Contribution margin represents the revenue remaining after variable costs are deducted, highlighting the profitability of individual products or services, whereas gross profit is the revenue left after subtracting the cost of goods sold, encompassing both fixed and variable costs directly tied to production. Understanding contribution margin helps businesses make informed decisions about pricing, product lines, and cost control, while gross profit provides insight into overall production efficiency. Both metrics are crucial for evaluating financial health but serve distinct purposes in cost analysis and strategic planning.

Table of Comparison

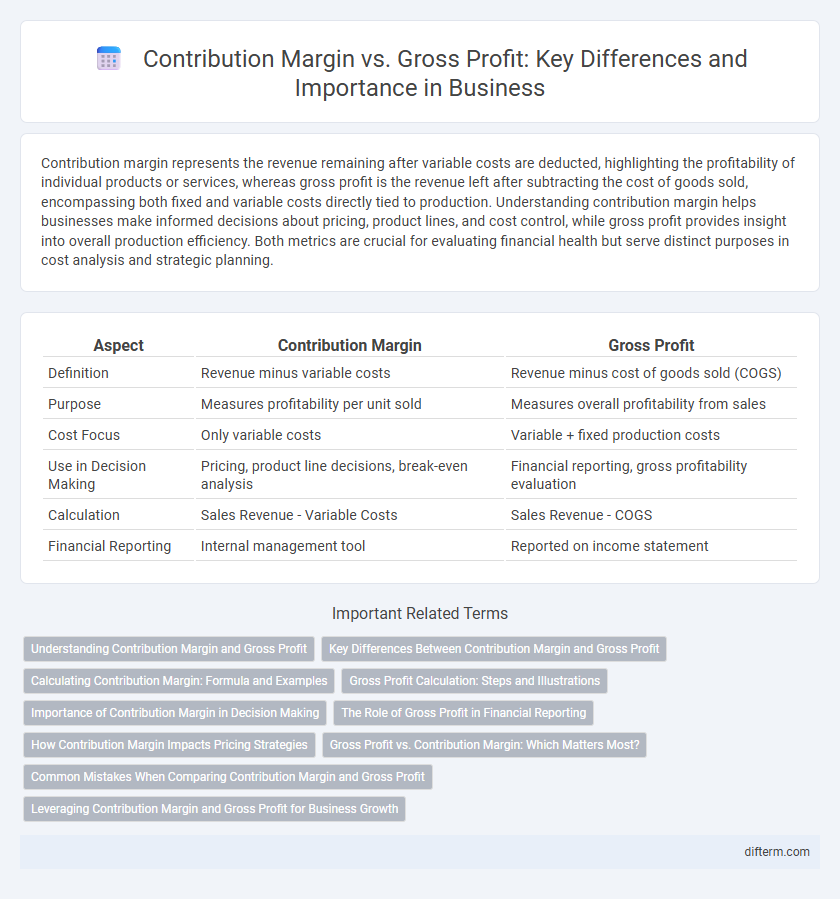

| Aspect | Contribution Margin | Gross Profit |

|---|---|---|

| Definition | Revenue minus variable costs | Revenue minus cost of goods sold (COGS) |

| Purpose | Measures profitability per unit sold | Measures overall profitability from sales |

| Cost Focus | Only variable costs | Variable + fixed production costs |

| Use in Decision Making | Pricing, product line decisions, break-even analysis | Financial reporting, gross profitability evaluation |

| Calculation | Sales Revenue - Variable Costs | Sales Revenue - COGS |

| Financial Reporting | Internal management tool | Reported on income statement |

Understanding Contribution Margin and Gross Profit

Contribution margin represents the revenue remaining after deducting variable costs, which directly contributes to covering fixed expenses and generating profit. Gross profit is calculated by subtracting the cost of goods sold (COGS) from total sales, reflecting the overall profitability of production before accounting for operating expenses. Analyzing both contribution margin and gross profit helps businesses optimize pricing, cost control, and financial decision-making.

Key Differences Between Contribution Margin and Gross Profit

Contribution margin represents the revenue remaining after variable costs are deducted, highlighting the amount available to cover fixed costs and generate profit, whereas gross profit subtracts only the cost of goods sold from total revenue, reflecting overall production efficiency. Key differences include contribution margin focusing on variable costs and operational decision-making, while gross profit provides insight into production profitability without accounting for fixed expenses. Understanding these distinctions enables businesses to better manage cost behavior and pricing strategies.

Calculating Contribution Margin: Formula and Examples

Contribution margin is calculated by subtracting variable costs from total sales revenue, expressed as Contribution Margin = Sales Revenue - Variable Costs. This metric helps determine how much revenue contributes to fixed costs and profit after covering variable expenses. For example, if a company has sales of $100,000 and variable costs of $60,000, the contribution margin is $40,000, which guides pricing and production decisions.

Gross Profit Calculation: Steps and Illustrations

Gross profit calculation begins by subtracting the cost of goods sold (COGS) from total sales revenue, highlighting the profitability from core business activities before operating expenses. Accurate identification of direct costs such as materials and labor is essential to determine COGS and calculate gross profit effectively. Illustrations often show gross profit margins as a percentage of sales, providing key insights into production efficiency and pricing strategy.

Importance of Contribution Margin in Decision Making

Contribution margin plays a crucial role in business decision making by highlighting the profitability of individual products or services after variable costs are deducted, enabling managers to identify which offerings contribute most to covering fixed costs and generating profit. Unlike gross profit, which accounts for total sales revenue minus the cost of goods sold, contribution margin focuses specifically on variable costs, providing clearer insights for pricing, product mix, and cost control decisions. Understanding contribution margin helps optimize resource allocation and supports strategic planning to maximize overall business profitability.

The Role of Gross Profit in Financial Reporting

Gross profit plays a critical role in financial reporting by reflecting the total revenue remaining after deducting the cost of goods sold (COGS), providing insight into a company's core profitability. It serves as a key indicator for investors and stakeholders to assess operational efficiency and pricing strategies. Unlike contribution margin, which isolates variable costs, gross profit encompasses all direct production costs, making it essential for comprehensive performance analysis on financial statements.

How Contribution Margin Impacts Pricing Strategies

Contribution margin directly affects pricing strategies by revealing the incremental profit generated by each unit sold, guiding businesses to set prices that cover variable costs and contribute to fixed expenses. Understanding contribution margin helps firms identify the minimum price point to avoid losses and optimize profit margins. Pricing decisions based on contribution margin analysis enable companies to strategically balance competitiveness and profitability in dynamic markets.

Gross Profit vs. Contribution Margin: Which Matters Most?

Gross profit represents total revenue minus the cost of goods sold, reflecting overall profitability before operating expenses, while contribution margin isolates the amount available to cover fixed costs and generate profit by subtracting variable costs from sales revenue. Business decision-making relies heavily on contribution margin to assess product-line viability and optimize pricing strategies, yet gross profit remains essential for evaluating overall financial health. Understanding which metric matters most depends on context: contribution margin drives operational efficiency and break-even analysis, whereas gross profit informs broader profitability assessments.

Common Mistakes When Comparing Contribution Margin and Gross Profit

Confusing contribution margin with gross profit often leads to misinterpretation of cost structures, as contribution margin excludes fixed costs while gross profit includes only variable costs and cost of goods sold. Neglecting the different purposes of these metrics results in flawed pricing and profitability decisions, since contribution margin highlights the incremental profit per unit. Many businesses mistakenly compare these figures directly without adjusting for overhead allocation, causing inaccuracies in break-even analysis and operational strategy.

Leveraging Contribution Margin and Gross Profit for Business Growth

Contribution margin and gross profit are essential financial metrics that businesses leverage to optimize pricing strategies and cost management for sustained growth. Contribution margin highlights the profitability of individual products by deducting variable costs, enabling targeted decision-making that enhances operational efficiency. Gross profit provides a broader view of overall profitability by subtracting the cost of goods sold from total revenue, supporting strategic investments and resource allocation to scale the business effectively.

Contribution Margin vs Gross Profit Infographic

difterm.com

difterm.com