Travel insurance provides comprehensive coverage for trip cancellations, lost luggage, and emergency medical expenses, ensuring financial protection during your journey. Medical evacuation insurance specifically covers the cost of transportation to the nearest adequate medical facility in case of severe illness or injury, which can often be excluded from standard travel insurance policies. Understanding the differences between these insurances is crucial for pet owners seeking adequate protection for their traveling pets.

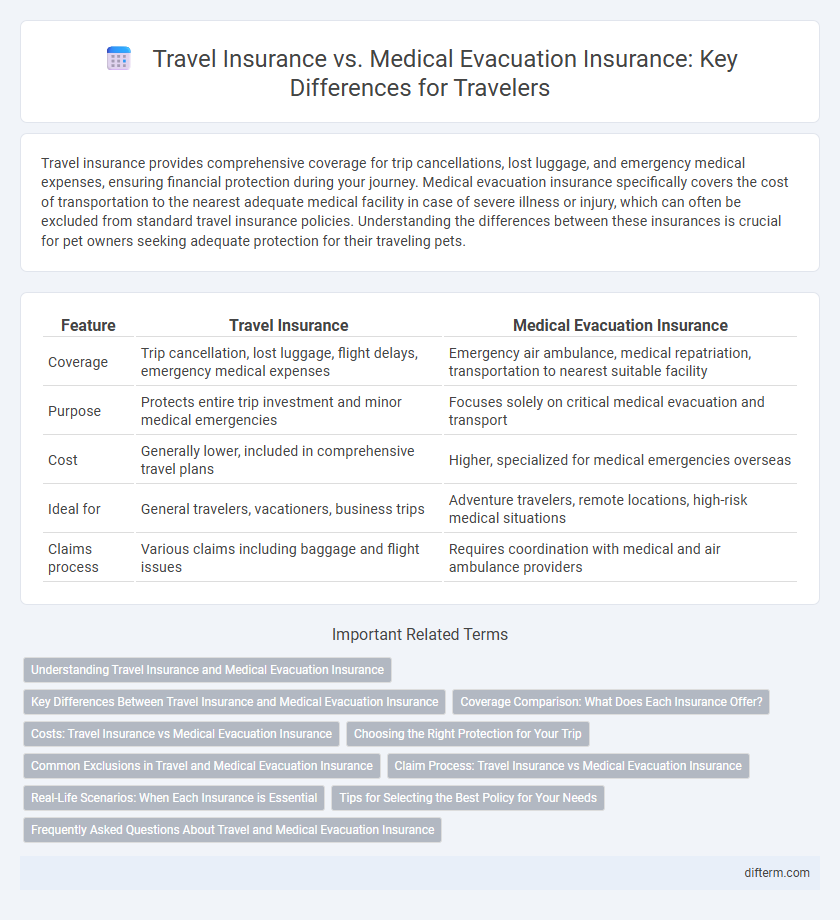

Table of Comparison

| Feature | Travel Insurance | Medical Evacuation Insurance |

|---|---|---|

| Coverage | Trip cancellation, lost luggage, flight delays, emergency medical expenses | Emergency air ambulance, medical repatriation, transportation to nearest suitable facility |

| Purpose | Protects entire trip investment and minor medical emergencies | Focuses solely on critical medical evacuation and transport |

| Cost | Generally lower, included in comprehensive travel plans | Higher, specialized for medical emergencies overseas |

| Ideal for | General travelers, vacationers, business trips | Adventure travelers, remote locations, high-risk medical situations |

| Claims process | Various claims including baggage and flight issues | Requires coordination with medical and air ambulance providers |

Understanding Travel Insurance and Medical Evacuation Insurance

Travel insurance provides comprehensive coverage for trip cancellations, lost luggage, and medical emergencies abroad, ensuring financial protection during unexpected travel disruptions. Medical evacuation insurance specifically covers emergency transportation to the nearest suitable medical facility, critical when local healthcare is inadequate or inaccessible. Understanding the distinct scope of each helps travelers choose appropriate coverage based on their destination's healthcare infrastructure and personal risk factors.

Key Differences Between Travel Insurance and Medical Evacuation Insurance

Travel insurance provides comprehensive coverage including trip cancellations, lost luggage, and medical emergencies, while medical evacuation insurance specifically covers emergency transportation to the nearest adequate medical facility. Medical evacuation insurance is crucial for travelers in remote areas or countries with limited healthcare infrastructure, offering a safety net for high-cost, long-distance medical transport. Understanding these key differences helps travelers choose the right protection based on their destination and health risk factors.

Coverage Comparison: What Does Each Insurance Offer?

Travel insurance typically offers coverage for trip cancellations, lost luggage, and medical emergencies abroad, including limited medical treatment costs. Medical evacuation insurance specifically covers the cost of emergency transportation to the nearest adequate medical facility or repatriation to the home country in case of serious illness or injury. While travel insurance provides broader protection for various travel-related risks, medical evacuation insurance is specialized for high-cost emergency medical transport scenarios.

Costs: Travel Insurance vs Medical Evacuation Insurance

Travel insurance typically offers broader coverage at a lower overall cost, including trip cancellations and lost luggage, while medical evacuation insurance focuses solely on emergency transportation expenses, often resulting in a higher price for the specialized service. The average travel insurance plan can range from 4% to 10% of the total trip cost, whereas medical evacuation insurance premiums vary depending on destination risk but often exceed $100 annually for comprehensive coverage. Evaluating specific travel plans and health risks helps determine whether the cost of travel insurance or standalone medical evacuation insurance offers better value.

Choosing the Right Protection for Your Trip

Travel insurance provides broad coverage including trip cancellations, lost luggage, and emergency medical expenses, while medical evacuation insurance specifically covers costly emergency transport to the nearest suitable medical facility. Selecting the right protection depends on your destination, health risks, and the availability of medical services, with medical evacuation insurance being crucial for remote or high-risk areas. Evaluating policy limits, exclusions, and the inclusion of medical evacuation ensures comprehensive security tailored to your travel needs.

Common Exclusions in Travel and Medical Evacuation Insurance

Travel insurance commonly excludes pre-existing medical conditions, extreme sports injuries, and losses due to war or terrorism, while medical evacuation insurance often excludes coverage for non-emergency transportation and elective procedures. Both policies typically do not cover expenses arising from mental health conditions or pandemics, yet medical evacuation insurance focuses more on emergency medical transport limitations. Understanding these exclusions helps travelers choose appropriate coverage to mitigate risks during international trips.

Claim Process: Travel Insurance vs Medical Evacuation Insurance

Travel insurance claim processes typically require submitting documentation such as medical reports, receipts, and proof of travel interruptions, with approvals depending on coverage terms for accidents, trip cancellations, or lost belongings. Medical evacuation insurance claims demand detailed medical records and coordination with specialized evacuation providers to verify the necessity and authorize emergency transport, often requiring immediate notification to the insurer. Understanding policy specifics and maintaining thorough documentation streamline claim approvals and ensure timely reimbursements under both travel and medical evacuation insurance.

Real-Life Scenarios: When Each Insurance is Essential

Travel insurance covers trip cancellations, lost luggage, and medical emergencies abroad, providing broad protection during common travel disruptions. Medical evacuation insurance is crucial when a traveler requires urgent air transport to a medical facility due to severe illness or injury, especially in remote or under-equipped destinations. In real-life scenarios, travelers in high-risk activities or isolated areas benefit most from medical evacuation coverage, while those concerned with overall trip security opt for standard travel insurance.

Tips for Selecting the Best Policy for Your Needs

When selecting travel insurance versus medical evacuation insurance, prioritize coverage limits, policy exclusions, and emergency response times to ensure comprehensive protection. Evaluate the insurer's reputation, claim processing efficiency, and the specific medical evacuation services included, such as air ambulance or repatriation. Tailor your choice to your destination, activities planned, and existing health conditions to maximize benefits and reduce out-of-pocket expenses.

Frequently Asked Questions About Travel and Medical Evacuation Insurance

Travel insurance typically covers trip cancellations, lost luggage, and minor medical expenses, while medical evacuation insurance specifically provides coverage for emergency transportation to the nearest suitable medical facility. Travelers often ask if medical evacuation is included in standard travel insurance or requires a separate policy, with the answer varying by provider and plan. Understanding the distinctions and coverage limits of both insurance types is crucial to ensure comprehensive protection during international trips.

Travel insurance vs Medical evacuation insurance Infographic

difterm.com

difterm.com