Acqui-hiring involves a company purchasing another primarily to gain its talented employees rather than its products or services, often accelerating growth through strategic human capital acquisition. Mergers combine two companies into a single entity, blending resources, operations, and market presence to enhance competitive advantage. Understanding the difference between acqui-hiring and mergers helps businesses choose the optimal strategy for expansion and innovation.

Table of Comparison

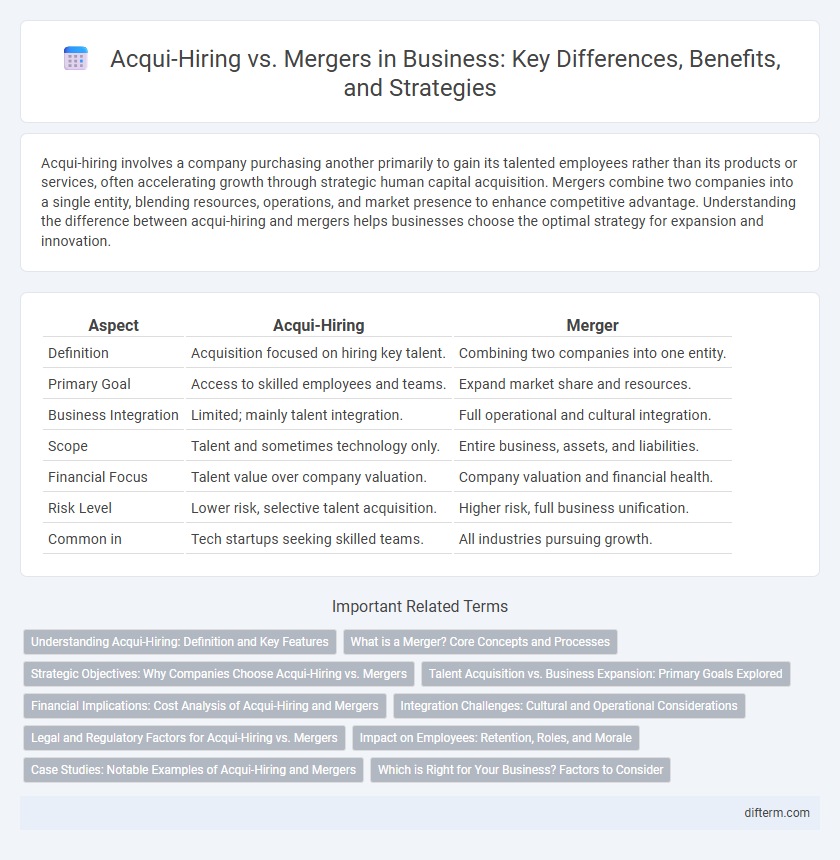

| Aspect | Acqui-Hiring | Merger |

|---|---|---|

| Definition | Acquisition focused on hiring key talent. | Combining two companies into one entity. |

| Primary Goal | Access to skilled employees and teams. | Expand market share and resources. |

| Business Integration | Limited; mainly talent integration. | Full operational and cultural integration. |

| Scope | Talent and sometimes technology only. | Entire business, assets, and liabilities. |

| Financial Focus | Talent value over company valuation. | Company valuation and financial health. |

| Risk Level | Lower risk, selective talent acquisition. | Higher risk, full business unification. |

| Common in | Tech startups seeking skilled teams. | All industries pursuing growth. |

Understanding Acqui-Hiring: Definition and Key Features

Acqui-hiring is a strategic business practice where a company acquires another primarily to recruit its talented employees rather than its products or services. This approach emphasizes the assimilation of skilled teams to boost innovation and enhance competitive advantage, often involving cultural integration and retention incentives. Unlike mergers, acqui-hiring focuses on human capital acquisition, making it a targeted talent acquisition strategy in the corporate landscape.

What is a Merger? Core Concepts and Processes

A merger is a strategic business transaction where two companies combine to form a single entity, aiming to enhance market share, operational efficiency, and competitive advantage. Core concepts include mutual agreement, asset consolidation, and integration of corporate cultures, with processes involving due diligence, valuation, regulatory approval, and financial restructuring. Successful mergers require harmonizing organizational goals and systems to create synergies that drive long-term growth and shareholder value.

Strategic Objectives: Why Companies Choose Acqui-Hiring vs. Mergers

Companies pursue acqui-hiring primarily to rapidly access specialized talent and accelerate innovation, especially in technology-driven sectors where human capital is a critical asset. Mergers typically aim to achieve broader strategic goals such as market expansion, enhanced competitive positioning, and operational synergies by combining resources and capabilities. Acqui-hiring addresses immediate skill shortages with minimal integration risk, while mergers focus on long-term growth and value creation through comprehensive organizational alignment.

Talent Acquisition vs. Business Expansion: Primary Goals Explored

Acqui-hiring prioritizes talent acquisition by targeting skilled employees to enhance innovation and operational capacity, often within tech startups. Mergers emphasize business expansion, combining resources and markets to increase scale, revenue, and competitive advantage. Choosing between acqui-hiring and mergers depends on whether the strategic goal centers on acquiring human capital or expanding organizational footprint.

Financial Implications: Cost Analysis of Acqui-Hiring and Mergers

Acqui-hiring typically involves lower upfront costs compared to mergers, as it centers on talent acquisition rather than full business integration. Mergers demand substantial financial resources for due diligence, legal fees, and long-term operational consolidation, often resulting in higher expenses but potential economies of scale. Cost analysis reveals acqui-hiring as a more cost-effective strategy for rapid team expansion, while mergers present complex financial commitments with prospects of greater market influence.

Integration Challenges: Cultural and Operational Considerations

Acqui-hiring often presents integration challenges centered around aligning distinct company cultures, requiring tailored strategies to retain key tech talent and preserve innovation momentum. Mergers demand comprehensive operational integration, involving unification of processes, systems, and governance structures that can disrupt workflows and productivity if not managed effectively. Addressing cultural compatibility and streamlining operational frameworks are critical for both approaches to realize synergies and achieve sustainable business growth.

Legal and Regulatory Factors for Acqui-Hiring vs. Mergers

Acqui-hiring involves acquiring talent through asset purchase, often bypassing complex regulatory hurdles associated with full-scale mergers, such as antitrust reviews and shareholder approvals. Mergers require comprehensive due diligence to comply with securities laws, labor regulations, and industry-specific compliance, increasing legal complexities and timelines. Both strategies must navigate intellectual property rights and employment contract transitions to mitigate risks and ensure regulatory adherence.

Impact on Employees: Retention, Roles, and Morale

Acqui-hiring typically prioritizes retaining key talent by integrating employees into new roles tailored to leverage their skills, often boosting morale through personalized career growth opportunities. In contrast, mergers can lead to role redundancies and uncertainty, causing fluctuations in employee retention and morale as organizational structures and cultures merge. Both strategies significantly influence employee engagement, but acqui-hiring tends to minimize disruption by focusing on talent acquisition rather than full organizational integration.

Case Studies: Notable Examples of Acqui-Hiring and Mergers

Facebook's acqui-hiring of Parse in 2013 exemplifies strategic talent acquisition to boost mobile development capabilities, while Disney's 2006 merger with Pixar showcased how combining creative assets can drive long-term value creation. Google's acquisition of Nest in 2014 highlights acqui-hiring efforts aimed at integrating hardware and software expertise for smart home innovation. In contrast, the Exxon-Mobil merger of 1999 remains a benchmark for consolidating market share and operational efficiencies in the energy sector.

Which is Right for Your Business? Factors to Consider

Acqui-hiring suits businesses seeking talent acquisition without complex integration, focusing on retaining key personnel to accelerate innovation and growth. Mergers benefit companies aiming for market expansion, resource consolidation, and long-term synergy but require thorough due diligence and cultural alignment. Consider factors like strategic goals, financial health, team compatibility, and integration capacity to determine the right approach for sustainable business success.

acqui-hiring vs merger Infographic

difterm.com

difterm.com