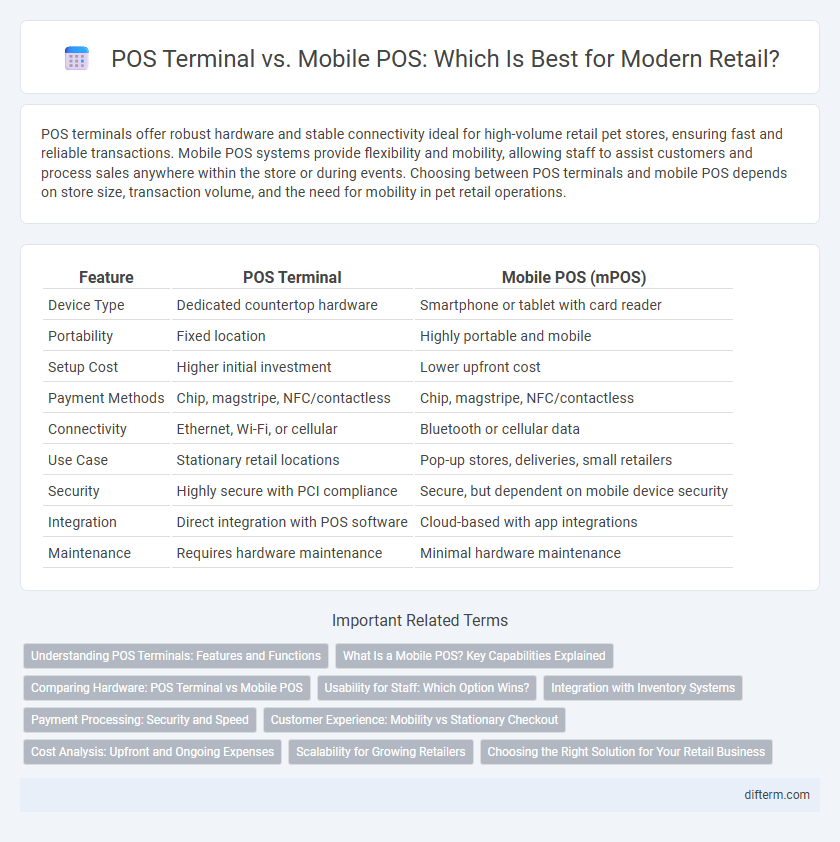

POS terminals offer robust hardware and stable connectivity ideal for high-volume retail pet stores, ensuring fast and reliable transactions. Mobile POS systems provide flexibility and mobility, allowing staff to assist customers and process sales anywhere within the store or during events. Choosing between POS terminals and mobile POS depends on store size, transaction volume, and the need for mobility in pet retail operations.

Table of Comparison

| Feature | POS Terminal | Mobile POS (mPOS) |

|---|---|---|

| Device Type | Dedicated countertop hardware | Smartphone or tablet with card reader |

| Portability | Fixed location | Highly portable and mobile |

| Setup Cost | Higher initial investment | Lower upfront cost |

| Payment Methods | Chip, magstripe, NFC/contactless | Chip, magstripe, NFC/contactless |

| Connectivity | Ethernet, Wi-Fi, or cellular | Bluetooth or cellular data |

| Use Case | Stationary retail locations | Pop-up stores, deliveries, small retailers |

| Security | Highly secure with PCI compliance | Secure, but dependent on mobile device security |

| Integration | Direct integration with POS software | Cloud-based with app integrations |

| Maintenance | Requires hardware maintenance | Minimal hardware maintenance |

Understanding POS Terminals: Features and Functions

POS terminals provide a fixed, secure checkout solution equipped with barcode scanners, receipt printers, and cash drawers for efficient transaction processing in retail environments. Mobile POS systems offer flexibility by enabling sales transactions through smartphones or tablets, supporting card payments and inventory management on-the-go. Understanding the distinct capabilities of POS terminals versus mobile POS helps retailers optimize checkout speed, customer experience, and operational efficiency.

What Is a Mobile POS? Key Capabilities Explained

A Mobile POS (mPOS) is a portable point-of-sale system that enables retailers to process transactions anywhere using a smartphone or tablet equipped with specialized software and a card reader. Key capabilities include real-time inventory management, secure payment processing via EMV and contactless options, and integrated customer data collection for personalized marketing. Unlike traditional POS terminals, mPOS solutions offer enhanced flexibility and mobility, driving improved customer experience and operational efficiency.

Comparing Hardware: POS Terminal vs Mobile POS

POS terminals typically feature robust hardware with integrated printers, barcode scanners, and cash drawers designed for high-volume retail environments, ensuring durability and efficiency. Mobile POS devices offer lightweight, portable hardware with touchscreen interfaces and wireless connectivity, enabling flexible checkout options and seamless customer interactions on the sales floor. Retailers must consider the trade-off between the comprehensive capabilities of stationary POS terminals and the mobility and convenience provided by mobile POS solutions.

Usability for Staff: Which Option Wins?

POS terminals provide a stable and familiar interface that enhances staff efficiency through dedicated hardware and larger screens, reducing transaction errors. Mobile POS systems offer flexibility by allowing employees to assist customers anywhere on the sales floor, accelerating checkout processes and improving the in-store experience. Staff usability favors mobile POS for mobility and convenience, while traditional POS terminals excel in reliability and ease of use during high-volume periods.

Integration with Inventory Systems

POS terminals typically offer robust integration with inventory systems through stable, wired connections and dedicated software, ensuring real-time stock updates and accurate sales tracking. Mobile POS solutions leverage cloud-based platforms, allowing seamless synchronization with inventory databases and enabling flexible access across multiple devices and locations. Both systems enhance inventory management efficiency, but mobile POS provides greater scalability and remote monitoring capabilities for dynamic retail environments.

Payment Processing: Security and Speed

POS terminals provide robust payment processing with hardware encryption and PCI compliance, ensuring secure and fast transactions in high-volume retail settings. Mobile POS systems utilize tokenization and end-to-end encryption to protect payment data while offering flexible, rapid processing suitable for on-the-go sales. Both solutions prioritize speed and security, with POS terminals excelling in stability and mobile POS delivering convenience and adaptability.

Customer Experience: Mobility vs Stationary Checkout

Mobile POS systems enhance customer experience by enabling transactions anywhere in the store, reducing wait times and allowing personalized service, which increases convenience and satisfaction. In contrast, traditional POS terminals are stationary, often leading to longer queues and less flexibility, potentially causing customer frustration. Retailers leveraging mobile POS benefit from seamless, faster checkouts and improved shopper engagement through on-the-spot assistance and promotions.

Cost Analysis: Upfront and Ongoing Expenses

POS terminals typically involve higher upfront costs due to hardware procurement and installation fees, while mobile POS solutions have lower initial expenses, leveraging existing smartphones or tablets. Ongoing expenses for POS terminals include maintenance, software licensing, and potential upgrades, whereas mobile POS systems often incur subscription fees and transaction charges that can scale with usage. Analyzing total cost of ownership highlights mobile POS as a cost-effective option for small to medium retailers seeking flexibility and lower capital investment.

Scalability for Growing Retailers

POS terminals provide robust scalability for growing retailers by supporting multiple payment methods and integrating seamlessly with inventory and customer management systems. Mobile POS solutions offer flexible scalability by enabling sales transactions anywhere in-store or on-the-go, ideal for pop-up shops and expanding retail locations. Both systems facilitate business growth, but mobile POS delivers enhanced agility and lower upfront costs, making it suitable for retailers aiming for rapid expansion.

Choosing the Right Solution for Your Retail Business

Selecting the right POS terminal or mobile POS system depends on your retail business size, transaction volume, and customer engagement needs. Traditional POS terminals offer robust hardware and extensive payment options ideal for fixed retail locations, while mobile POS systems provide flexibility and mobility, enhancing in-store and off-site sales opportunities. Evaluating factors such as budget, integration capabilities with inventory management, and ease of use ensures an optimized payment solution tailored to your retail operations.

POS Terminal vs Mobile POS Infographic

difterm.com

difterm.com