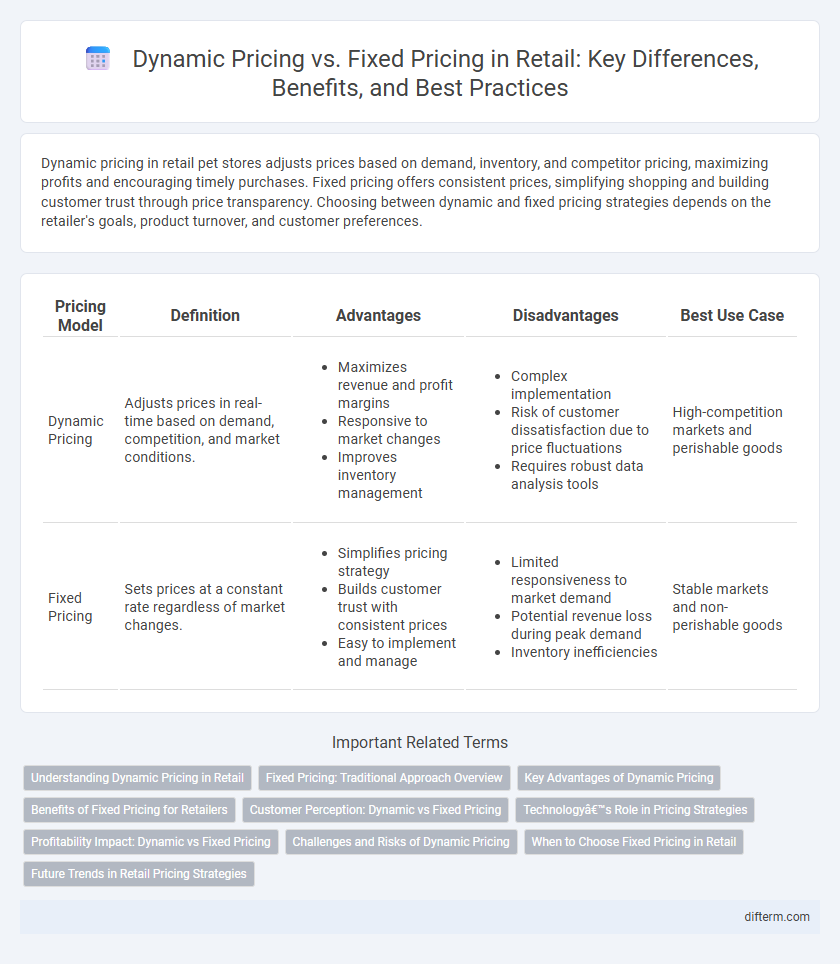

Dynamic pricing in retail pet stores adjusts prices based on demand, inventory, and competitor pricing, maximizing profits and encouraging timely purchases. Fixed pricing offers consistent prices, simplifying shopping and building customer trust through price transparency. Choosing between dynamic and fixed pricing strategies depends on the retailer's goals, product turnover, and customer preferences.

Table of Comparison

| Pricing Model | Definition | Advantages | Disadvantages | Best Use Case |

|---|---|---|---|---|

| Dynamic Pricing | Adjusts prices in real-time based on demand, competition, and market conditions. |

|

|

High-competition markets and perishable goods |

| Fixed Pricing | Sets prices at a constant rate regardless of market changes. |

|

|

Stable markets and non-perishable goods |

Understanding Dynamic Pricing in Retail

Dynamic pricing in retail leverages real-time data analytics and AI algorithms to adjust product prices based on demand, competitor pricing, and inventory levels, maximizing revenue and sales efficiency. Unlike fixed pricing, dynamic pricing enables retailers to respond swiftly to market fluctuations, seasonality, and consumer behavior, enhancing profitability. This strategy also improves inventory turnover by aligning prices with current market conditions and customer willingness to pay.

Fixed Pricing: Traditional Approach Overview

Fixed pricing remains a cornerstone in retail, offering consistent and predictable price points that foster customer trust and simplify purchasing decisions. Retailers implementing fixed pricing rely on stable market analysis, cost-plus strategies, and competitor benchmarks to maintain profitability without frequent adjustments. This approach minimizes consumer confusion and streamlines inventory management, ensuring transparent value communication across all sales channels.

Key Advantages of Dynamic Pricing

Dynamic pricing enables retailers to adjust product prices in real time based on demand fluctuations, competitor pricing, and inventory levels, maximizing revenue potential. This strategy enhances competitiveness by allowing swift adaptation to market trends and consumer behavior, driving higher sales conversion rates. Moreover, dynamic pricing improves inventory management by reducing overstock and minimizing stockouts through optimized pricing adjustments.

Benefits of Fixed Pricing for Retailers

Fixed pricing provides retailers with predictable revenue streams and simplifies inventory management by maintaining consistent price points. It enhances customer trust and loyalty through transparent and stable pricing structures, reducing price-related confusion and frustration. Fixed pricing also facilitates straightforward marketing strategies and competitive positioning in a crowded retail landscape.

Customer Perception: Dynamic vs Fixed Pricing

Dynamic pricing often enhances customer perception by offering personalized, market-driven prices that reflect real-time demand and inventory levels, creating a sense of fairness and opportunity. Fixed pricing provides consistency and predictability, fostering trust and transparency, especially valued by price-sensitive consumers who prefer stability. Retailers leveraging dynamic pricing must balance perceived fairness with potential customer frustration due to price fluctuations, while fixed pricing appeals to those prioritizing simplicity and reliability.

Technology’s Role in Pricing Strategies

Technology plays a crucial role in dynamic pricing by enabling real-time data analysis and algorithm-driven price adjustments based on demand, competition, and inventory levels. Fixed pricing, while simpler, benefits from technology through advanced data analytics and market research tools that help retailers set optimal price points from the outset. Incorporating AI and machine learning enhances both strategies by providing predictive insights that maximize profitability and customer satisfaction.

Profitability Impact: Dynamic vs Fixed Pricing

Dynamic pricing maximizes profitability by adjusting prices in real-time based on demand, competitor actions, and inventory levels, leading to higher revenue and margin optimization compared to fixed pricing. Fixed pricing often results in missed opportunities during peak demand periods and unsold inventory when demand drops, limiting overall profit potential. Retailers employing dynamic pricing strategies report profit increases of up to 25% due to enhanced price flexibility and market responsiveness.

Challenges and Risks of Dynamic Pricing

Dynamic pricing in retail faces challenges such as consumer backlash due to perceived unfairness and price volatility, which can erode brand trust and customer loyalty. Implementation risks include complex algorithms that may misprice products, leading to revenue loss or inventory imbalances. Retailers must also navigate legal and ethical concerns, ensuring compliance with pricing regulations to avoid penalties.

When to Choose Fixed Pricing in Retail

Fixed pricing is ideal in retail when product demand is stable and predictable, enabling consistent profit margins without frequent adjustments. Retailers should choose fixed pricing for essential goods, brand positioning that emphasizes reliability, and when operational simplicity is prioritized to reduce pricing errors. It also benefits businesses targeting price-sensitive customers who favor transparent and consistent pricing over fluctuating costs.

Future Trends in Retail Pricing Strategies

Dynamic pricing leverages real-time data analytics and AI to adjust prices based on demand, competitor pricing, and customer behavior, enabling retailers to maximize profits and enhance customer satisfaction. Fixed pricing remains relevant in brand positioning and consumer trust, but future retail trends favor hybrid models that combine price flexibility with transparency to meet evolving market expectations. Integration of machine learning and IoT devices will drive more sophisticated, personalized pricing strategies that continuously adapt to market fluctuations and shopper preferences.

Dynamic Pricing vs Fixed Pricing Infographic

difterm.com

difterm.com