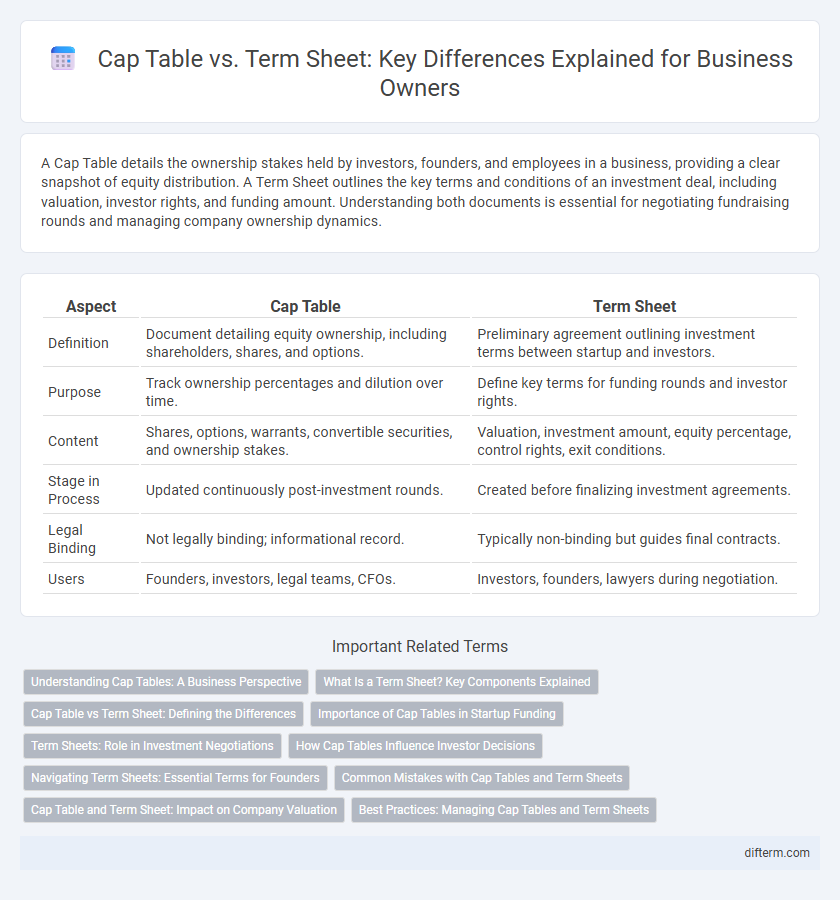

A Cap Table details the ownership stakes held by investors, founders, and employees in a business, providing a clear snapshot of equity distribution. A Term Sheet outlines the key terms and conditions of an investment deal, including valuation, investor rights, and funding amount. Understanding both documents is essential for negotiating fundraising rounds and managing company ownership dynamics.

Table of Comparison

| Aspect | Cap Table | Term Sheet |

|---|---|---|

| Definition | Document detailing equity ownership, including shareholders, shares, and options. | Preliminary agreement outlining investment terms between startup and investors. |

| Purpose | Track ownership percentages and dilution over time. | Define key terms for funding rounds and investor rights. |

| Content | Shares, options, warrants, convertible securities, and ownership stakes. | Valuation, investment amount, equity percentage, control rights, exit conditions. |

| Stage in Process | Updated continuously post-investment rounds. | Created before finalizing investment agreements. |

| Legal Binding | Not legally binding; informational record. | Typically non-binding but guides final contracts. |

| Users | Founders, investors, legal teams, CFOs. | Investors, founders, lawyers during negotiation. |

Understanding Cap Tables: A Business Perspective

A cap table, or capitalization table, provides a detailed breakdown of a company's ownership stakes, equity dilution, and value percentages among shareholders, essential for business decision-making and funding rounds. Unlike a term sheet that outlines the initial terms and conditions of an investment, the cap table offers a dynamic snapshot of equity distribution and investor influence. Understanding cap tables enables businesses to manage shareholder equity transparently and assess the impact of new investments on ownership structure effectively.

What Is a Term Sheet? Key Components Explained

A term sheet outlines the key terms and conditions of a proposed investment deal between a startup and investors, serving as a non-binding agreement that guides the negotiation process. Essential components include valuation, investment amount, equity ownership, liquidation preferences, board composition, voting rights, and investor protections. Understanding these critical elements helps founders and investors align expectations before finalizing definitive agreements and impacting the company's capitalization table (cap table).

Cap Table vs Term Sheet: Defining the Differences

A Cap Table (Capitalization Table) details the ownership structure of a company, listing all equity holders and their percentage of ownership, while a Term Sheet outlines the key terms and conditions of an investment deal between investors and the company. The Cap Table provides a snapshot of current ownership and dilution impact from financing rounds, whereas the Term Sheet serves as a non-binding agreement that guides the negotiation of definitive investment documents. Understanding the differences between a Cap Table and a Term Sheet is crucial for founders and investors to manage equity distribution and investment terms effectively.

Importance of Cap Tables in Startup Funding

Cap tables provide a detailed record of a startup's ownership structure, including equity stakes, option pools, and convertible securities, which is crucial for aligning investor expectations and facilitating transparent negotiations. Unlike term sheets that outline the proposed deal terms, cap tables offer a dynamic snapshot of ownership changes over time, enabling founders and investors to track dilution and valuation impact during funding rounds. Accurate cap tables ensure clarity in investment distributions, protect stakeholder interests, and streamline due diligence processes in startup financing.

Term Sheets: Role in Investment Negotiations

Term sheets serve as critical frameworks in investment negotiations, outlining key terms such as valuation, equity stakes, and investor rights to align expectations between startups and investors. They establish the foundational agreements that guide due diligence and final contract drafting, reducing potential misunderstandings and legal risks. Clear term sheets accelerate investment processes by providing a mutually accepted blueprint for deal structure and governance.

How Cap Tables Influence Investor Decisions

Cap tables provide a detailed breakdown of ownership percentages, equity dilution, and option pools, enabling investors to assess the startup's valuation and investment risk accurately. They reveal how funding rounds impact shareholder control and potential returns, directly influencing investor confidence and negotiation terms. Clear, well-structured cap tables facilitate transparent decision-making, making startups more attractive to venture capitalists and angel investors.

Navigating Term Sheets: Essential Terms for Founders

Navigating term sheets requires founders to understand critical elements such as valuation, equity dilution, liquidation preferences, and control rights that directly impact the cap table. Founders must assess how terms like anti-dilution clauses and option pools influence ownership percentages and future fundraising rounds. Precise negotiation of these terms ensures alignment between cap table structure and long-term business goals.

Common Mistakes with Cap Tables and Term Sheets

Common mistakes with cap tables often include inaccurate shareholder information, failure to update after financing rounds, and neglecting to reflect option pool adjustments, leading to misrepresentation of ownership stakes. Term sheet errors frequently involve ambiguous valuation terms, unclear liquidation preferences, and overlooked conditions that affect investor rights and future funding rounds. Ensuring precise cap table management and thorough term sheet review minimizes risks of dilution confusion and contractual disputes.

Cap Table and Term Sheet: Impact on Company Valuation

Cap tables provide a detailed breakdown of company ownership, equity dilution, and potential investor returns, directly influencing valuation by clarifying ownership stakes and control rights. Term sheets outline the key investment terms, including valuation metrics, preferred stock rights, and liquidation preferences, which can significantly affect investor perception and company worth. Understanding the interplay between cap tables and term sheets is crucial for accurate company valuation and strategic financing decisions.

Best Practices: Managing Cap Tables and Term Sheets

Effective management of cap tables and term sheets requires accurate record-keeping and regular updates to reflect equity ownership, option pools, and investment terms. Utilize specialized software tools for real-time tracking and ensure clear communication among founders, investors, and legal advisors to prevent misunderstandings. Establish standardized workflows for reviewing and approving changes to maintain transparency and compliance throughout fundraising and growth phases.

Cap Table vs Term Sheet Infographic

difterm.com

difterm.com