Travel credit cards offer enhanced security features, fraud protection, and rewards like travel points or airline miles, making them ideal for managing expenses during trips. Debit cards directly withdraw funds from your bank account but may lack the same level of fraud protection and can incur foreign transaction fees or ATM charges abroad. Opting for a travel credit card provides greater financial flexibility and benefits that optimize travel spending.

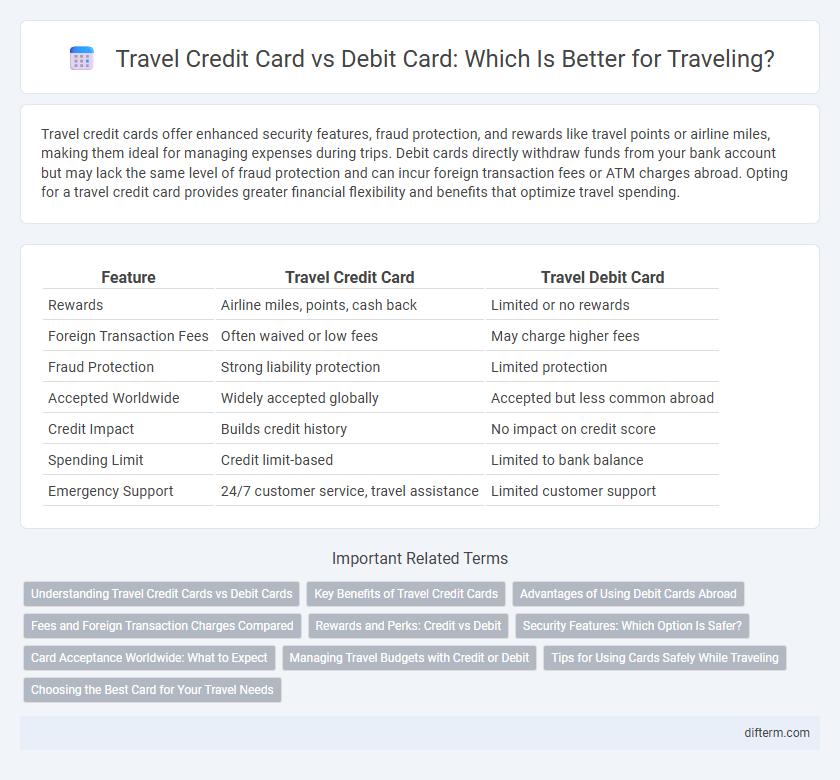

Table of Comparison

| Feature | Travel Credit Card | Travel Debit Card |

|---|---|---|

| Rewards | Airline miles, points, cash back | Limited or no rewards |

| Foreign Transaction Fees | Often waived or low fees | May charge higher fees |

| Fraud Protection | Strong liability protection | Limited protection |

| Accepted Worldwide | Widely accepted globally | Accepted but less common abroad |

| Credit Impact | Builds credit history | No impact on credit score |

| Spending Limit | Credit limit-based | Limited to bank balance |

| Emergency Support | 24/7 customer service, travel assistance | Limited customer support |

Understanding Travel Credit Cards vs Debit Cards

Travel credit cards offer benefits such as travel rewards, purchase protection, and fraud liability coverage, making them a preferred choice for frequent travelers. Debit cards provide easier access to funds and lower risk of overspending but often lack travel-specific perks and protections. Understanding these differences helps travelers choose the best payment method for budgeting, security, and maximizing travel rewards.

Key Benefits of Travel Credit Cards

Travel credit cards offer significant benefits such as earning travel rewards points, airport lounge access, and travel insurance coverage, enhancing the overall travel experience. These cards provide foreign transaction fee waivers and fraud protection, making them safer and more cost-effective for international use compared to debit cards. Cardholders also enjoy perks like rental car insurance and emergency assistance, which debit cards typically do not offer.

Advantages of Using Debit Cards Abroad

Debit cards offer advantages for travelers by providing direct access to funds without incurring interest charges or debt. Many debit cards feature lower foreign transaction fees compared to credit cards, making everyday purchases and cash withdrawals abroad more cost-effective. Enhanced security measures such as EMV chips and real-time transaction alerts help protect travelers from fraud while managing expenses efficiently.

Fees and Foreign Transaction Charges Compared

Travel credit cards typically offer lower foreign transaction fees, often around 0-3%, while debit cards may charge higher fees or currency conversion costs by banks. Credit cards provide better protection against fraud and may waive ATM withdrawal fees abroad, unlike many debit cards. Choosing a travel credit card with no foreign transaction fees can significantly reduce travel expenses compared to debit cards with variable charge structures.

Rewards and Perks: Credit vs Debit

Travel credit cards offer superior rewards and perks compared to debit cards, including points, miles, and cashback on purchases that can be redeemed for flights, hotel stays, and travel experiences. Many credit cards provide additional benefits such as travel insurance, airport lounge access, and no foreign transaction fees, which debit cards typically lack. Debit cards generally do not offer extensive rewards programs, making credit cards the preferred option for maximizing travel-related benefits.

Security Features: Which Option Is Safer?

Travel credit cards typically offer enhanced security features such as fraud alerts, zero-liability policies, and advanced encryption technology, making them safer for international transactions compared to debit cards. Debit cards allow direct access to bank accounts, increasing the risk of immediate fund loss if compromised, while credit cards provide a buffer by using a separate credit line. Many credit cards also offer purchase protection and dispute resolution, providing travelers with added peace of mind during their trips.

Card Acceptance Worldwide: What to Expect

Travel credit cards typically offer broader acceptance worldwide, especially for hotels, car rentals, and dining establishments compared to debit cards. Credit cards are often preferred for international transactions due to enhanced fraud protection and the ability to handle currency conversion seamlessly. Some countries might limit debit card usage at certain locations, making credit cards more reliable for travel purchases.

Managing Travel Budgets with Credit or Debit

Managing travel budgets with credit or debit cards depends on spending habits and fees; credit cards offer rewards, consumer protection, and emergency funds, enhancing financial flexibility during trips. Debit cards limit spending to available balances, reducing debt risk but may incur foreign transaction fees and lack extensive fraud protection. Choosing between them requires assessing travel expenses, security preferences, and potential cost savings from card-specific benefits.

Tips for Using Cards Safely While Traveling

Use credit cards for travel purchases to benefit from fraud protection and travel insurance, while keeping debit card usage minimal to avoid direct access to your bank funds. Notify your card issuer of your travel dates and destinations to prevent transaction blocks and monitor your accounts regularly for unauthorized activity. Always use secure, trusted ATMs and avoid public Wi-Fi when accessing financial data to reduce the risk of card information theft.

Choosing the Best Card for Your Travel Needs

Travel credit cards offer extensive benefits such as travel insurance, airline miles, and global acceptance, making them ideal for frequent travelers seeking rewards and added security. Debit cards provide direct access to funds without incurring debt but may lack fraud protection and international perks. Prioritize cards with low foreign transaction fees, robust fraud protection, and comprehensive travel rewards to optimize your travel budgeting and convenience.

travel credit card vs debit card Infographic

difterm.com

difterm.com