be used when retailers need to strategically reduce prices to clear out excess or seasonal inventory, improve cash flow, and attract price-sensitive customers. This approach helps in managing stock levels without impacting vendor relationships, as markdown allowances are pre-negotiated discounts granted by suppliers to support promotional price cuts. Implementing markdown allowances is ideal during planned sales events or when inventory aging threatens profitability, allowing retailers to maintain margin integrity while driving turnover.

Financial Impact of Chargebacks vs Markdown Allowances

Chargebacks directly reduce retailer revenue by reclaiming funds from suppliers for non-compliant shipments, resulting in immediate financial losses. Markdown allowances enable retailers to discount products to accelerate sales, impacting gross margins but potentially increasing inventory turnover. Understanding the balance between chargebacks and markdown allowances is crucial for optimizing overall profit margins and cash flow in retail operations.

Pros and Cons: Chargeback vs Markdown Allowance

Chargebacks in retail often serve as a direct financial penalty for suppliers failing to meet contract terms, providing clear accountability but potentially straining retailer-supplier relationships. Markdown allowances offer retailers flexibility to reduce prices and stimulate sales while allowing suppliers to share the cost of discounts, though they can complicate inventory management and impact profit margins. Choosing between chargebacks and markdown allowances requires balancing enforcement and collaboration to optimize revenue and maintain supplier partnerships.

Preventative Measures for Chargebacks

Implementing robust transaction verification systems and clear return policies significantly reduces chargebacks in retail, safeguarding merchant revenue. Utilizing real-time fraud detection tools and educating staff on identifying suspicious activities help prevent unauthorized transactions. Leveraging detailed sales data to optimize markdown allowances minimizes excessive discounting while maintaining customer satisfaction.

Best Practices for Negotiating Markdown Allowances

Negotiating markdown allowances effectively requires clear communication of sales data and inventory turnover rates to demonstrate the necessity of discounts for moving slow-selling items. Retailers should leverage historical sales performance and competitor pricing analysis to justify markdown requests, ensuring mutual benefit and minimized chargeback risks. Building transparent agreements with suppliers on markdown thresholds and timing helps streamline chargeback management and supports more accurate financial forecasting.

Choosing the Right Approach: Chargeback or Markdown Allowance

Chargeback and markdown allowance are critical strategies in retail inventory management, each affecting profitability and supplier relationships differently. Chargebacks directly recover costs from suppliers for non-compliance or promotional failures, enabling retailers to maintain pricing integrity, while markdown allowances provide financial support for inventory clearance, enhancing sales velocity without penalizing suppliers. Choosing the right approach depends on factors like product lifecycle, supplier agreements, and inventory turnover rates to optimize cost control and maintain collaborative partnerships.

Chargeback vs Markdown Allowance Infographic

difterm.com

difterm.com