Travel insurance offers comprehensive coverage including medical emergencies, trip delays, and lost luggage, providing broader protection during a trip. Trip cancellation insurance is a specific type of travel insurance that reimburses non-refundable expenses if you must cancel or interrupt your trip due to covered reasons. Choosing between the two depends on your travel needs and risk tolerance; full travel insurance covers more scenarios while trip cancellation insurance focuses solely on protecting your prepaid trip costs.

Table of Comparison

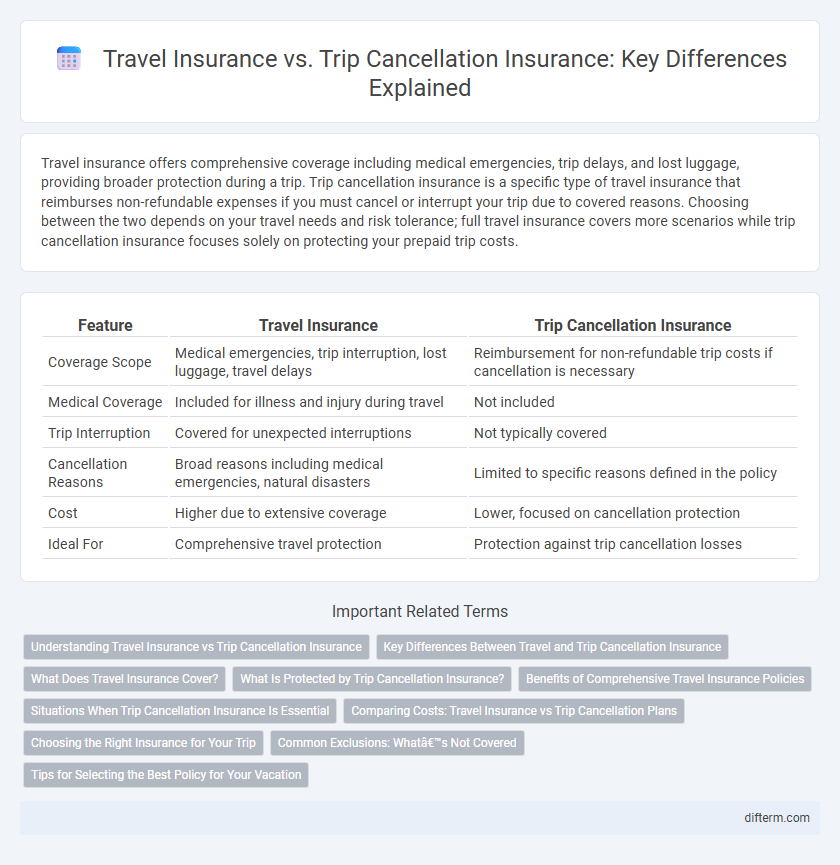

| Feature | Travel Insurance | Trip Cancellation Insurance |

|---|---|---|

| Coverage Scope | Medical emergencies, trip interruption, lost luggage, travel delays | Reimbursement for non-refundable trip costs if cancellation is necessary |

| Medical Coverage | Included for illness and injury during travel | Not included |

| Trip Interruption | Covered for unexpected interruptions | Not typically covered |

| Cancellation Reasons | Broad reasons including medical emergencies, natural disasters | Limited to specific reasons defined in the policy |

| Cost | Higher due to extensive coverage | Lower, focused on cancellation protection |

| Ideal For | Comprehensive travel protection | Protection against trip cancellation losses |

Understanding Travel Insurance vs Trip Cancellation Insurance

Travel insurance provides comprehensive coverage including medical emergencies, lost luggage, and trip interruptions, whereas trip cancellation insurance specifically reimburses prepaid expenses if you cancel your trip due to covered reasons like illness or severe weather. Understanding the distinction helps travelers select policies that suit their risk tolerance and trip plans, ensuring financial protection against potential disruptions. Comparing policy terms such as coverage limits, exclusions, and claim procedures is essential for maximizing benefits.

Key Differences Between Travel and Trip Cancellation Insurance

Travel insurance provides broad coverage including medical emergencies, lost luggage, and trip interruptions, while trip cancellation insurance specifically reimburses non-refundable expenses if a trip is canceled for covered reasons. Trip cancellation insurance is typically purchased as a standalone policy or an add-on, focusing solely on protecting financial investments against unforeseen cancellations. Travel insurance offers more comprehensive protection, addressing a wider range of travel-related risks beyond cancellation.

What Does Travel Insurance Cover?

Travel insurance typically covers medical emergencies, trip interruptions, lost luggage, and emergency evacuations, providing comprehensive protection during your journey. Trip cancellation insurance specifically reimburses non-refundable expenses if you must cancel or interrupt your trip due to covered reasons such as illness, severe weather, or a family emergency. Understanding these distinctions helps travelers choose the appropriate policy based on their coverage needs and travel risks.

What Is Protected by Trip Cancellation Insurance?

Trip cancellation insurance specifically protects prepaid, non-refundable trip costs such as flights, accommodations, and tours if you must cancel due to covered reasons like illness, severe weather, or unforeseen emergencies. It reimburses expenses that are lost when a trip is canceled before departure, safeguarding your financial investment in travel arrangements. This coverage typically excludes incidents occurring after the trip has started, distinguishing it from broader travel insurance policies.

Benefits of Comprehensive Travel Insurance Policies

Comprehensive travel insurance policies provide extensive coverage that includes trip cancellation, medical emergencies, lost luggage, and travel delays, ensuring peace of mind throughout the journey. They protect travelers from unexpected financial losses caused by cancellations due to illness, natural disasters, or other unforeseen events, which standalone trip cancellation insurance may not fully cover. These policies offer a holistic safety net, combining multiple protections into one plan for more efficient and cost-effective travel security.

Situations When Trip Cancellation Insurance Is Essential

Trip cancellation insurance is essential when unexpected events such as illness, family emergencies, or severe weather prevent travelers from starting their trip, ensuring reimbursement for non-refundable costs. Unlike general travel insurance, which covers broader risks during travel, trip cancellation insurance specifically protects the financial investment made before departure. This coverage is crucial for expensive vacations or non-refundable bookings where losses could be significant without protection.

Comparing Costs: Travel Insurance vs Trip Cancellation Plans

Travel insurance typically covers a wide range of risks, including medical emergencies, lost luggage, and trip interruptions, often resulting in higher overall premiums. Trip cancellation insurance specifically protects against non-refundable trip costs if unforeseen events cause you to cancel, usually at a lower cost than comprehensive travel policies. Evaluating the cost-benefit ratio depends on the traveler's needs, destination risks, and the value of non-refundable expenses.

Choosing the Right Insurance for Your Trip

Choosing the right insurance for your trip depends on understanding the key differences between travel insurance and trip cancellation insurance. Travel insurance offers comprehensive coverage including medical emergencies, lost luggage, and trip interruptions, while trip cancellation insurance specifically protects your prepaid expenses if you need to cancel your trip for covered reasons. Assess your travel risks, destination, and financial investment to select a policy that provides the best protection tailored to your needs.

Common Exclusions: What’s Not Covered

Travel insurance commonly excludes pre-existing medical conditions, extreme sports injuries, and losses due to war or pandemics, while trip cancellation insurance typically does not cover cancellations caused by change of mind or financial difficulties. Both policies often exclude coverage for acts of terrorism and natural disasters unless specified in the terms. Understanding these common exclusions helps travelers select appropriate protection and avoid unexpected out-of-pocket expenses.

Tips for Selecting the Best Policy for Your Vacation

When selecting the best travel insurance policy, prioritize coverage that matches your specific vacation needs, including medical emergencies, trip interruptions, and lost baggage. Compare trip cancellation insurance options to ensure it covers unforeseen events like illness or severe weather, which may force you to cancel or reschedule. Review policy exclusions and claim processes carefully to avoid surprises and secure comprehensive protection for your travel investment.

travel insurance vs trip cancellation insurance Infographic

difterm.com

difterm.com