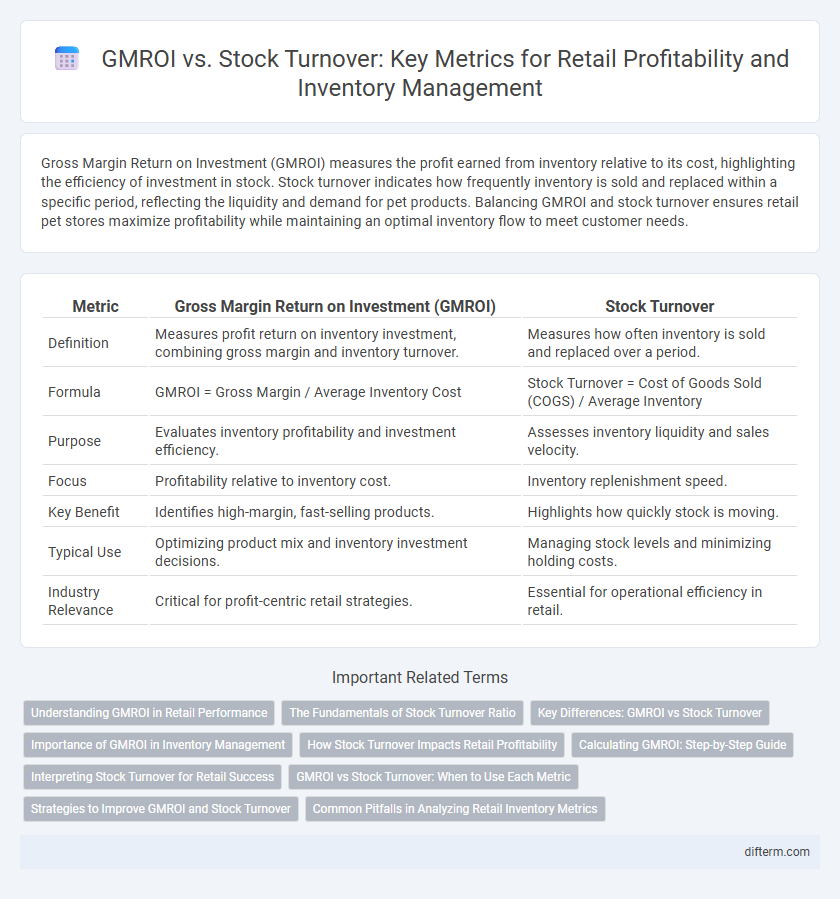

Gross Margin Return on Investment (GMROI) measures the profit earned from inventory relative to its cost, highlighting the efficiency of investment in stock. Stock turnover indicates how frequently inventory is sold and replaced within a specific period, reflecting the liquidity and demand for pet products. Balancing GMROI and stock turnover ensures retail pet stores maximize profitability while maintaining an optimal inventory flow to meet customer needs.

Table of Comparison

| Metric | Gross Margin Return on Investment (GMROI) | Stock Turnover |

|---|---|---|

| Definition | Measures profit return on inventory investment, combining gross margin and inventory turnover. | Measures how often inventory is sold and replaced over a period. |

| Formula | GMROI = Gross Margin / Average Inventory Cost | Stock Turnover = Cost of Goods Sold (COGS) / Average Inventory |

| Purpose | Evaluates inventory profitability and investment efficiency. | Assesses inventory liquidity and sales velocity. |

| Focus | Profitability relative to inventory cost. | Inventory replenishment speed. |

| Key Benefit | Identifies high-margin, fast-selling products. | Highlights how quickly stock is moving. |

| Typical Use | Optimizing product mix and inventory investment decisions. | Managing stock levels and minimizing holding costs. |

| Industry Relevance | Critical for profit-centric retail strategies. | Essential for operational efficiency in retail. |

Understanding GMROI in Retail Performance

Gross Margin Return on Investment (GMROI) measures the profitability of inventory investments by comparing gross margin to average inventory cost, offering insight into how efficiently stock generates profit. Stock Turnover calculates the frequency at which inventory is sold and replaced over a period, highlighting inventory liquidity and demand responsiveness. Understanding GMROI in retail performance enables retailers to balance profitability and inventory efficiency, optimizing product assortment and pricing strategies for maximum financial returns.

The Fundamentals of Stock Turnover Ratio

Stock turnover ratio measures how efficiently a retailer sells inventory within a specific period, calculated by dividing the cost of goods sold (COGS) by average inventory value. A higher stock turnover ratio indicates strong sales performance and effective inventory management, directly impacting cash flow and profitability. Understanding stock turnover helps retailers optimize stock levels, reduce holding costs, and improve overall Gross Margin Return on Investment (GMROI).

Key Differences: GMROI vs Stock Turnover

Gross Margin Return on Investment (GMROI) measures the profitability of inventory by calculating the gross margin earned for every dollar invested in stock, emphasizing financial return efficiency. Stock Turnover quantifies how frequently inventory is sold and replaced over a period, highlighting inventory movement and demand velocity. While GMROI focuses on profit relative to stock investment, Stock Turnover centers on the rate of inventory utilization, making both metrics critical yet distinct for optimizing retail performance.

Importance of GMROI in Inventory Management

GMROI measures the profitability of inventory by indicating how much gross profit is earned for every dollar invested in stock, making it crucial for effective inventory management. Stock turnover tracks how often inventory is sold and replaced over a period but does not account for profit margins, limiting its insight into true inventory performance. Prioritizing GMROI helps retailers optimize both profitability and inventory investment efficiency by balancing sales velocity with gross margin contribution.

How Stock Turnover Impacts Retail Profitability

Stock Turnover directly affects retail profitability by indicating how quickly inventory is sold and replaced, influencing cash flow and storage costs. Higher stock turnover reduces holding costs and minimizes inventory obsolescence, leading to improved Gross Margin Return on Investment (GMROI). Efficient stock turnover ensures optimal inventory levels, maximizing profit margins and retail asset utilization.

Calculating GMROI: Step-by-Step Guide

Calculating Gross Margin Return on Investment (GMROI) involves dividing the gross margin by the average inventory cost to measure profitability relative to inventory investment. Retailers first determine gross margin by subtracting the cost of goods sold from net sales, then calculate average inventory cost by averaging beginning and ending inventory values. A step-by-step approach ensures accurate GMROI, enabling retailers to evaluate inventory efficiency and optimize stock turnover for improved financial performance.

Interpreting Stock Turnover for Retail Success

Stock Turnover measures how frequently inventory is sold and replaced over a period, providing insights into product demand and operational efficiency in retail. A high stock turnover indicates strong sales performance and effective inventory management, reducing holding costs and minimizing obsolete stock risks. Analyzing stock turnover alongside Gross Margin Return on Investment (GMROI) helps retailers optimize inventory investment by balancing profitability with sales velocity for sustained retail success.

GMROI vs Stock Turnover: When to Use Each Metric

Gross Margin Return on Investment (GMROI) measures profitability by evaluating the gross profit earned per dollar invested in inventory, making it ideal for assessing product profitability and inventory efficiency. Stock Turnover calculates how many times inventory is sold and replaced over a period, providing insights into sales velocity and inventory management effectiveness. Use GMROI to prioritize high-margin products and optimize investment, while Stock Turnover focuses on liquidity and helps identify slow-moving inventory for timely replenishment.

Strategies to Improve GMROI and Stock Turnover

Improving Gross Margin Return on Investment (GMROI) and stock turnover requires optimizing inventory levels and pricing strategies to maximize profitability per dollar invested. Implementing demand forecasting techniques and enhancing supplier relationships can reduce stockouts and overstock situations, leading to higher turnover rates and improved margin returns. Leveraging data analytics to identify slow-moving items allows for targeted promotions and markdowns, further boosting both GMROI and stock turnover efficiency.

Common Pitfalls in Analyzing Retail Inventory Metrics

Misinterpreting Gross Margin Return on Investment (GMROI) without considering stock turnover can lead to flawed inventory decisions, as high GMROI might mask slow-moving stock draining liquidity. Retailers often neglect that fast stock turnover with lower GMROI can outperform slower turnover with high GMROI by accelerating cash flow and reducing holding costs. Analyzing inventory metrics in isolation risks overlooking the balance between profitability and efficiency crucial for optimal inventory management.

Gross Margin Return on Investment (GMROI) vs Stock Turnover Infographic

difterm.com

difterm.com