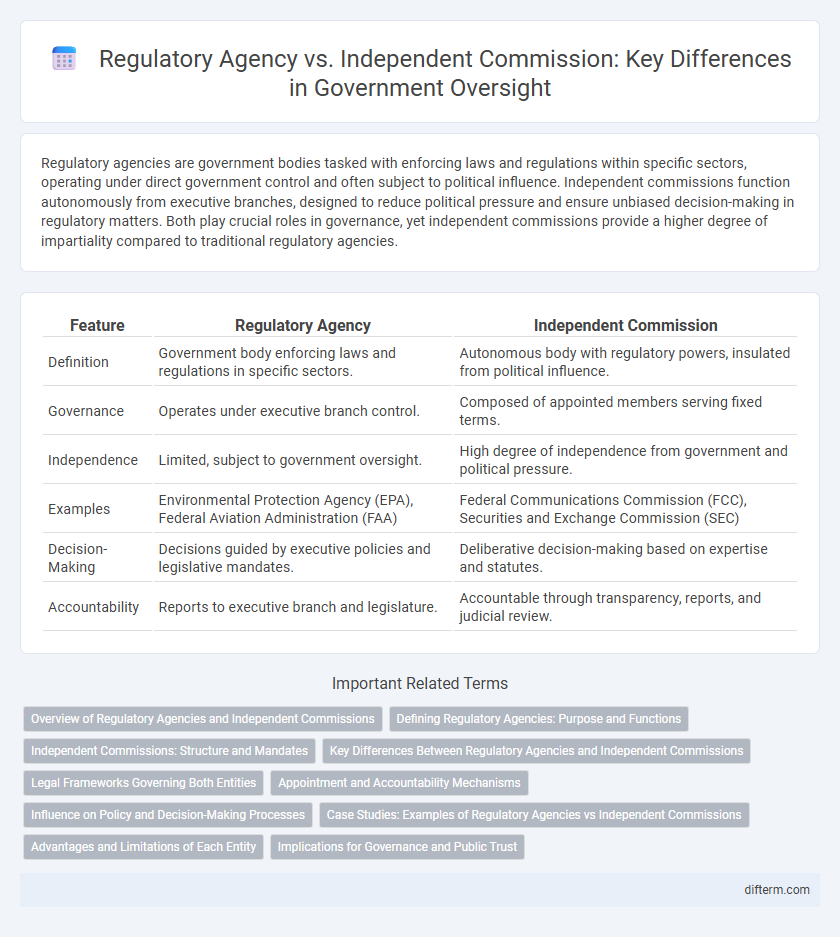

Regulatory agencies are government bodies tasked with enforcing laws and regulations within specific sectors, operating under direct government control and often subject to political influence. Independent commissions function autonomously from executive branches, designed to reduce political pressure and ensure unbiased decision-making in regulatory matters. Both play crucial roles in governance, yet independent commissions provide a higher degree of impartiality compared to traditional regulatory agencies.

Table of Comparison

| Feature | Regulatory Agency | Independent Commission |

|---|---|---|

| Definition | Government body enforcing laws and regulations in specific sectors. | Autonomous body with regulatory powers, insulated from political influence. |

| Governance | Operates under executive branch control. | Composed of appointed members serving fixed terms. |

| Independence | Limited, subject to government oversight. | High degree of independence from government and political pressure. |

| Examples | Environmental Protection Agency (EPA), Federal Aviation Administration (FAA) | Federal Communications Commission (FCC), Securities and Exchange Commission (SEC) |

| Decision-Making | Decisions guided by executive policies and legislative mandates. | Deliberative decision-making based on expertise and statutes. |

| Accountability | Reports to executive branch and legislature. | Accountable through transparency, reports, and judicial review. |

Overview of Regulatory Agencies and Independent Commissions

Regulatory agencies are government bodies responsible for enforcing laws and regulations within specific industries, such as the Environmental Protection Agency (EPA) or the Securities and Exchange Commission (SEC), with authority granted by legislative statutes. Independent commissions operate with a degree of autonomy from executive control to ensure impartial decision-making, often overseeing elections, public utilities, or financial markets, exemplified by the Federal Election Commission (FEC) or the Federal Communications Commission (FCC). Both entities play critical roles in governance by maintaining regulatory compliance and protecting public interests, but independent commissions typically have bipartisan leadership structures to reduce political influence.

Defining Regulatory Agencies: Purpose and Functions

Regulatory agencies are government bodies established to oversee and enforce laws within specific sectors, ensuring compliance and protecting public interests. Independent commissions function autonomously to make impartial decisions, often insulating regulatory processes from political influence. Both entities play crucial roles in maintaining regulatory frameworks but differ in their levels of operational independence and accountability.

Independent Commissions: Structure and Mandates

Independent commissions operate with a distinct structure designed to ensure impartiality and autonomy, typically featuring bipartisan leadership and fixed terms to shield members from political pressure. Their mandates often encompass specialized regulatory functions, enforcement of laws, and oversight responsibilities within specific sectors such as finance, communications, or environmental protection. These commissions derive authority from enabling legislation, empowering them to make decisions, issue rulings, and implement policies critical to maintaining regulatory compliance and public accountability.

Key Differences Between Regulatory Agencies and Independent Commissions

Regulatory agencies operate under executive branch authority with direct government oversight, implementing and enforcing specific laws within defined sectors. Independent commissions function with a higher degree of autonomy, designed to minimize political influence by having bipartisan leadership and fixed terms for commissioners. Key differences include governance structure, agency independence, appointment processes, and the scope of regulatory powers.

Legal Frameworks Governing Both Entities

Regulatory agencies operate under specific legislative mandates granted by government statutes, allowing direct oversight and enforcement authority within defined sectors such as finance or environmental protection. Independent commissions are established through charters or laws designed to ensure impartiality and autonomy, functioning with protections that limit political influence to safeguard decision-making processes. Both entities are governed by distinct legal frameworks that delineate their powers, accountability mechanisms, and operational scope to balance regulatory effectiveness with checks on authority.

Appointment and Accountability Mechanisms

Regulatory agencies are typically appointed by the executive branch, often requiring legislative confirmation, and are directly accountable to government officials or departments. Independent commissions have members appointed through bipartisan processes or fixed terms to ensure insulation from political pressure, with accountability maintained via statutory mandates and public reporting. These mechanisms influence the degree of autonomy and oversight each entity possesses within government regulatory frameworks.

Influence on Policy and Decision-Making Processes

Regulatory agencies typically operate under direct government oversight, allowing elected officials to exert significant influence on policy and decision-making processes, aligning agency actions with broader governmental priorities. Independent commissions maintain a higher degree of autonomy, insulated from political pressures, enabling impartial decision-making aimed at specialized regulatory objectives. This structural difference impacts how regulations are formulated and enforced, with independent commissions often prioritizing expertise and consistency over immediate political considerations.

Case Studies: Examples of Regulatory Agencies vs Independent Commissions

The U.S. Securities and Exchange Commission (SEC) exemplifies a regulatory agency with statutory authority to enforce securities laws and oversee market integrity, while the Federal Election Commission (FEC) functions as an independent commission tasked with regulating campaign finance without direct executive control. Case studies of the Environmental Protection Agency (EPA) and the Consumer Product Safety Commission (CPSC) further highlight differences where regulatory agencies possess rulemaking and enforcement powers directly linked to executive oversight, whereas independent commissions emphasize bipartisan representation to ensure balanced, apolitical decision-making. These examples underscore how structural variations impact regulatory effectiveness, accountability, and public trust across federal government institutions.

Advantages and Limitations of Each Entity

Regulatory agencies benefit from direct government oversight, ensuring alignment with national policies and swift policy implementation, but they may face political influence that can limit impartiality. Independent commissions provide greater autonomy, which fosters unbiased decision-making and protection from political pressures, although their independence can result in slower responsiveness to urgent governmental priorities. Balancing accountability and independence remains a key challenge in optimizing the effectiveness of both entities within governance frameworks.

Implications for Governance and Public Trust

Regulatory agencies operate under executive branch oversight, which can enhance accountability but may limit impartiality, affecting public trust in governance. Independent commissions function with statutory autonomy, promoting unbiased decision-making and reinforcing confidence in regulatory processes. The degree of independence influences policy implementation effectiveness and citizen perception of government integrity.

regulatory agency vs independent commission Infographic

difterm.com

difterm.com