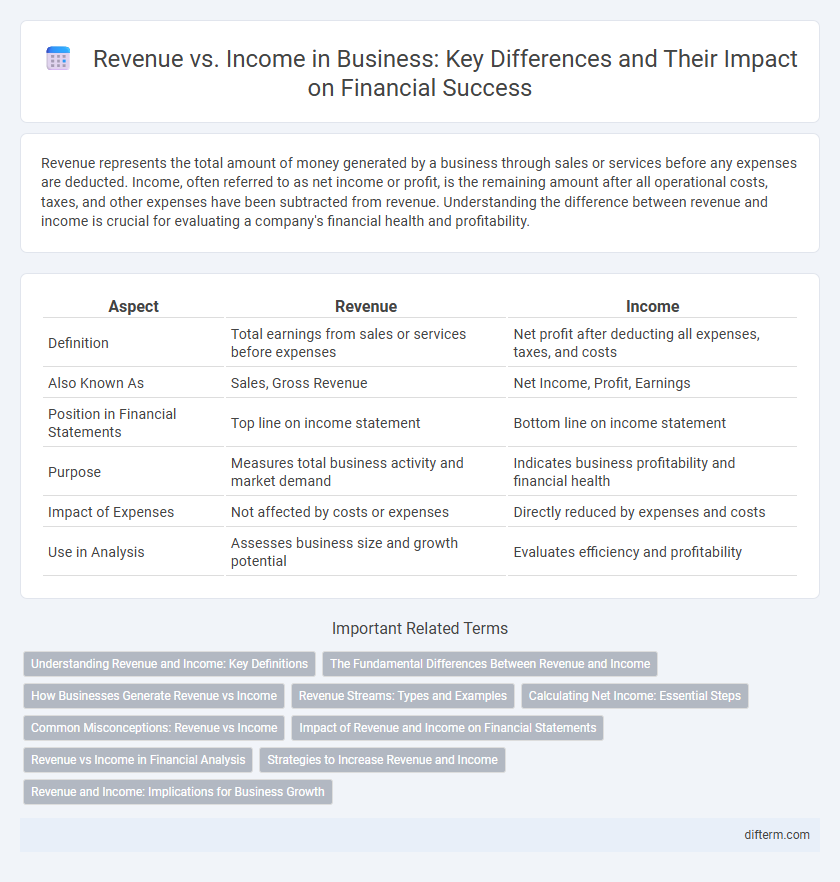

Revenue represents the total amount of money generated by a business through sales or services before any expenses are deducted. Income, often referred to as net income or profit, is the remaining amount after all operational costs, taxes, and other expenses have been subtracted from revenue. Understanding the difference between revenue and income is crucial for evaluating a company's financial health and profitability.

Table of Comparison

| Aspect | Revenue | Income |

|---|---|---|

| Definition | Total earnings from sales or services before expenses | Net profit after deducting all expenses, taxes, and costs |

| Also Known As | Sales, Gross Revenue | Net Income, Profit, Earnings |

| Position in Financial Statements | Top line on income statement | Bottom line on income statement |

| Purpose | Measures total business activity and market demand | Indicates business profitability and financial health |

| Impact of Expenses | Not affected by costs or expenses | Directly reduced by expenses and costs |

| Use in Analysis | Assesses business size and growth potential | Evaluates efficiency and profitability |

Understanding Revenue and Income: Key Definitions

Revenue represents the total amount of money generated from sales or services before any expenses are deducted, serving as a crucial indicator of business activity. Income, often called net income or profit, is the remaining amount after subtracting all costs, taxes, and expenses from revenue, reflecting the company's true profitability. Understanding the distinction between revenue and income is essential for accurate financial analysis and effective business decision-making.

The Fundamental Differences Between Revenue and Income

Revenue represents the total amount of money generated from sales or services before any expenses are deducted, serving as a top-line indicator of business performance. Income, specifically net income, reflects the profit remaining after all operating costs, taxes, and expenses have been subtracted from revenue, indicating the company's profitability. Understanding the fundamental differences between revenue and income is crucial for accurate financial analysis and strategic decision-making in business management.

How Businesses Generate Revenue vs Income

Businesses generate revenue by selling products or services to customers, which represents the total amount earned before any expenses are deducted. Income, often referred to as net income or profit, is the remaining amount after all operational costs, taxes, and expenses are subtracted from the revenue. Understanding the distinction between revenue and income is crucial for assessing a company's financial health and operational efficiency.

Revenue Streams: Types and Examples

Revenue streams represent the various sources a business generates income, including product sales, subscription fees, licensing, advertising, and service fees. Diverse revenue streams such as recurring subscriptions, dynamic pricing models, and affiliate marketing enhance financial stability and market reach. Understanding specific examples like e-commerce sales, SaaS subscriptions, and ad placements allows businesses to optimize revenue generation and strategic growth.

Calculating Net Income: Essential Steps

Calculating net income involves subtracting total expenses, including operating costs, taxes, interest, and depreciation, from total revenue generated during a specific period. Accurate evaluation of gross profit and operating expenses is crucial to determine the precise net income figure. This financial metric reflects a company's profitability after all costs have been accounted for and is vital for assessing overall business performance.

Common Misconceptions: Revenue vs Income

Revenue is the total amount of money generated from sales before any expenses are deducted, while income represents the net profit remaining after all costs, taxes, and expenses are subtracted. A common misconception is that revenue and income are interchangeable, which can mislead assessments of a company's financial health. Understanding that revenue measures gross inflow and income reflects profitability is crucial for accurate business analysis and decision-making.

Impact of Revenue and Income on Financial Statements

Revenue represents the total earnings generated from core business activities, directly influencing the top line of the income statement and providing insight into market demand and operational scale. Income, often referring to net income or profit, reflects the company's profitability after deducting expenses, taxes, and costs, impacting retained earnings and shareholder equity on the balance sheet. Together, revenue and income shape financial analysis, cash flow projections, and strategic decision-making by illustrating overall financial health and operational efficiency.

Revenue vs Income in Financial Analysis

Revenue represents the total sales generated by a business before deducting any expenses, serving as a key indicator of market demand and operational scale. Income, often referred to as net income or profit, is derived after subtracting all costs, taxes, and expenses from revenue, offering a clear measure of a company's profitability and financial health. Financial analysis leverages both revenue and income metrics to assess efficiency, cost management, and overall business performance, enabling more informed strategic decisions.

Strategies to Increase Revenue and Income

Implementing targeted marketing campaigns and diversifying product lines drive revenue growth by attracting new customers and expanding market reach. Optimizing operational efficiency and managing costs effectively increase net income, ensuring profitability improves alongside higher sales. Leveraging data analytics to identify high-margin opportunities and customer preferences enhances both revenue streams and after-tax income.

Revenue and Income: Implications for Business Growth

Revenue represents the total amount of money generated from sales before any expenses are deducted, serving as a key indicator of market demand and business scale. Income, often referred to as net profit, reflects the remaining earnings after all costs, taxes, and expenses have been subtracted, providing insight into operational efficiency and profitability. Understanding the distinction between revenue and income is crucial for strategic decision-making as high revenue with low income may signal the need for cost management to sustain business growth.

Revenue vs Income Infographic

difterm.com

difterm.com