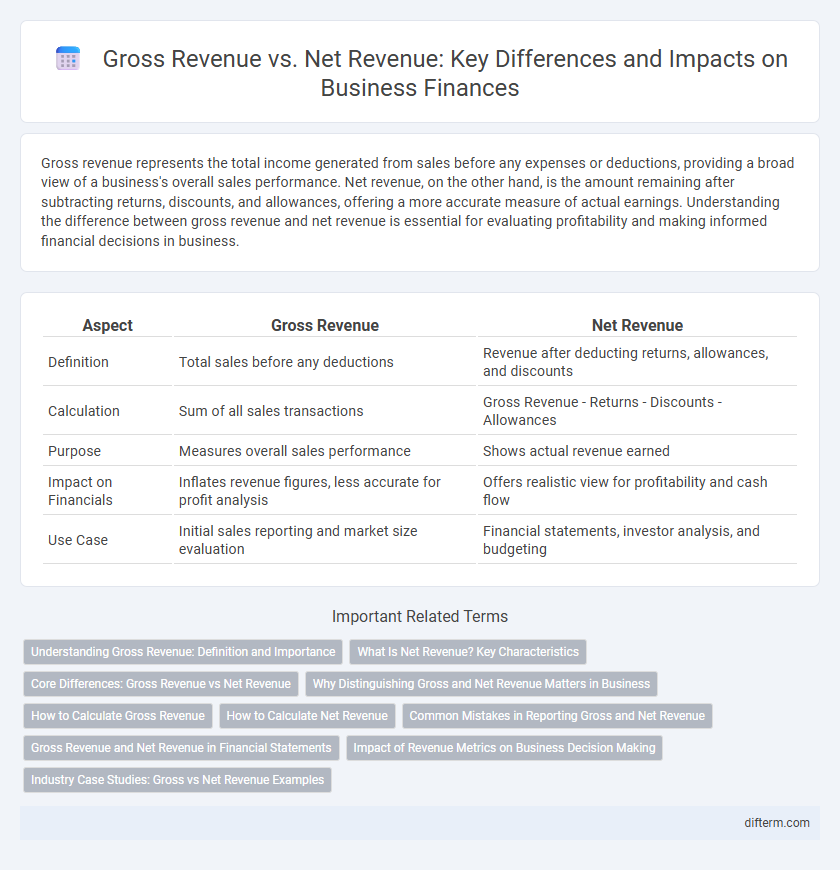

Gross revenue represents the total income generated from sales before any expenses or deductions, providing a broad view of a business's overall sales performance. Net revenue, on the other hand, is the amount remaining after subtracting returns, discounts, and allowances, offering a more accurate measure of actual earnings. Understanding the difference between gross revenue and net revenue is essential for evaluating profitability and making informed financial decisions in business.

Table of Comparison

| Aspect | Gross Revenue | Net Revenue |

|---|---|---|

| Definition | Total sales before any deductions | Revenue after deducting returns, allowances, and discounts |

| Calculation | Sum of all sales transactions | Gross Revenue - Returns - Discounts - Allowances |

| Purpose | Measures overall sales performance | Shows actual revenue earned |

| Impact on Financials | Inflates revenue figures, less accurate for profit analysis | Offers realistic view for profitability and cash flow |

| Use Case | Initial sales reporting and market size evaluation | Financial statements, investor analysis, and budgeting |

Understanding Gross Revenue: Definition and Importance

Gross revenue represents the total income a business generates from sales before deducting any expenses, discounts, or returns. Understanding gross revenue is crucial for assessing a company's overall market performance and demand for its products or services. It serves as the foundation for calculating net revenue, profitability, and financial health.

What Is Net Revenue? Key Characteristics

Net revenue represents the total income a business retains after deducting returns, allowances, and discounts from gross revenue, reflecting the actual earnings from sales. Key characteristics of net revenue include its accuracy in showcasing true business performance and its role as a critical metric for financial analysis and decision-making. Understanding net revenue is essential for evaluating profitability, cash flow, and operational efficiency within a company's financial statements.

Core Differences: Gross Revenue vs Net Revenue

Gross revenue represents the total income generated from sales before any expenses or deductions, while net revenue reflects the amount remaining after subtracting costs such as returns, discounts, and allowances. Core differences include gross revenue serving as a top-line indicator of business activity, whereas net revenue provides a more accurate measure of actual earnings and operational efficiency. Understanding these distinctions is crucial for financial analysis, budgeting, and strategic decision-making in business management.

Why Distinguishing Gross and Net Revenue Matters in Business

Distinguishing gross revenue from net revenue matters in business because gross revenue reflects the total sales before any deductions, providing a snapshot of overall market demand, while net revenue offers a clearer picture of actual profitability by accounting for returns, discounts, and allowances. Accurate differentiation aids in financial analysis, budgeting, and strategic decision-making, ensuring businesses understand true earnings and operational efficiency. Investors and stakeholders rely on net revenue to assess sustainable performance and growth potential.

How to Calculate Gross Revenue

Gross revenue is calculated by summing all sales or income generated from business operations before deducting any expenses, returns, or allowances. To determine gross revenue, multiply the total units sold by the selling price per unit and add any additional income streams such as service fees or interest income. Accurately calculating gross revenue provides insight into the company's total earning potential, serving as a foundation for further financial analysis.

How to Calculate Net Revenue

Net revenue is calculated by subtracting returns, allowances, and discounts from the gross revenue. Begin with the total sales or gross revenue figure, then deduct any sales returns and allowances granted to customers. This process ensures that net revenue accurately reflects the actual income generated from business operations after adjustments.

Common Mistakes in Reporting Gross and Net Revenue

Confusing gross revenue with net revenue is a common mistake that leads to inaccurate financial analysis and decision-making. Many businesses overlook deducting returns, allowances, and discounts from gross revenue to calculate net revenue properly. Misreporting these figures can distort profitability assessments and mislead stakeholders about a company's actual financial health.

Gross Revenue and Net Revenue in Financial Statements

Gross Revenue represents the total income generated from sales before any deductions, serving as a key indicator of business volume in financial statements. Net Revenue, also known as net sales, is calculated by subtracting returns, allowances, and discounts from Gross Revenue, providing a more accurate measure of actual income. Both figures are essential in financial reporting, with Gross Revenue highlighting overall market activity and Net Revenue reflecting true earnings available for operational costs and profit analysis.

Impact of Revenue Metrics on Business Decision Making

Gross revenue represents the total income generated from sales before any deductions, while net revenue accounts for returns, discounts, and allowances, providing a more accurate reflection of financial health. Businesses relying solely on gross revenue may overestimate profitability, leading to misguided budgeting and investment decisions. Accurate analysis of net revenue enables strategic resource allocation and realistic forecasting, ultimately enhancing decision-making processes and long-term growth.

Industry Case Studies: Gross vs Net Revenue Examples

Industry case studies reveal that gross revenue often serves as a top-line indicator reflecting total sales before expenses, while net revenue provides a more accurate measure of profitability by deducting returns, discounts, and allowances. For example, the retail sector frequently experiences significant differences between gross and net revenue due to high return rates and promotional discounts. In technology firms, net revenue is crucial for evaluating financial health since service subscriptions may involve recurring adjustments impacting the final revenue recognized.

Gross Revenue vs Net Revenue Infographic

difterm.com

difterm.com