Cold wallets store cryptocurrency offline, providing enhanced security against hacking and cyber threats, making them ideal for long-term storage. Hot wallets, connected to the internet, offer immediate access and convenience for frequent transactions but are more vulnerable to attacks. Choosing between cold and hot wallets depends on balancing security needs with accessibility preferences in managing digital assets.

Table of Comparison

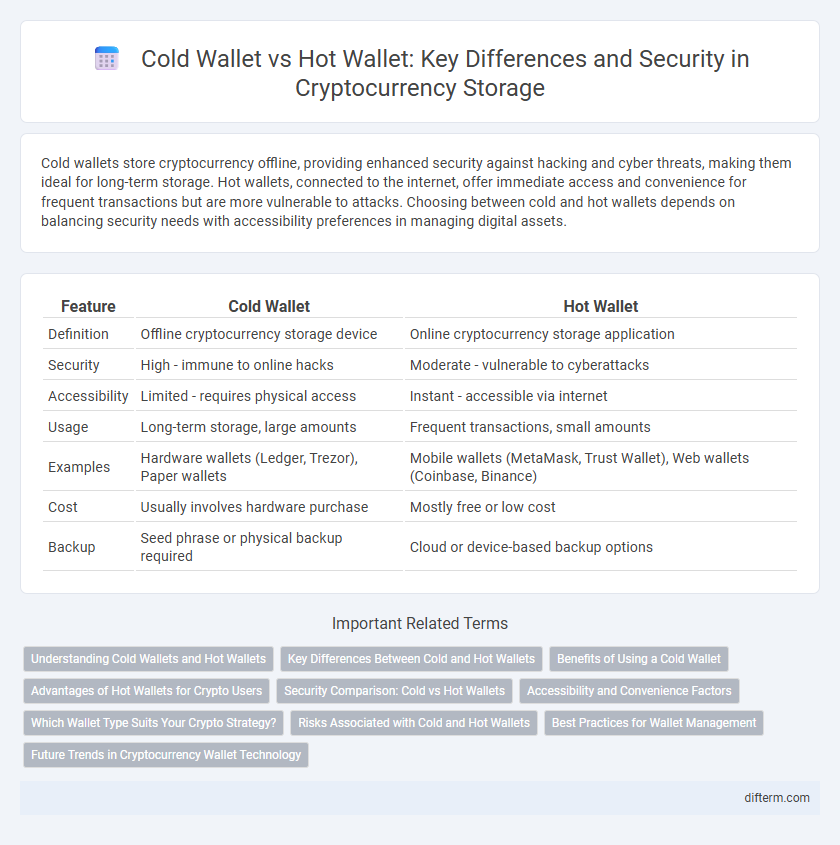

| Feature | Cold Wallet | Hot Wallet |

|---|---|---|

| Definition | Offline cryptocurrency storage device | Online cryptocurrency storage application |

| Security | High - immune to online hacks | Moderate - vulnerable to cyberattacks |

| Accessibility | Limited - requires physical access | Instant - accessible via internet |

| Usage | Long-term storage, large amounts | Frequent transactions, small amounts |

| Examples | Hardware wallets (Ledger, Trezor), Paper wallets | Mobile wallets (MetaMask, Trust Wallet), Web wallets (Coinbase, Binance) |

| Cost | Usually involves hardware purchase | Mostly free or low cost |

| Backup | Seed phrase or physical backup required | Cloud or device-based backup options |

Understanding Cold Wallets and Hot Wallets

Cold wallets store cryptocurrency offline, enhancing security by isolating private keys from internet exposure and reducing risks of hacking and phishing attacks. Hot wallets operate online, providing users with quick and easy access for real-time transactions but are more vulnerable to cyber threats due to constant internet connectivity. Choosing between cold wallets like hardware devices and hot wallets such as mobile apps depends on balancing security needs with convenience for asset management.

Key Differences Between Cold and Hot Wallets

Cold wallets store cryptocurrency offline, offering enhanced security by isolating private keys from internet access and reducing exposure to hacking risks. Hot wallets, connected to the internet, provide convenient and quick access for frequent transactions but are more vulnerable to cyberattacks and phishing attempts. The key differences revolve around security level, accessibility, and use cases, with cold wallets favored for long-term storage and hot wallets suited for active trading and daily use.

Benefits of Using a Cold Wallet

Cold wallets provide enhanced security by storing cryptocurrency offline, significantly reducing the risk of hacking and cyber theft. They protect private keys from malware and phishing attacks common on internet-connected devices. Users benefit from long-term storage stability and peace of mind due to cold wallets' isolation from online vulnerabilities.

Advantages of Hot Wallets for Crypto Users

Hot wallets provide instant access to cryptocurrencies, enabling seamless and rapid transactions essential for active trading and frequent transfers. Their user-friendly interfaces support quick connectivity to decentralized applications and exchanges, enhancing overall convenience and efficiency. Integration with various platforms and devices ensures portable and real-time management of digital assets, making hot wallets a preferred choice for dynamic crypto users.

Security Comparison: Cold vs Hot Wallets

Cold wallets store cryptocurrency offline, significantly reducing exposure to hacking attempts and malware, making them the most secure option for long-term storage. Hot wallets, connected to the internet, offer convenience and faster access but carry higher risks of cyberattacks and phishing scams. Security protocols such as multi-factor authentication and hardware encryption enhance protection for hot wallets but cannot fully eliminate online vulnerabilities compared to cold wallets.

Accessibility and Convenience Factors

Cold wallets offer enhanced security by storing cryptocurrencies offline, significantly reducing the risk of hacking, but they lack the immediate accessibility provided by hot wallets. Hot wallets allow users quick and easy access to their digital assets through internet-connected devices, making them ideal for frequent trading and transactions despite higher vulnerability to cyber threats. Choosing between cold and hot wallets depends on prioritizing convenience for regular access or security for long-term storage in cryptocurrency management.

Which Wallet Type Suits Your Crypto Strategy?

Cold wallets provide enhanced security by storing cryptocurrency offline, making them ideal for long-term investors who prioritize asset protection from cyber threats. Hot wallets offer quick access and ease of transactions, suitable for active traders needing frequent transfers and real-time market engagement. Choosing between cold and hot wallets depends on balancing security needs with the frequency and speed of your crypto transactions.

Risks Associated with Cold and Hot Wallets

Cold wallets, being offline storage devices, minimize exposure to hacking risks but are susceptible to physical damage, loss, or theft. Hot wallets, connected to the internet, offer convenience and quick access yet face significant vulnerabilities such as phishing attacks, malware infiltration, and unauthorized access. Investing in multi-factor authentication and regular security audits reduces risks associated with both cold and hot wallets.

Best Practices for Wallet Management

Cold wallets provide superior security by storing cryptocurrencies offline, minimizing exposure to hacks and malware compared to hot wallets, which remain connected to the internet. Best practices for managing wallets include diversifying asset storage between cold and hot wallets, enabling two-factor authentication, and regularly updating wallet software to prevent vulnerabilities. Implementing secure backup procedures for private keys and using hardware wallets for cold storage further enhances the protection of digital assets.

Future Trends in Cryptocurrency Wallet Technology

Emerging advancements in cryptocurrency wallet technology emphasize enhanced security features in cold wallets, including biometric authentication and multi-signature capabilities, to counter evolving cyber threats. Hot wallets are integrating AI-driven transaction monitoring and seamless interoperability with decentralized finance (DeFi) platforms, fostering real-time asset management and increased user convenience. Future trends indicate a hybrid approach combining the robust security of cold wallets with the accessibility of hot wallets, driving innovation toward more user-centric and secure digital asset storage solutions.

cold wallet vs hot wallet Infographic

difterm.com

difterm.com