Stakeholders encompass all parties impacted by a business, including employees, customers, suppliers, and the community, while shareholders specifically own shares of the company and seek financial returns. Understanding the distinct interests of stakeholders and shareholders is crucial for balanced decision-making and sustainable business growth. Companies that prioritize both stakeholder engagement and shareholder value often achieve long-term success and enhanced corporate reputation.

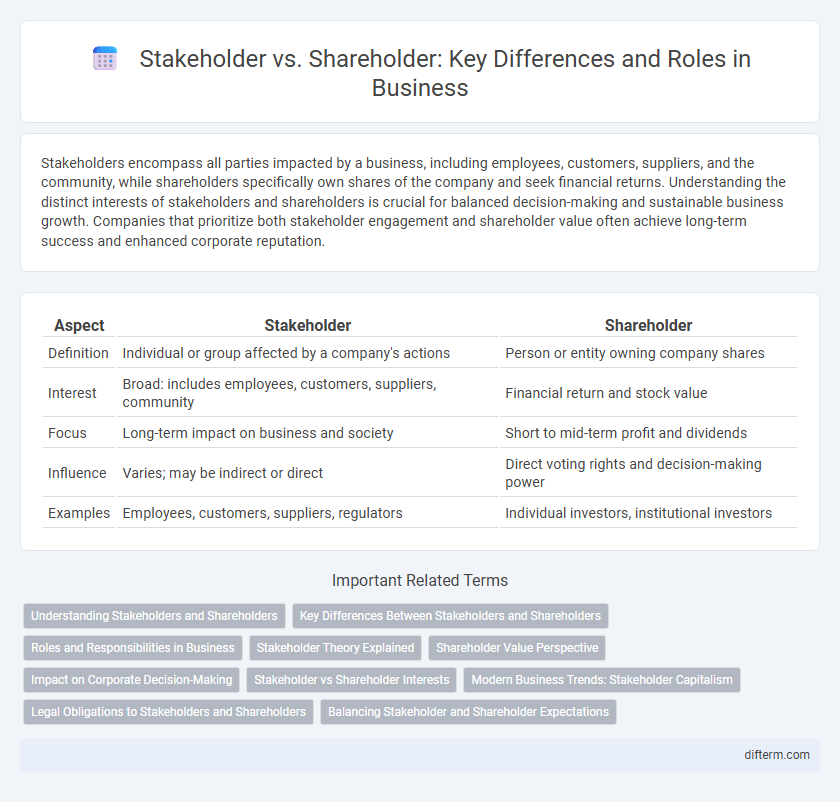

Table of Comparison

| Aspect | Stakeholder | Shareholder |

|---|---|---|

| Definition | Individual or group affected by a company's actions | Person or entity owning company shares |

| Interest | Broad: includes employees, customers, suppliers, community | Financial return and stock value |

| Focus | Long-term impact on business and society | Short to mid-term profit and dividends |

| Influence | Varies; may be indirect or direct | Direct voting rights and decision-making power |

| Examples | Employees, customers, suppliers, regulators | Individual investors, institutional investors |

Understanding Stakeholders and Shareholders

Stakeholders encompass all individuals or groups affected by a company's actions, including employees, customers, suppliers, and the community, while shareholders specifically own shares in the company and have financial interests tied to its performance. Understanding the distinct roles and interests of stakeholders versus shareholders is crucial for effective business strategy and corporate governance. Companies that balance stakeholder concerns with shareholder returns often achieve sustainable growth and long-term value creation.

Key Differences Between Stakeholders and Shareholders

Stakeholders encompass a broad group including employees, customers, suppliers, and the community, all impacted by a company's operations, while shareholders specifically own equity stakes and seek financial returns. Unlike shareholders who primarily focus on dividends and stock value, stakeholders prioritize diverse interests such as job security, product quality, and social responsibility. Understanding the key differences clarifies how business decisions balance profit motives with broader social and economic impacts.

Roles and Responsibilities in Business

Stakeholders encompass all individuals or groups affected by a company's operations, including employees, customers, suppliers, and the community, each with diverse interests and expectations. Shareholders specifically own company stock and prioritize maximizing financial returns and corporate governance through voting rights. While shareholders focus on profitability and equity value, stakeholders require a broader approach to social responsibility, operational impact, and long-term sustainability.

Stakeholder Theory Explained

Stakeholder Theory emphasizes the importance of considering all parties impacted by a business, including employees, customers, suppliers, and the community, beyond just shareholders who own shares. This approach prioritizes long-term value creation and ethical responsibility by addressing diverse stakeholder interests rather than focusing solely on maximizing shareholder profits. Businesses adopting Stakeholder Theory often experience enhanced reputation, sustainable growth, and stronger relationships across their value chain.

Shareholder Value Perspective

Shareholder value perspective emphasizes maximizing returns on investment by prioritizing financial performance, dividend payouts, and stock price appreciation. This approach aligns management decisions with shareholder interests, driving strategies that increase equity value and long-term profitability. Companies focusing on shareholder value often measure success through metrics like earnings per share (EPS) and return on equity (ROE).

Impact on Corporate Decision-Making

Stakeholders encompass a broad group including employees, customers, suppliers, and the community, whose interests influence corporate decision-making beyond mere profit. Shareholders specifically seek financial returns, steering decisions toward maximizing shareholder value and stock performance. Balancing stakeholder demands with shareholder expectations shapes strategic priorities and governance policies to ensure sustainable growth and corporate responsibility.

Stakeholder vs Shareholder Interests

Stakeholders include employees, customers, suppliers, and communities, whose interests focus on long-term business sustainability, ethical practices, and social responsibility. Shareholders prioritize maximizing financial returns, dividend growth, and stock value appreciation in the short to medium term. Balancing stakeholder and shareholder interests is essential for corporate governance and sustainable business success.

Modern Business Trends: Stakeholder Capitalism

Modern business trends increasingly emphasize stakeholder capitalism, where companies prioritize the interests of all stakeholders--including employees, customers, suppliers, communities, and shareholders--over just maximizing shareholder profits. This approach fosters long-term value creation, corporate social responsibility, and sustainable business practices. Embracing stakeholder capitalism drives innovation, enhances reputation, and aligns business strategies with broader societal goals.

Legal Obligations to Stakeholders and Shareholders

Legal obligations to shareholders primarily involve fiduciary duties such as duty of care and loyalty to maximize shareholder value and protect their financial interests. Stakeholders, including employees, customers, suppliers, and the community, are protected through broader legal frameworks like labor laws, environmental regulations, and consumer protection statutes. Companies must balance these obligations, complying with corporate governance standards to address shareholder expectations while fulfilling statutory responsibilities toward diverse stakeholder groups.

Balancing Stakeholder and Shareholder Expectations

Balancing stakeholder and shareholder expectations requires aligning financial performance with social responsibility and sustainable business practices. Corporations must engage in transparent communication, ensuring that shareholders see value in long-term growth while stakeholders benefit from ethical operations and community impact. Effective governance frameworks integrate diverse interests to promote stability and resilience in competitive markets.

Stakeholder vs Shareholder Infographic

difterm.com

difterm.com