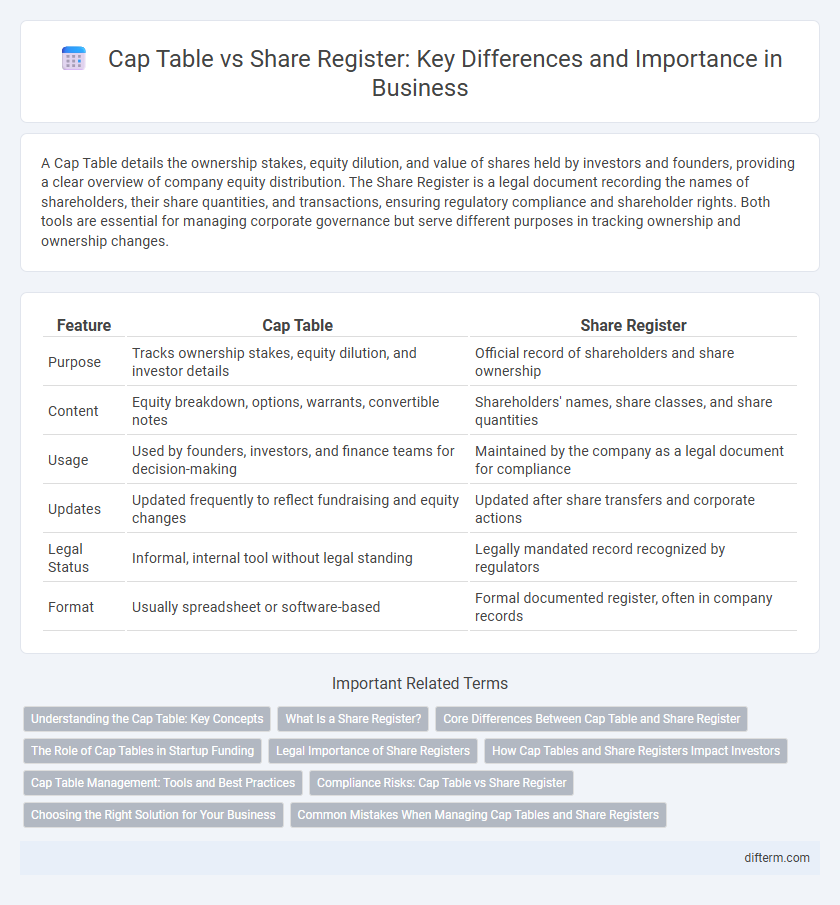

A Cap Table details the ownership stakes, equity dilution, and value of shares held by investors and founders, providing a clear overview of company equity distribution. The Share Register is a legal document recording the names of shareholders, their share quantities, and transactions, ensuring regulatory compliance and shareholder rights. Both tools are essential for managing corporate governance but serve different purposes in tracking ownership and ownership changes.

Table of Comparison

| Feature | Cap Table | Share Register |

|---|---|---|

| Purpose | Tracks ownership stakes, equity dilution, and investor details | Official record of shareholders and share ownership |

| Content | Equity breakdown, options, warrants, convertible notes | Shareholders' names, share classes, and share quantities |

| Usage | Used by founders, investors, and finance teams for decision-making | Maintained by the company as a legal document for compliance |

| Updates | Updated frequently to reflect fundraising and equity changes | Updated after share transfers and corporate actions |

| Legal Status | Informal, internal tool without legal standing | Legally mandated record recognized by regulators |

| Format | Usually spreadsheet or software-based | Formal documented register, often in company records |

Understanding the Cap Table: Key Concepts

A capitalization table (Cap Table) outlines the ownership stakes, equity dilution, and value of equity in a business, providing detailed insights into shareholders, types of shares, and the percentage of ownership. It is a dynamic document used by startups and investors to track funding rounds, option pools, and convertible securities, offering a comprehensive view of control and financial interest. Unlike a share register, which is a legal record of shareholders for compliance, the Cap Table serves as a strategic tool for decision-making and equity management.

What Is a Share Register?

A share register is a legal document or electronic record that details the ownership of a company's shares, including shareholder names, contact information, and share quantities. Unlike a cap table that provides a broader overview of equity distribution and financial instruments, the share register serves as the official record required by corporate law for shareholder identification and dividend payments. Maintaining an accurate share register is crucial for compliance, shareholder communication, and corporate governance transparency.

Core Differences Between Cap Table and Share Register

Cap Table provides a detailed breakdown of ownership stakes, including types of shares and options, reflecting the equity distribution among founders, investors, and employees, which is crucial for fundraising and valuation analysis. The Share Register is the official legal document listing registered shareholders and their shareholdings, ensuring compliance with corporate governance and regulatory requirements. While a Cap Table is primarily used for strategic management decisions and equity planning, the Share Register serves as the authoritative record for legal ownership and shareholder rights.

The Role of Cap Tables in Startup Funding

Cap tables provide a detailed breakdown of ownership stakes, including shareholders, types of shares, and dilution impact, which is crucial for startup funding decisions. They enable investors to evaluate equity distribution and potential returns, helping founders manage fundraising rounds strategically. Accurate cap tables simplify negotiations and ensure transparency during investment processes, directly affecting startup valuation and capital structure.

Legal Importance of Share Registers

The share register serves as the legally recognized document detailing the ownership of a company's shares, essential for verifying shareholder rights and facilitating compliance with corporate governance laws. Unlike the cap table, which provides a comprehensive overview of equity distribution primarily for internal management and investor relations, the share register has statutory significance in legal disputes and regulatory reporting. Maintaining an accurate and up-to-date share register is critical to ensuring transparency and protecting shareholder interests under corporate law.

How Cap Tables and Share Registers Impact Investors

Cap tables provide investors with a clear breakdown of company ownership percentages, equity dilution, and share classes, crucial for assessing investment value and control. Share registers offer precise legal documentation of shareholders and their shareholdings, ensuring transparency and compliance with regulatory requirements. Together, these tools enable investors to make informed decisions by verifying ownership structure and tracking changes over time.

Cap Table Management: Tools and Best Practices

Cap table management tools streamline equity tracking by consolidating shareholder information, ownership percentages, and dilution effects in real time, enhancing transparency for stakeholders. Best practices include regular updates, integration with legal and financial systems, and automated scenario modeling to support fundraising and compliance. Utilizing cloud-based platforms with role-based access controls ensures data accuracy, security, and strategic decision-making in equity management.

Compliance Risks: Cap Table vs Share Register

Cap tables provide a detailed overview of ownership percentages and equity dilution but may lack the formal compliance rigor required for legal record-keeping, unlike share registers mandated by corporate law which ensure accurate tracking of share ownership and transfers. Inaccuracies or discrepancies between cap tables and share registers can lead to significant compliance risks, including shareholder disputes, regulatory penalties, and challenges during audits or fundraising rounds. Maintaining synchronization between both documents is critical for legal compliance, transparent governance, and preventing potential violations of securities regulations.

Choosing the Right Solution for Your Business

A cap table provides a detailed breakdown of ownership percentages, equity dilution, and investor stakes, making it essential for startups managing fundraising and stock options. In contrast, a share register acts as the official legal record of shareholders, crucial for compliance and corporate governance. Selecting the right solution depends on your business's stage and needs: use cap tables for strategic equity management and share registers to maintain accurate, legally binding shareholder records.

Common Mistakes When Managing Cap Tables and Share Registers

Common mistakes when managing cap tables and share registers include inaccurate record-keeping, failure to update ownership changes promptly, and confusion between authorized shares and issued shares. These errors can lead to legal complications, misrepresentation of ownership percentages, and challenges in investor relations. Properly maintaining these documents with software solutions or legal counsel ensures clarity and compliance.

Cap Table vs Share Register Infographic

difterm.com

difterm.com